Should I Buy XRP Now? What You Need to Know Before Investing

- XRP settles transactions in 3-5 seconds with minimal fees, making it one of the fastest cryptocurrencies for cross-border payments.

- The SEC settlement in August 2024 and first XRP ETF approvals in late 2024 provided significant regulatory clarity for institutional investors.

- XRP faces real competition from stablecoins in the payments market, and bank adoption of Ripple's network doesn't automatically require using XRP itself.

- Financial advisors typically recommend limiting crypto exposure to 5-10% of your portfolio, with individual tokens like XRP representing an even smaller allocation.

- Dollar-cost averaging removes timing pressure when buying volatile assets like XRP, which can experience 20-30% price swings in a single month.

Why Should I Buy XRP Instead of Other Cryptocurrencies?

Should I Buy XRP Now? Recent Market Developments

Should I Invest in XRP? Key Factors to Consider

1. Understanding Your Risk Tolerance

2. The Use Case Reality Check

3. Timing Your Purchase Strategy

4. Comparing XRP to Other Cryptocurrencies

5. How Much XRP Should You Buy?

Where Should I Buy XRP? A Safe Purchase Guide

FAQ

Conclusion

Popüler Makaleler

When Will XRP Go Up? Technical Signals & Expert Forecasts

XRP has dropped nearly 40% from its July 2025 peak of $3.65, now trading around $2 and leaving investors wondering when the recovery will start.This article examines when XRP will go up by analyzing t

What Does XRP Stand For? The Complete Answer Explained

If you've encountered XRP in cryptocurrency discussions, you might wonder what those three letters actually mean.Unlike many crypto tickers, XRP isn't an acronym with a hidden meaning waiting to be de

Why Is XRP Going Up? Key Drivers Behind the Rally

XRP surged more than 18% in the first five days of January, breaking decisively above $2.12.This rally caught many traders off guard, but specific catalysts explain why XRP is going up right now.This

How to Trade TSLA Earnings Volatility: Profit from Price Swings on MEXC

Every quarter, the release of Tesla (TSLA) earnings reports creates a frenzy in the financial markets. For long-term investors, this is a time of anxiety as they wait to see if the company met revenue

Popüler Haberler

Daha Fazla Göster

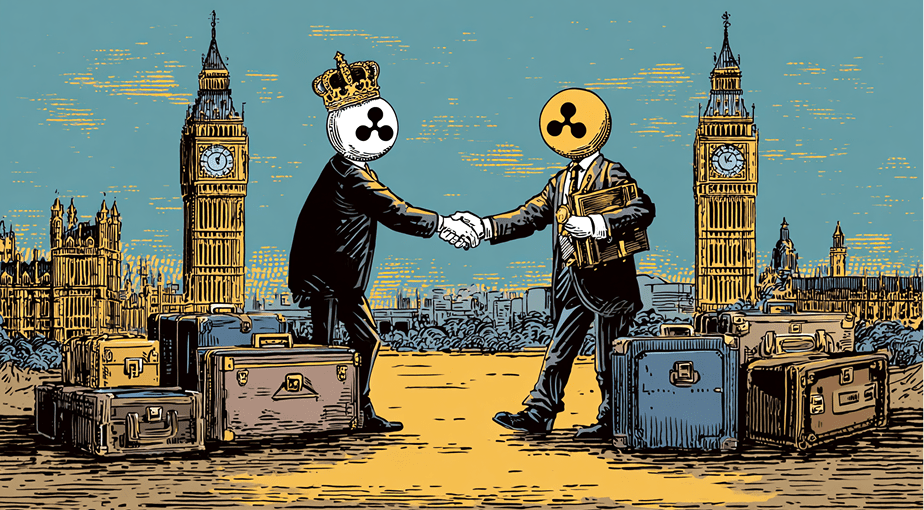

Ripple Secures FCA Registration, Expands Crypto Services in UK

The post Ripple Secures FCA Registration, Expands Crypto Services in UK appeared on BitcoinEthereumNews.com. In Brief Ripple secures FCA registration, expanding

Ripple Wins FCA Approval and Expands Crypto Payments in the UK

TLDR Ripple gets FCA approval to offer regulated digital payment services in the UK. XRP rises 10% as Ripple gains regulatory clarity for UK operations. Ripple’

Dom Kwok Criticizes XRP Critics, Calls Attacks a Waste of Time

TLDR Dom Kwok, a Goldman Sachs veteran, criticizes XRP critics for being uninformed and unproductive in their attacks on the cryptocurrency. Kwok defends XRP by

Top Crypto to Invest In 2026: XRP ETFs See $40.8M Outflow, XLM Drops to $0.23, as APEMARS Holds a 26,500% ROI Window

Is your portfolio ready for 2026, or are you still waiting while the market moves without you? With traders watching ETF flows, upgrades, and presales like hawks

İlgili Makaleler

When Will XRP Go Up? Technical Signals & Expert Forecasts

XRP has dropped nearly 40% from its July 2025 peak of $3.65, now trading around $2 and leaving investors wondering when the recovery will start.This article examines when XRP will go up by analyzing t

What Does XRP Stand For? The Complete Answer Explained

If you've encountered XRP in cryptocurrency discussions, you might wonder what those three letters actually mean.Unlike many crypto tickers, XRP isn't an acronym with a hidden meaning waiting to be de

Why Is XRP Going Up? Key Drivers Behind the Rally

XRP surged more than 18% in the first five days of January, breaking decisively above $2.12.This rally caught many traders off guard, but specific catalysts explain why XRP is going up right now.This

How to Trade TSLA Earnings Volatility: Profit from Price Swings on MEXC

Every quarter, the release of Tesla (TSLA) earnings reports creates a frenzy in the financial markets. For long-term investors, this is a time of anxiety as they wait to see if the company met revenue