Ethereum Unstaking Queue Hits Record High as $12 Billion Waits to Exit

TLDR

- Ethereum’s validator exit queue reaches $12B with 2.6M ETH waiting to unstake.

- Ethereum blobs demand surges, boosting Layer 2 transaction efficiency.

- Ethereum mainnet generates 87% of Aave’s total revenue despite competition.

- Ethereum price remains above $4,500 as market interest stays strong.

Ethereum’s validator exit queue has reached an all-time high, with over $12 billion worth of ETH waiting to be unstaked. This marks a crucial moment for the Ethereum network as large amounts of ETH are poised to leave staking contracts. Meanwhile, Ethereum’s mainnet continues to be a key driver for decentralized finance (DeFi) activity despite the growing interest in Layer 2 solutions. Below are the latest developments surrounding Ethereum’s network and its key players.

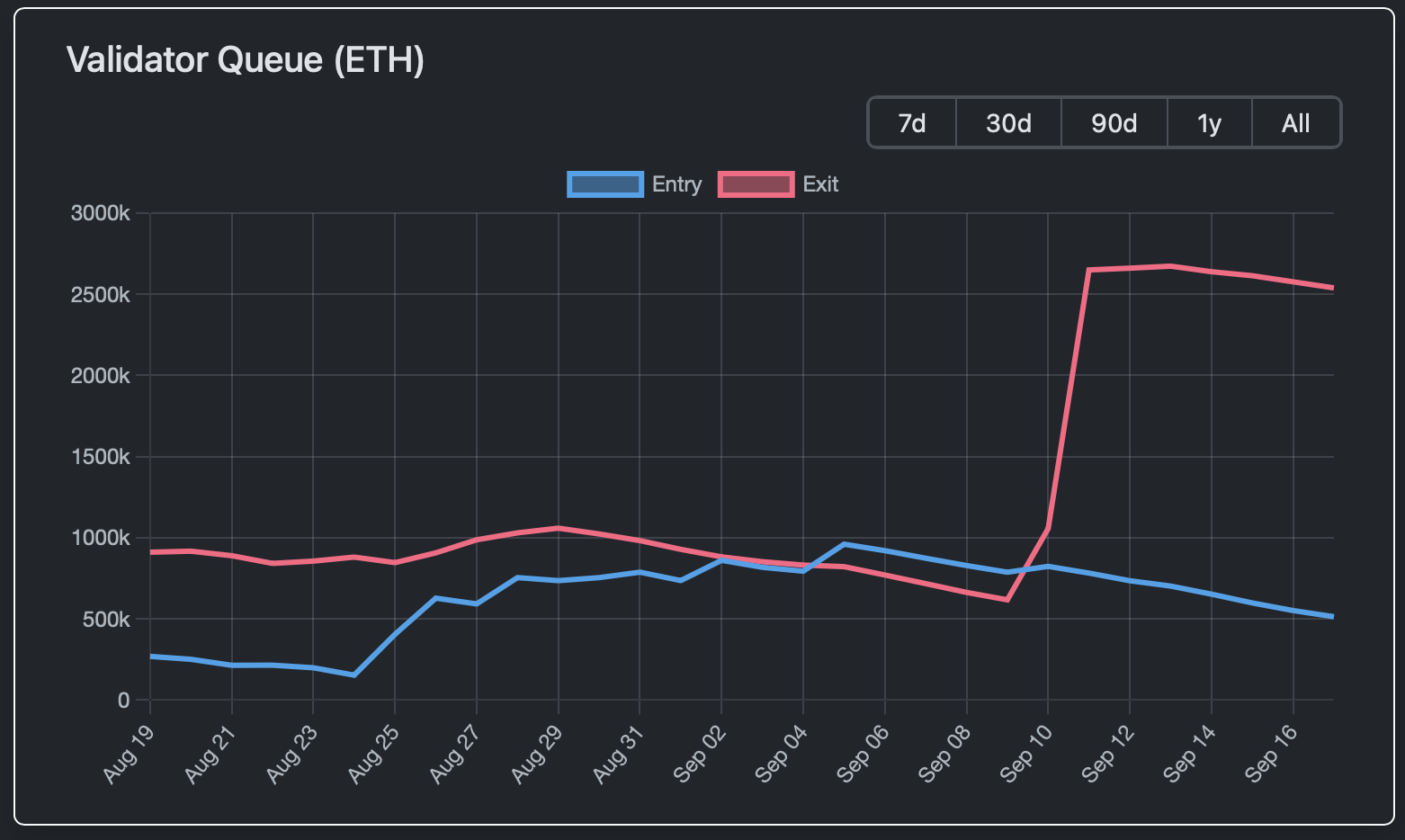

Ethereum Validator Exit Queue at All-Time High

Ethereum’s validator exit queue has surged to new levels, with over 2.6 million ETH, valued at approximately $12 billion, currently waiting to be unstaked. The queue’s length has now reached a historic high, with the estimated wait time for exit set at 44 days. This marks the longest waiting period ever recorded for unstaking ETH.

Source: X

The increase in the exit queue raises concerns about potential selling pressure on Ethereum’s market. If the ETH waiting to exit from staking contracts is sold, it could flood the market with a significant amount of ETH. However, some analysts suggest this could also be a sign of institutional investors preparing to acquire ETH in bulk, especially as corporate treasuries show a growing interest in digital assets.

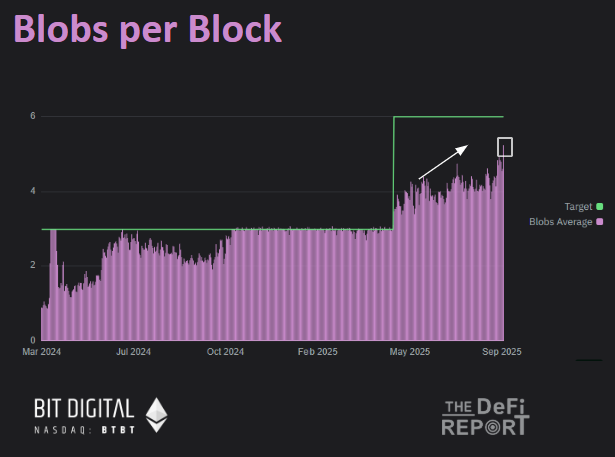

Growing Demand for Ethereum Blobs

Ethereum’s Layer 2 (L2) ecosystem is seeing rising demand for blobs, a data structure used by platforms built on top of Ethereum. These blobs are part of the Ethereum 2.0 upgrade, introduced through EIP 4844, which enhances the interaction between the Ethereum mainnet and Layer 2 solutions.

Source: X

The increased demand for blobs indicates higher transactional activity and smart contract usage on Ethereum’s network. Blobs help optimize data storage and transaction costs, making them a key part of Ethereum’s scalability strategy. As more data is processed through Ethereum’s mainnet, there is a notable rise in the burning of ETH, further impacting the network’s dynamics.

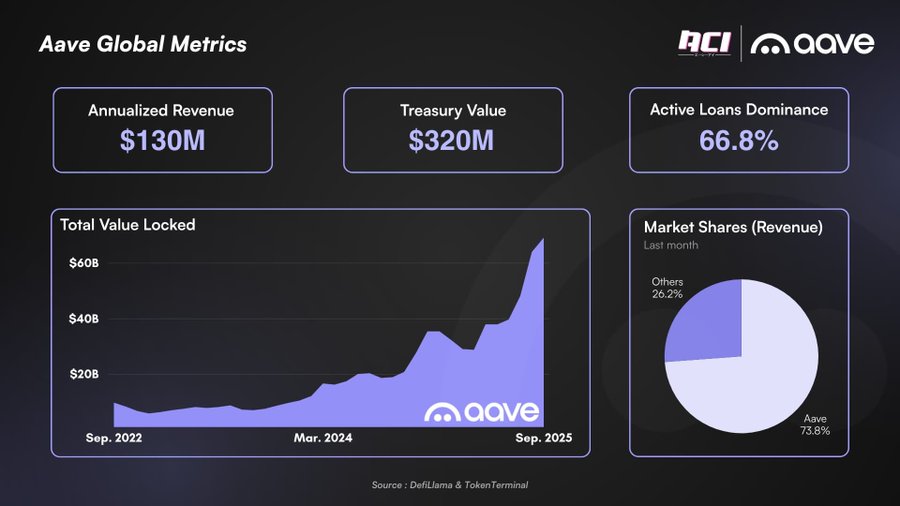

Ethereum Mainnet Dominates Aave’s Revenue

Despite the growing popularity of other blockchain networks, Ethereum’s mainnet continues to dominate decentralized finance (DeFi) applications like Aave. Data from the Aave Chan Initiative reveals that Ethereum remains responsible for 87% of the total revenue generated by the protocol.

Source: X

While Aave is also deployed on several other networks, including Polygon, Arbitrum, and Avalanche, the Ethereum mainnet remains the most profitable for the platform. Lower transaction fees and faster processing speeds on other chains have not been able to eclipse Ethereum’s dominance in terms of revenue generation for DeFi projects.

Ethereum’s Price Performance Amid Mixed Signals

Amidst these developments, Ethereum’s price is attempting to maintain stability above the $4,500 mark. Over the past 24 hours, Ethereum has seen a slight increase of 0.51%, with trading volumes surging. As of the latest data, Ethereum is trading at $4,483 on major platforms.

High open interest in Ethereum futures suggests that investor interest in ETH remains strong. However, the growing validator exit queue and potential market flooding could exert downward pressure on its price in the near future. Despite these concerns, Ethereum continues to maintain a prominent role in the broader cryptocurrency market, with its mainnet continuing to serve as a backbone for DeFi projects.

The post Ethereum Unstaking Queue Hits Record High as $12 Billion Waits to Exit appeared first on CoinCentral.

You May Also Like

Google's AP2 protocol has been released. Does encrypted AI still have a chance?

Zama to Conduct Sealed-Bid Dutch Auction Using Encryption Tech