CME to Launch Solana and XRP Options on October 13

CME Group to launch Solana and XRP options on October 13, offering flexible contracts and expanding crypto risk management tools.

CME Group has announced it will launch options on Solana (SOL) and XRP futures on October 13, 2025. However, this launch still depends on final regulatory approval. The new products will offer standard and micro-sized products. Daily, monthly, and quarterly expiration dates will also be available under these contracts.

CME Offers New Tools to Manage Risk with Solana, XRP Options

With this launch, CME will enable clients to trade options on SOL, Micro SOL, XRP, and Micro XRP futures. Traders will be able to choose expiration on every business day, as well as on monthly and quarterly expiration dates. This allows market participants to have more flexibility and options to manage their crypto exposure.

According to Giovanni Vicioso, CME Group Global Head of Cryptocurrency products, the company has witnessed robust growth and liquidity on its Solana and XRP futures. Therefore, CME has added options to the list of offerings. The new contracts, he said, which are offered in two sizes, are geared for both institutional investors and active individual traders. These options will provide users with choices for managing risk and developing more effective trading strategies.

Related Reading: Volatility Shares Launches First XRP Futures ETF on Nasdaq | Live Bitcoin News

In addition, the big players in the crypto trading space have expressed their support for the move. Roman Makarov, Head of Options Trading at Cumberland, said the launch reflects an increasing demand for the market outside of Bitcoin and Ethereum. He further commented that providing options on Solana and XRP is a good move in the direction of more widespread use of crypto derivatives.

Similarly, Co-Head of Markets at FalconX Joshua Lim said the emergence of digital asset treasuries has led to a need for robust hedging tools. He said institutions need good risk management mechanisms, particularly when it comes to expanding assets such as Solana and XRP. FalconX is pleased to partner with CME Group to increase market efficiency and liquidity.

CME Futures for SOL and XRP Reach $38.5B in Combined Volume

Since their introduction, CME’s Solana and XRP futures have rapidly grown to be two of its most popular products. For instance, over 540,000 Solana futures contracts have already been traded since March 17, 2025. These contracts have a total notional value of $22.3 billion. In August alone, ADV was 9,000 contracts, or $437.4 million. The average daily open interest (ADOI) reached 12,500 contracts, or $895 million.

Likewise, the performance of the XRP future has also done well. Since the start on May 19, 2025, the platform has facilitated more than 370,000 contracts with a cumulative notional value of $16.2 billion. XRP futures broke a record on August 2025 with an ADV of 6,600 contracts valued at $385 million. The ADOI also recorded a record $942 million expenditure for 9,300 contracts.

In conclusion, CME Group’s decision to introduce Solana and XRP options represents another significant milestone in the cryptocurrency market. These products provide traders with more tools to manage risk while gaining exposure to two of the most popular digital assets. As the market expands, the demand for diversity and choice from organizations and individuals is also growing – and CME is responding to that call.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

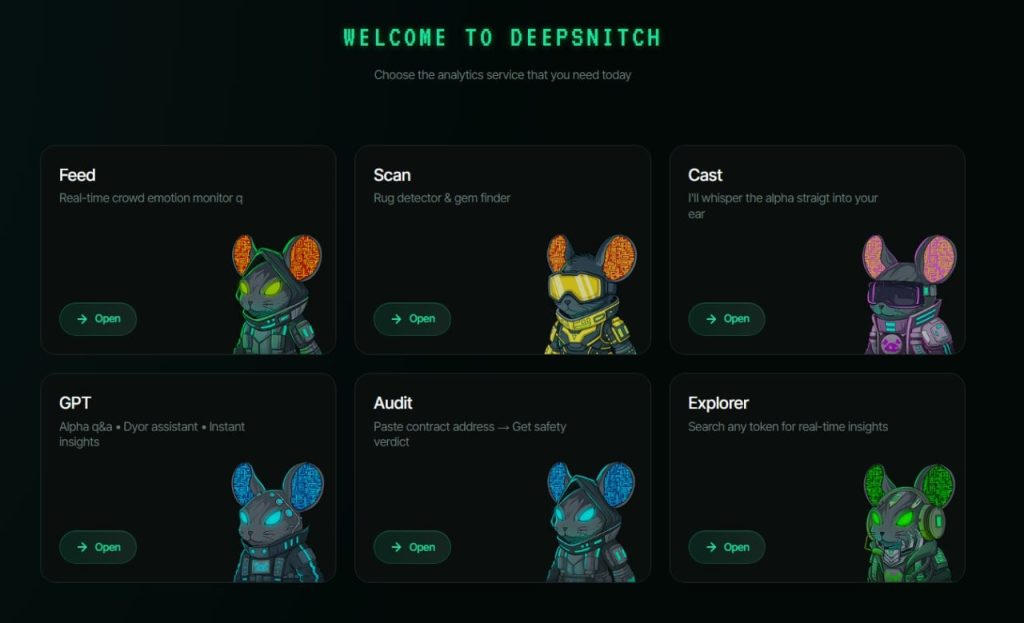

XRP Price Prediction March Update: Ripple and Aave Consolidate While DeepSnitch AI Surges 170%+ and Raises $1.8M