Fed Rate Cut Sparks Hope for BTC Rally – Bitcoin Hyper Presale Nears $17M to Solve Bitcoin’s Bottlenecks

But as adoption for $BTC grows, the network’s limitations – like steep fees and low speeds – will only become more obvious.

Thankfully, Bitcoin Hyper ($HYPER) is preparing to fix them – it’s no wonder that it has nearly raised $17M on presale.

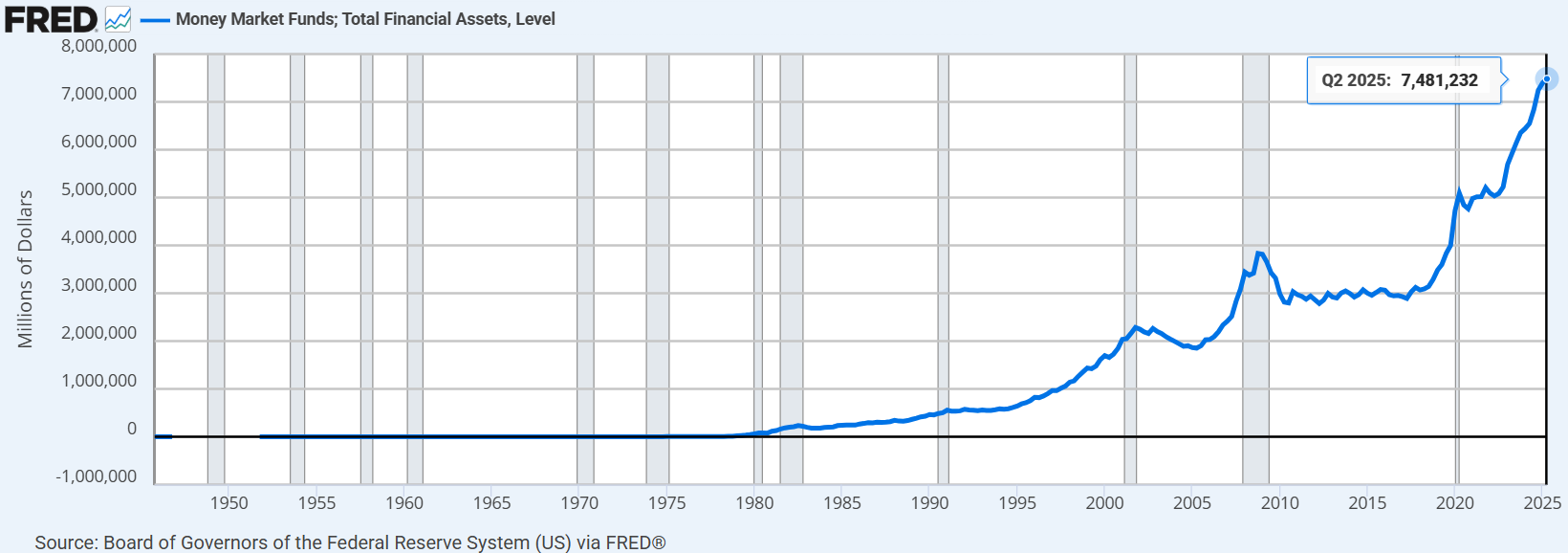

Fed Rate Cut Might Redirect $7.4T Money Market Funds to $BTC

With over $7.4T in money markets, the Fed’s rate cut could help move these funds into $BTC – especially now that exposure to the crypto leader is easier through spot Bitcoin ETFs and treasury proxies.

Source: FRED

Fed Chair Powell also signaled that two more rate cuts might occur before this year’s end, citing ongoing concerns over the US labor market. In return, it could boost momentum for the #1 crypto even further.

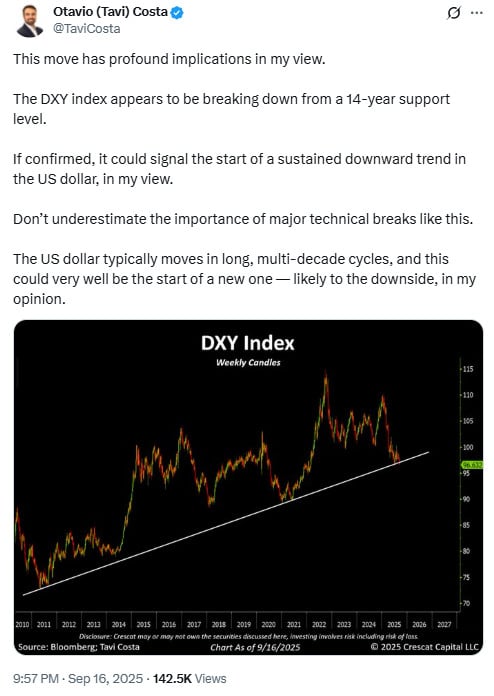

And that’s not all. Macro Strategist Octavio (Tavi) Costa suggests the US dollar may be breaking down from a 14-year support level. With the potential of a much weaker dollar ahead, the bull case for risk assets like $BTC is anticipated to strengthen.

Source: X Octavio (Tavi) Costa

As $BTC adoption likely accelerates under these conditions, Bitcoin Hyper could be precisely what’s needed to keep the network functional amid surging demand.

Bitcoin Hyper to Solve Bitcoin’s Scalability Crisis

Bitcoin Hyper is a pioneering Layer 2 (L2) solution designed to address the Bitcoin network’s most significant pain points: slow scalability, transaction speed, and steep fees.

Right now, Bitcoin can only facilitate 10.73 transactions per second (tps). In comparison, Ethereum can handle over double the workload at 23.82 tps.

Bitcoin’s max throughput of 13.2 tps is also 78.83% lower than Ethereum’s 62.34 tps. Because it can only process a limited number of transactions, it’s no stranger to becoming congested during peak demand.

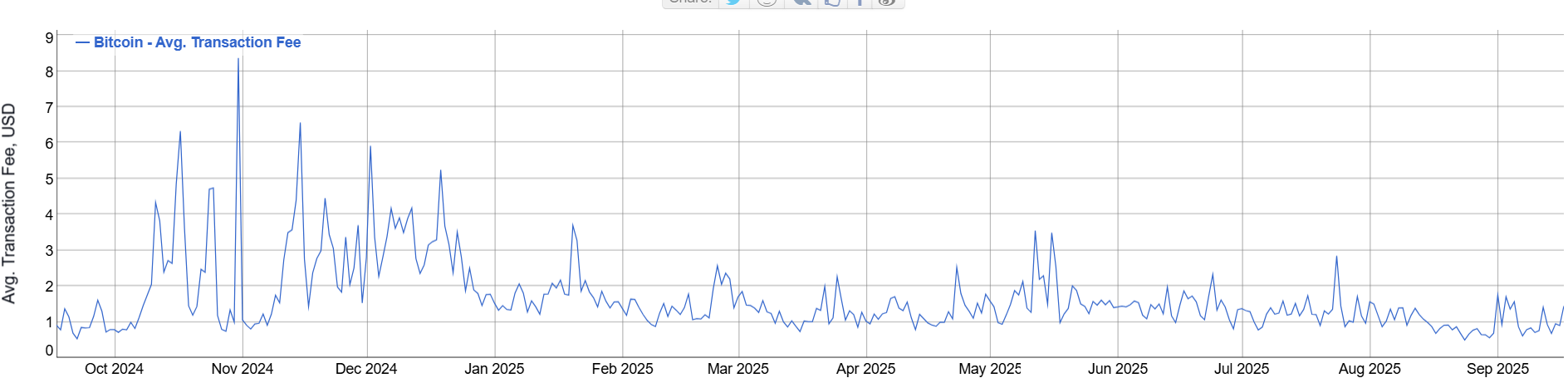

For instance, Bitcoin transaction fees spiked above $8 during peak demand in November 2024. This surge came as $BTC hit $87K for the first time, driven by the so-called ‘Trump Pump,’ when the US presidential election sparked fresh optimism among crypto traders.

Source: BitInfoCharts

Bitcoin’s gas fees have since leveled out, now averaging at just $1.4. Still, they remain much higher than other blockchains, like Solana, where fees typically range between $0.0024 and $0.048 per transaction.

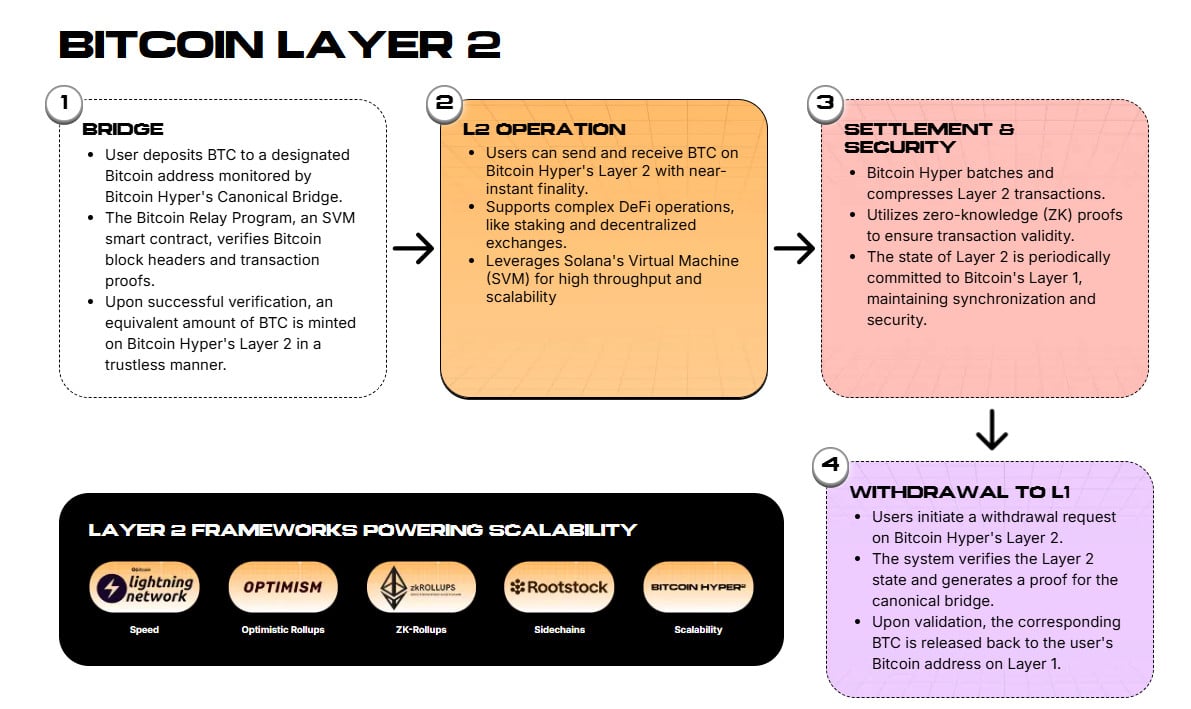

Bitcoin Hyper strives to make the Bitcoin network comparably fast. By leveraging the Solana Virtual Machine (SVM), developers will be able to build on the network while handling thousands of transactions per second (tps).

The L2 will also utilize a Canonical Bridge, allowing you to deposit $BTC on the Bitcoin mainnet and mint its equivalent on the Hyper ecosystem.

Source: Bitcoin Hyper

The bridge means you can unlock faster, cheaper transactions as you move assets between other chains. Think of it as a direct, secure pathway for cross-chain transfers without intermediaries.

Buying $HYPER will also help boost the L2’s sustainability, as 30% of its total token supply is earmarked for development.

Taking that into consideration, it’s no surprise that $HYPER has already attracted $16.6M on presale, despite one coin costing just $0.012935.

Check out the Bitcoin Hyper whitepaper for more information.

You May Also Like

Will XRP Price Increase In September 2025?

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be