Liquidity is constrained, volatility is insufficient, and the forecast market is "falsely hot".

Author: David

Compiled by: TechFlow

Over the summer, I’ve been quietly trading while thinking about and building tools related to prediction markets. I’ve been involved in this space on and off for over a year, ever since I joined Polymarket in mid-2024 and started trading during the election cycle.

In June of this year, the conflict between Israel and Iran reignited my passion for prediction markets. At the time, I wasn't just trading real-time events on Polymarket for fun; I was using it as a vital source of information to guide my actual portfolio trading. Over the following months, I delved deeply into prediction markets, from their origins and numerous iterations to their visions of future possibilities. It felt like entering an endless intellectual labyrinth.

It was incredibly exciting for me to learn about a niche market that had so much potential but wasn’t discussed or taken seriously.

But then, along came John Wang. In early August, I noticed John starting tweeting about his deep dive into prediction markets, so I sent him a private message suggesting we chat. While I won't reveal the details of our conversation, it wasn't long before he was completely immersed in the subject, almost single-handedly bringing prediction markets to the forefront through a flurry of tweets.

That said, while I’m excited about the early stages of prediction markets, they’re still in their infancy. While there’s a lot of discussion about their positive implications, there are still many challenges and limitations in their current form that need to be addressed if they are to truly become a new mainstream form of trading.

Liquidity constraints

The first major drawback of prediction markets is liquidity. Market liquidity is already insufficient for most professional traders, let alone funds capable of large-scale trading. Furthermore, due to the difficulty of market making in binary prediction markets, there are few willing market makers. Furthermore, the inherently low trading volume in these markets limits market makers' profit opportunities, making them less motivated to experiment.

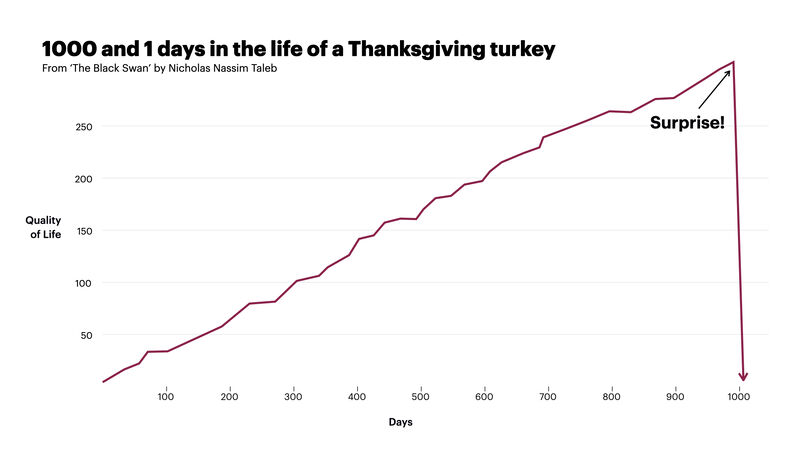

Binary markets are difficult to market-make for several reasons. The first is high inventory risk, which is difficult to hedge. Because these markets are event-driven, their nature means there's little or no chance of mean reversion following major news headlines. For example, a market may be trading at an 80% probability of a certain outcome (a "yes"), but then news breaks that significantly reduces the probability to 30%. If market makers are misplaced in this situation, they could be forced into holding large, losing positions that are often difficult to exit. This risk can be mitigated through hedging, but simple or efficient capital solutions aren't always available.

Why are market makers afraid of being “tricked”?

Another issue is "toxic flow" and a lack of demand diversity. Market makers typically profit from the bid-ask spread. For example, they might buy shares of X for $1 and sell them for $1.01, repeating this process without maintaining a directional view on the underlying asset. Market maker profitability depends largely on whether the market has a high proportion of "low information demand" and a low proportion of "high information demand."

Taking the stock market as an example, "low information demand" typically refers to investors trading to hedge other positions or rebalance their portfolios. They buy stocks not because they believe they will rise, but because they need them for portfolio construction. This type of demand is generally beneficial to market makers because buyers are not price sensitive.

The opposite is true for “high information demand” or “toxic traffic.” These buyers typically possess information or an advantage that has not yet been made public, believe the market is mispriced, and seek to profit from the transaction.

A healthy ratio of these two types of buyers is necessary for market makers to profitably provide sufficient liquidity. However, current demand in prediction markets lacks diversity, with few participants other than speculators, and is susceptible to "toxic flow" from insiders. This demand structure must change if liquidity is to improve.

Retail investor restrictions

From a retail investor’s perspective, prediction markets have many limitations, which I will briefly describe.

First, the market lacks sufficiently compelling opportunities and potential returns. Most markets like those on Polymarket and Kalshi typically offer low volatility, and the potential returns are insufficient to attract retail investors. Even if a seemingly certain outcome is trading at 70%, if its expiration date is two months away, it still lacks appeal for modern, dopamine-seeking retail investors. Furthermore, due to the aforementioned challenges faced by market makers, these markets are unable to offer leveraged trading options to increase potential returns.

Secondly, the return ceiling of binary markets undermines the incentive to “get in first,” which is precisely one of the key reasons why stocks and cryptocurrencies are so attractive. There are currently some new prototypes being tested that introduce reflexivity by removing binary outcomes, but their success remains to be seen.

Third, event-based markets reduce reflexivity. This is both a strength and a weakness, as it means prediction markets are less susceptible to manipulation or cabalism, similar to issues in cryptocurrencies. However, this also limits potential gains, preventing the 100x returns retail investors crave. I have some thoughts on this, but I won't discuss them today.

Poor discovery and user experience

Anyone actively using prediction markets will have encountered numerous annoyances in the current iteration of the user interface (UI). There are simply too many issues, and especially for advanced users, these issues cumulatively become a headache. The worst of these, in my opinion, is the market discovery mechanism.

Polymarket and Kalshi There are tens of thousands of markets today, and the number is growing, but you’ve probably never heard of the vast majority of them, and there’s no easy way to find them.

A ray of hope

The good news is that many of these challenges are not unique to prediction markets.

Early areas like decentralized finance (DeFi), perpetual contract exchanges, and short-term options contracts faced similar challenges. This, however, demonstrates the enormous opportunities inherent in prediction markets, which are still a niche market.

Take Polymarket, for example, whose 250,000 active users traded $1 billion in volume last month. By comparison, almost every one of the top 100 traders on HyperLiquid reached that level of volume.

We can be excited about new things, but we must also remain pragmatic and face their current actual state in order to push them to new heights.

You May Also Like

Will XRP Price Increase In September 2025?

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be