Analysts Compare Zexpire’s $ZX to HYPE as Early DeFi Derivatives Success Story

The post Analysts Compare Zexpire’s $ZX to HYPE as Early DeFi Derivatives Success Story appeared first on Coinpedia Fintech News

Market analysts are drawing parallels between Zexpire’s utility token, ZX, and the once-celebrated HYPE token, positioning ZX as a fresh example of early success in decentralised finance derivatives. ZX has registered sharp price gains since launch, accompanied by a rise in daily trading volume that mirrors HYPE’s rapid ascent in 2020. Coverage from several research desks states that the token’s swift integration by multiple lending and perpetual swap venues underscores a growing acceptance of niche derivative assets in retail and professional circles alike.

The comparison rests on more than price performance. Observers cite a similar pattern of early liquidity incentives, open-source risk metrics, and community-driven governance that propelled HYPE into prominence before its peak. Zexpire’s roadmap calls for additional derivative pairs tied to commodities and index baskets, a move analysts say could broaden market depth and sustain momentum. If adoption continues at the present pace, ZX may serve as the clearest case since HYPE of how a novel derivatives token can achieve scale in a still-maturing DeFi segment.

Hyperliquid and (HYPE) signals fresh surge ahead of altcoin season

In 2025 HYPE is expected to build on its breakout and lift faith in its base. Average price near $45 signals steady gains, with a surge to $70 possible, while dips may pull it to $30. And now let us explore the current situation with this coin.

Source: TradingView

HYPE has climbed 5.7 percent in the past week and 35.26 percent over the month. The six month run now totals 268.62 percent. Price trades between 47.93 and 58.39, just under the 10 day average of 58.60 and above the 100 day mark at 54.54. Buyers eye the first barrier at 63.12, a break could open room toward 73.58. Solid buying interest rests at 42.20, with deeper cover at 31.74. Momentum readings sit high yet positive. Holding above current support may lift the coin another 10 to 25 percent, making an advance toward 63.12 more likely than a slide below 42.20.

First-Mover in Gamified Options Trading: Could ZX Be the Next HYPE?

In crypto, the biggest gains often go to first movers in new categories. This cycle has already provided a valid example: HYPE, the token of Hyperliquid, rode the surge in derivatives trading and put on outsized returns for early holders.

Zexpire is aiming to do the same — but in an even fresher niche. It’s the first 0DTE DeFi protocol that turns options trading into a simple, one-click daily play.

One-Click Options, Fixed Risk

Crypto options already see around $3 billion in daily volume, and prediction markets like Polymarket have pushed past $10 billion in cumulative bets.

Zexpire combines the two, wrapping volatility trading into a format anyone can play.

Zexpire removes the complexity of options trading: no more intimidating charts and Greeks. Just one question: Will BTC stay in range today, or break out? Click your choice and let the market play out. The risk is capped — you’ll never lose more than your stake.

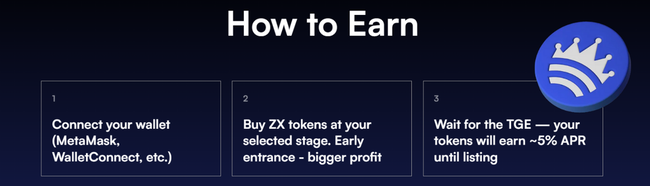

Be Among the First to Buy ZX

Like HYPE for Hyperliquid, ZX is the Fuel of Zexpire

Every play on Zexpire runs on its native token ZX, which is currently in seed access at just $0.003, stepping up stage by stage until it reaches $0.025 at listing.

That structure means the earliest participants lock in the lowest entry point, while later buyers pay more.

Beyond price, early buyers also get extras like staking yield before TGE, cashback perks, and beta access — benefits designed to reward the first wave of holders.

First-Mover Advantage: Getting ZX Before It Explodes

Every cycle has tokens that capture a new wave before the market catches on. HYPE did it with derivatives on Hyperliquid, turning early adoption into one of the cycle’s strongest narratives.

Now $ZX is positioned to do the same for gamified options trading — a brand-new category that combines the growth of prediction markets with the simplicity of one-click plays.

Early buyers secure the lowest entry point, while long-term holders stand to benefit from fee burns, buybacks, staking rewards, and platform perks that tighten supply and reward participation.

Buy $ZX, the Next Breakout Token

Conclusion

Analysts see HYPE as a strong early success, yet the latest data points to a newcomer that goes further. Zexpire is the first DeFi platform that turns crypto’s biggest challenge—volatility—into a profit chance. Users face one simple choice each day: will Bitcoin stay in range or break out? Losses stop at the entry fee, so there are no liquidations or margin calls.

Every prediction runs on $ZX, the native token that powers fees, discounts, and scheduled buybacks. Constant demand for play tickets gives $ZX built-in utility and rewards the earliest buyers. Entry now positions holders ahead of wider adoption and fresh listings. HYPE represents a promising opportunity too.

Get more information about Zexpire ($ZX) here:

- Site: https://zexpire.com/

- Telegram: https://t.me/zexpire_0dte

- X: https://x.com/Zexpire_0dte

You May Also Like

Telos Advisers Welcomes Stephen Gardner as a Strategic Advisory Board Member

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon