Tesla (TSLA) Stock: Robotaxi Approval in Arizona Lifts Shares Ahead of Earnings

TLDR

- Tesla received approval to test robotaxis in Arizona with safety drivers, expanding beyond its Austin pilot program

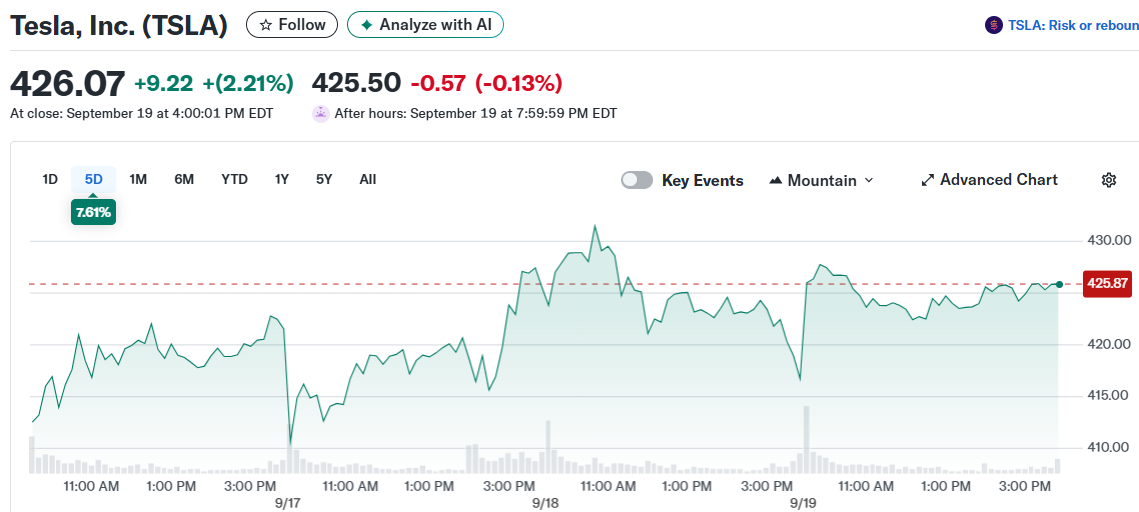

- Stock rose 2.21% to $426.07 following the Arizona testing announcement

- Vehicle deliveries are down year over year, but energy storage business shows strong margins around 30%

- Tesla reports earnings next month with investors watching for stability after recent pullbacks in vehicle sales

- Analysts maintain a Hold rating with average price target of $321.86, implying 24% downside from current levels

Tesla shares climbed 2.21% to $426.07 on Friday after the company received approval to test robotaxis in Arizona. The Arizona Department of Transportation cleared Tesla to begin autonomous vehicle trials in the Phoenix Metro area.

Tesla, Inc. (TSLA)

Tesla, Inc. (TSLA)

The testing program will require safety drivers inside each vehicle. Tesla has not announced when the trials will start or how long they will continue.

This marks Tesla’s second major testing location after launching a small pilot program in Austin, Texas earlier this year. The Austin program operates about a dozen vehicles with safety monitors in passenger seats.

Arizona has become a popular testing ground for autonomous vehicles. Companies like Waymo and General Motors’ Cruise already operate in the region.

Phoenix offers wide roads and mixed traffic conditions that make it ideal for testing. Tesla can currently only test vehicles with human oversight in Arizona.

The company would need additional approval to run commercial robotaxi services without safety drivers. CEO Elon Musk has said Tesla plans to launch robotaxi services covering about half the United States by end of 2025.

Vehicle Sales Face Headwinds

Tesla’s second quarter results showed total revenue of $22.5 billion, down 12% year over year. Automotive revenue fell 16% as deliveries dropped and average selling prices declined.

Automotive gross margin was 17.2%, down from 18.5% a year earlier. The company cited lower prices and fewer regulatory credits as challenges.

Operating expenses increased as Tesla invested more in artificial intelligence and product development. Vehicle deliveries remain down compared to last year.

Energy Business Provides Bright Spot

Tesla’s energy storage business delivered strong performance with gross margins of 30.3% in the second quarter. The segment maintained 29.6% margins for the first half of 2025.

Energy deployments totaled 9.6 gigawatt hours in Q2. Tesla deployed 20 GWh through the first six months of 2025.

The company recently introduced new Megapack 3 and Megablock systems in September. These products target utility and data center customers.

Tesla’s balance sheet remains strong with $15.6 billion in cash and $21.2 billion in short-term investments as of June 30. Operating cash flow was $4.7 billion through the first half of 2025.

Analysts maintain a Hold rating on Tesla stock based on 34 ratings in the last three months. The average price target stands at $321.86, suggesting 24% downside from current levels.

Tesla reports earnings next month with investors watching for signs the business is stabilizing. The stock trades at more than 250 times earnings as of current levels.

The post Tesla (TSLA) Stock: Robotaxi Approval in Arizona Lifts Shares Ahead of Earnings appeared first on CoinCentral.

You May Also Like

Qatar wealth fund commits $25bn to Goldman investments

Positive view remains intact above 185.00, with bullish RSI momentum