Zexpire Becomes the Top Crypto to Buy Today After Analysts Compare It to Solana

Zexpire has surged to the forefront of market discussions after a series of analyst reports likened its potential to the early days of Solana, propelling the token to the top of today’s buy lists. Trading volume doubled over the past 24 hours, and pricing data from major exchanges show a steady upward trend that contrasts with the broader market’s mixed performance.

Analysts cite Zexpire’s rapid transaction capability and scalable architecture as the main drivers behind the newfound optimism, noting parallels with key factors that once fueled Solana’s meteoric rise. Venture funds are reportedly increasing allocations, and several leading exchanges have flagged heightened retail interest, reinforcing the view that Zexpire could become a standout performer in the coming quarter.

Solana: The Speed-Run Crypto Chasing New Highs

Born in 2017 from the mind of former Qualcomm and Dropbox engineer Anatoly Yakovenko, Solana was built to fix the sluggish pace and high costs long associated with older blockchains. Its clever time-stamping approach lets the network check the order of events almost instantly, pushing through more than 50,000 transfers every second while keeping fees almost negligible. Since the public launch in 2020, this turbocharged design has drawn a flood of developers who are building everything from online games to digital-collectible markets, all keen to tap a platform that feels as quick as the apps people already use daily.

That raw speed has translated into headline-grabbing numbers. With a market value topping $103 billion in early January and a price that rocketed over 600 percent since mid-2021, Solana now sits among the five largest digital coins. Fans tout it as an “Ethereum killer,” praising lower costs and smoother traffic, while rivals such as Cardano, Polkadot and Avalanche race to keep up. Still, glitches—including short network outages—have shown that pushing the limits brings its own hurdles, and the crowded field of smart-contract platforms leaves no room for complacency.

Zexpire Introduces One-Click Simplicity to Capture Crypto Options Boom

Crypto options has become one of DeFi’s fastest-growing segments, as its daily trading volumes average around $3 billion. Traditionally, this market has long been dominated by professionals, but now it’s starting to open up to a broader audience.

Zexpire, the first 0DTE DeFi protocol, removes the complexity of options trading and turns it into a one-click prediction experience. The process is reduced to a binary choice: users bet on whether the price will stay within a defined range or break out in the next 24 hours

Simply put, trading with Zexpire works like this: Guess right, and you win. Guess wrong, and your loss is capped at your stake. No margin calls. No cascading liquidations.

$ZX Serves the Fuel Behind Simplified Options Trading with Zexpire

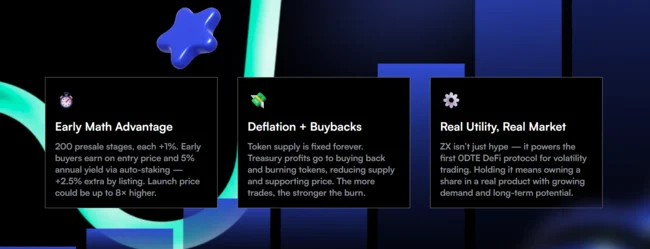

To earn on volatility with Zexpire, you need its native token ZX. It serves as a governance token and provides its holders with discounts on game tickets and cashback on losses.

Before its exchange debut, $ZX is available in in seed access at just $0.003, nearly 800% cheaper than the planned listing price of $0.025.

- Staking rewards up to 5% before a TGE

- Loyalty bonuses

- Airdrops and beta access

$ZX Rises with Each Stage — Buy Now for the Steepest Discounts

Zexpire has also built in a deflationary mechanism. 20% of platform fees will be burned, and a buyback program is designed to support demand. $ZX is available across multiple chains including Base, Solana, TON, and Tron and can be purchased directly with a card.

Why $ZX Could Be the Next Breakout Token

Options trading has become one of crypto’s biggest growth stories. BTC options volumes regularly hit billions, yet participation is dominated by pros. Zexpire is making a contrarian bet by stripping it all down to a fast, gamified format.

HYPE became one of this cycle’s strongest tokens by riding the derivatives boom on Hyperliquid. Zexpire is aiming to do the same in the options niche, but with an even broader retail angle: fixed-risk mechanics and gameplay simplicity that make it accessible to anyone.

If Zexpire can capture even a fraction of the momentum that HYPE did, $ZX could be DeFi’s next breakout token.

Buy $ZX, the Next Breakout Token

Conclusion

Market watchers still rate SOL as a strong pick thanks to its speed and growing app list. Yet even that success shines a light on the next step forward. Zexpire is the first DeFi platform that flips crypto’s biggest issue—wild price swings—into a profit route. Users face one choice only: will Bitcoin stay flat or break out today? No leverage, no liquidations, losses capped at the ticket size.

Each round is powered by $ZX. The token pays fees, fuels buybacks, and grants discounts, so demand is hard-wired. Early entry locks in those perks before wider release. SOL keeps its appeal, but Zexpire sets a new playbook for gains from volatility. It represents a promising opportunity too.

Get more information about Zexpire ($ZX) here:

- Site: https://zexpire.com/

- Telegram: https://t.me/zexpire_0dte

- X: https://x.com/Zexpire_0dte

You May Also Like

Top 4 Tokens Turning IP Rights Into Investable Assets

Fed Decides On Interest Rates Today—Here’s What To Watch For