Best Crypto Presales That Could Explode in 2025

Crypto prices are down on Monday, but there’s just over one week until the historically bearish Q3 ends, making way for Q4 – crypto’s strongest-performing fiscal quarter based on past records.

As a result, the current discount on prices could prove a lucrative “buy the dip” opportunity for investors looking to grab bargains ahead of the next rally. But here’s the real alpha: rather than buying cryptos already trading on exchanges and therefore subject to volatility, smart money is pouring into presale tokens that have yet to list on the open market.

Presales enable investors to purchase at stable and discounted rates while projects are still in their development phases, a setup that can result in substantial gains. And with Q4 looming, this could certainly prove to be one of the most opportune times to get involved with early-stage projects.

With that in mind, let’s examine the three top crypto presales that could explode this year. We’ll pay attention to evolving market trends, use cases, and tokenomics to identify projects with the highest room for growth.

Bitcoin Hyper

Bitcoin usually leads crypto’s Q4 rallies, with the market-leading asset averaging an 85% Q4 return since 2013. But as Bitcoin goes up, Bitcoin-related altcoins tend to perform well – and that’s why Bitcoin Hyper could be the best crypto presale to buy now.

Bitcoin Hyper is a Bitcoin Layer 2 blockchain created to address Bitcoin’s main issues of slow speeds and limited functionality. Bitcoin can only handle about seven transactions per second, and is mostly limited to sending and receiving BTC. More advanced blockchains can do everything from complex decentralized finance operations to hosting social media platforms.

Bitcoin Hyper is powered by Solana Virtual Machine (SVM) tooling, ZK-rollups, and a trustless canonical bridge, making it fast, flexible, secure, and seamless. It aims to process thousands of transactions per second and will also support smart contracts, paving the way for dApps, meme coins, payments, and more.

And so it’s no surprise that HYPER is thriving, with its presale raising over $17 million so far and offering dynamic staking APYs of up to 66%. This early success suggests that the project could achieve significant gains once it’s listed on exchanges.

Visit Bitcoin Hyper Presale

Snorter

If last Q4 is any indication, meme coin prices could surge in the upcoming quarter. However, meme coin trading success depends heavily on timing, and traders without access to advanced tools often miss out on the biggest opportunities. That’s why Snorter might be a top presale to buy now.

The Snorter team is developing a Solana-based meme coin trading bot (Snorter Bot), enabling users to execute meme coin trades within milliseconds thanks to its private RPC infrastructure that avoids the typical congestion on decentralized exchanges.

Snorter also provides various methods to place orders, from automated token sniping and copy trading to limit orders. Moreover, it offers protection against common meme coin trading risks with features like rug pull detection, MEV resistance, and dynamic stop losses.

The SNORT token powers the platform by offering trading fee discounts, staking rewards (116% APY), and governance rights. So far, its presale has raised $4 million, clearly demonstrating market interest and setting the stage for price appreciation once it launches on exchanges.

Visit Snorter Presale

PEPENODE

Mining is the lifeblood of many blockchains; it’s how Proof-of-Work networks like Bitcoin are secured, how new tokens are distributed, and it’s ultimately a core pillar of decentralization. However, many retail investors are sidelined from mining rewards due to barriers such as technical expertise requirements, and the high setup costs associated with running a node. This is where PEPENODE comes into play.

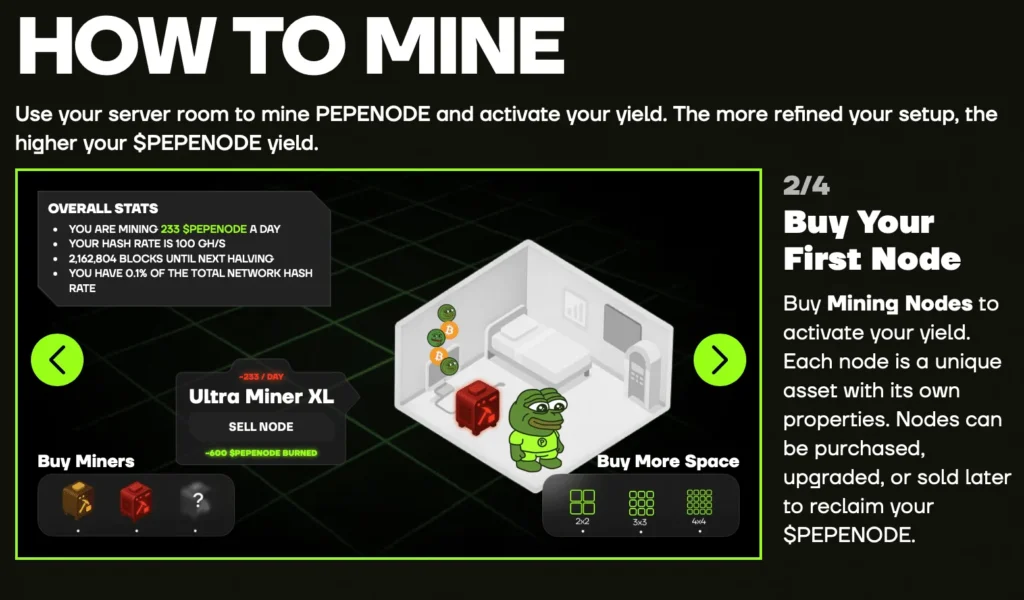

PEPENODE is creating the world’s first Mine-to-Earn meme coin, seamlessly blending gamified meme coin mechanics with real crypto rewards based on a virtual mining experience. Users spend PEPENODE tokens to buy and upgrade Miner Nodes. These Miner Nodes generate virtual mining power – and the more users generate, the more meme coin rewards they can earn, both in PEPENODE tokens and other meme coins like Fartcoin and Pepe.

PEPENODE is also deflationary, with 70% of tokens spent on Miner Nodes and upgrades being burned. This hard-wired scarcity suggests long-term growth potential, especially when paired with the token’s utility-driven demand sources. Staking APYs also run up to 965%, creating a clear incentive for holders to keep their tokens locked up.

So far, the PEPENODE presale has raised $1.3 million, which is a significant amount but indicates that it’s still early days – so those who buy now will be among the very first adopters.

Visit PEPENODE Presale

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy