Intel Corporation (INTC) Stock: Rallies on $5B Nvidia Deal and $2B SoftBank Backing

TLDRs;

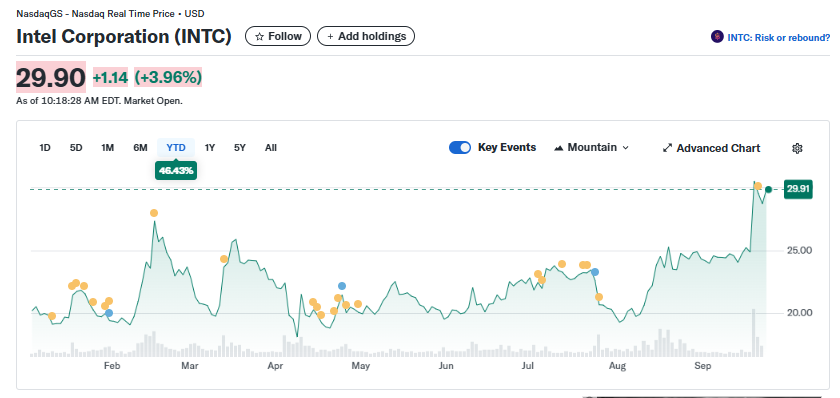

- Intel stock has risen 46% in 2025, driven by $5B from Nvidia, $2B from SoftBank, and U.S. backing.

- Nvidia’s $5B investment focuses on product collaboration while maintaining reliance on TSMC for chip production.

- SoftBank’s $2B stake signals confidence in Intel despite its $13B foundry losses in the past year.

- U.S. government invested $5.7B for a 10% stake, securing control of Intel’s domestic foundry operations.

Intel Corporation (NASDAQ: INTC) has emerged as one of Wall Street’s biggest comeback stories of 2025, with its stock surging 46% year-to-date on the back of major investment deals with Nvidia and SoftBank, alongside significant U.S. government funding.

While the company’s foundry business continues to face steep losses, the financial lifelines and partnerships have reignited investor optimism and bolstered Intel’s strategic position in the global semiconductor race.

Intel Corporation (INTC)

Intel Corporation (INTC)

Nvidia Takes $5B Stake in Intel

In one of the year’s most closely watched transactions, Nvidia purchased $5 billion worth of Intel shares as part of a broader collaboration.

According to Nvidia CEO Jensen Huang, the partnership is focused on product-level cooperation, though he emphasized Nvidia would continue to rely on Taiwan Semiconductor Manufacturing Co. (TSMC) for critical chip production.

The investment marks a rare alignment between two long-time industry competitors. While Intel seeks to strengthen its capital base and showcase its manufacturing capabilities, Nvidia gains an opportunity to test Intel’s technology without severing ties to its primary foundry supplier.

SoftBank Adds $2B Investment Push

SoftBank followed Nvidia’s lead with a $2 billion equity investment in Intel earlier this year. The Japanese conglomerate, known for its aggressive bets on technology companies, has highlighted Intel’s long-term potential as a key player in reshaping the semiconductor supply chain.

SoftBank’s backing signals confidence in Intel’s strategic pivot, even as the company’s balance sheet remains weighed down by the ongoing struggles of its foundry unit, which posted $13 billion in annual losses on $18 billion in revenue.

U.S. Government Boosts Funding and Stakes

The U.S. government has also deepened its involvement with Intel. In August, the company confirmed it had received $5.7 billion in cash in exchange for a 10% ownership stake, part of a broader deal aimed at safeguarding America’s domestic chip manufacturing capacity.

The White House emphasized the investment as a national security measure, designed to keep Intel’s foundry under U.S. control and ensure resilience against global supply chain disruptions. Commerce Department officials noted that final terms are still under negotiation, but the agreement reflects Washington’s renewed willingness to support critical industries.

Challenges Remain Despite Rally

Despite Intel’s remarkable stock rally, the company’s path to profitability remains uncertain. Analysts expect Intel to post $640 million in adjusted net income in 2025, rising to $3.2 billion in 2026. Yet its capital spending, projected at $18 billion this year, will likely keep free cash flow negative.

The company’s workforce cuts, reducing headcount to around 75,000, are part of ongoing cost controls, but Intel’s turnaround depends heavily on whether its foundry business can reverse persistent losses.

Still, with Nvidia, SoftBank, and the U.S. government on board, Intel has re-established itself as a pivotal player in the global chip war, balancing financial turbulence with powerful new allies.

The post Intel Corporation (INTC) Stock: Rallies on $5B Nvidia Deal and $2B SoftBank Backing appeared first on CoinCentral.

You May Also Like

Tether CEO Delivers Rare Bitcoin Price Comment

Zepto Life Technology Launches Plasma-Based FungiFlex® Mold Panel as CLIA Reference Laboratory Test