FTX Genesis Lawsuit: A Massive $1.15 Billion Legal Battle Unfolds

BitcoinWorld

FTX Genesis Lawsuit: A Massive $1.15 Billion Legal Battle Unfolds

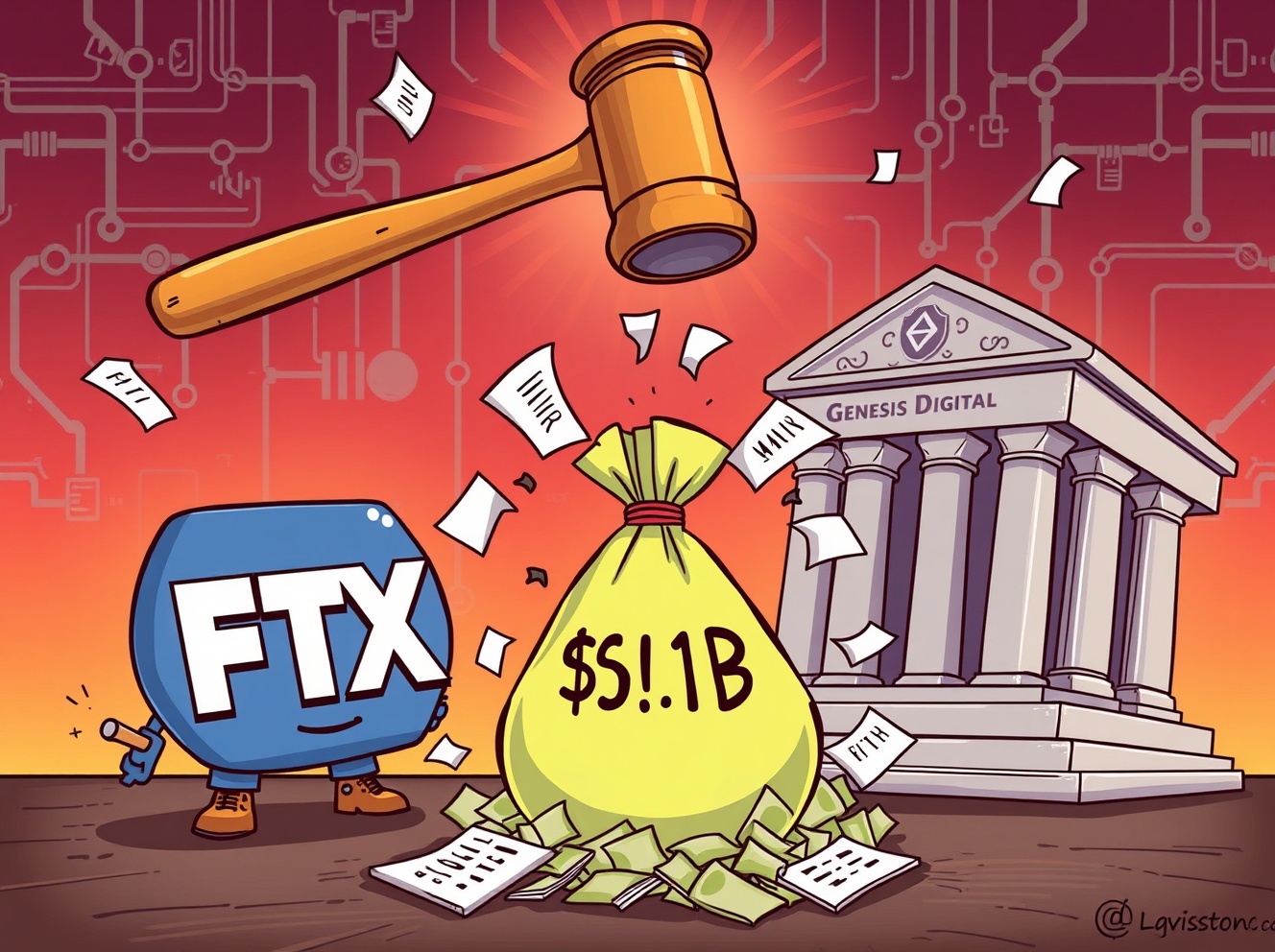

The crypto world is once again abuzz with significant legal developments. The FTX Trust has officially filed a substantial FTX Genesis lawsuit, seeking to recover a staggering $1.15 billion from Genesis Digital. This move marks another crucial chapter in the ongoing saga of FTX’s collapse and its creditors’ efforts to reclaim lost funds.

This lawsuit isn’t just about a large sum of money; it represents a deeper dive into the complex web of financial transactions that occurred before FTX’s dramatic downfall. It highlights the intricate relationships and potential vulnerabilities within the broader digital asset ecosystem.

What’s Behind the FTX Genesis Lawsuit?

The core of this legal action, as reported by Bloomberg, centers on claims of preferential transfers. Essentially, the FTX Trust alleges that Genesis Digital received substantial payments from FTX shortly before the crypto exchange filed for bankruptcy. These payments are now being scrutinized as potentially unfair to other creditors.

In bankruptcy proceedings, a “preferential transfer” refers to payments made by a debtor to certain creditors within a specific period (usually 90 days) before filing for bankruptcy. If these transfers gave those creditors more than they would have received in the bankruptcy process, they can be clawed back to ensure fair distribution among all creditors.

Unpacking the Claims: How Did Genesis Get Involved?

Genesis Digital, a prominent player in the crypto lending space and a subsidiary of Digital Currency Group (DCG), had significant dealings with FTX. The FTX Genesis lawsuit specifically targets these transactions, asserting that they unfairly benefited Genesis at the expense of other FTX creditors.

The lawsuit details how Genesis allegedly received these transfers, which include both cash and digital assets. The FTX Trust’s goal is to reverse these transactions, thereby increasing the pool of assets available to repay FTX’s numerous customers and investors who suffered losses.

- Alleged Preferential Transfers: Payments made to Genesis Digital just prior to FTX’s bankruptcy filing.

- Significant Sum: The lawsuit seeks to recover $1.15 billion, a substantial amount for any bankruptcy estate.

- Creditor Recovery: The primary aim is to maximize funds available for FTX’s creditors.

What Are the Broader Implications of the FTX Genesis Lawsuit?

This FTX Genesis lawsuit carries significant weight for both companies and the wider crypto industry. For FTX, a successful recovery would be a major win, providing more resources for its ongoing bankruptcy proceedings and potentially increasing the payout to victims.

Conversely, for Genesis Digital and its parent company, DCG, this lawsuit adds another layer of complexity to their already challenging financial situation. Genesis itself faced severe liquidity issues following the collapse of Three Arrows Capital and FTX, leading to its own bankruptcy filing.

Moreover, this case underscores the increasing scrutiny on inter-company transactions within the crypto sector. Regulators and bankruptcy courts are paying close attention to how funds moved between interconnected entities before major collapses, setting precedents for future cases.

What Does This Mean for the Crypto Community?

The outcome of the FTX Genesis lawsuit could shape how bankruptcy estates pursue claims against related parties in the future. It emphasizes the importance of transparency and robust financial practices in the volatile crypto market. For investors, it’s a stark reminder of the risks involved and the potential for long, drawn-out legal battles to recover assets.

This legal action also serves as a crucial example of the ongoing efforts to bring accountability to the crypto industry. As the sector matures, such lawsuits become more common, reflecting a push towards greater legal clarity and investor protection.

Concluding Thoughts on the FTX Genesis Lawsuit

The filing of the $1.15 billion FTX Genesis lawsuit is a critical development in the arduous process of untangling FTX’s financial mess. It highlights the aggressive stance taken by the FTX Trust to reclaim assets and underscores the interconnectedness of major crypto players.

As this legal battle unfolds, its resolution will undoubtedly have lasting implications for the involved parties and contribute to the evolving legal framework governing digital assets. The crypto community will be watching closely to see how this significant claim progresses.

Frequently Asked Questions (FAQs)

What is the FTX Trust?

The FTX Trust, or the Debtors, refers to the entities managing the bankruptcy proceedings of FTX and its affiliated companies. Their primary role is to recover assets and distribute them fairly among creditors.

Who is Genesis Digital?

Genesis Digital is a subsidiary of Digital Currency Group (DCG) and was a major player in the crypto lending market. It filed for bankruptcy in early 2023 following significant losses and liquidity issues.

What are “preferential transfers” in a bankruptcy context?

Preferential transfers are payments made by a company to certain creditors shortly before filing for bankruptcy. These payments can be clawed back by the bankruptcy estate if they unfairly favored those creditors over others.

What is the goal of the FTX Genesis lawsuit?

The main goal of the lawsuit is to recover $1.15 billion that the FTX Trust alleges was preferentially transferred to Genesis Digital. This recovered money would then be used to repay FTX’s creditors.

How might this lawsuit affect the crypto market?

While direct market impact might be limited, the lawsuit contributes to the ongoing narrative of regulatory scrutiny and accountability in crypto. It could set precedents for future bankruptcy cases involving digital assets and influence investor confidence in the long term.

If you found this article insightful, consider sharing it with your network! Stay informed about the latest developments in the crypto space by sharing this crucial update.

To learn more about the latest crypto market trends, explore our article on key developments shaping digital asset price action.

This post FTX Genesis Lawsuit: A Massive $1.15 Billion Legal Battle Unfolds first appeared on BitcoinWorld.

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

QNT Technical Analysis Jan 21