On-Chain Insights Reveal Bitcoin’s Silent Build-Up Stage

- Bitcoin’s on-chain data shows shrinking exchange supply and neutral investor sentiment, hinting at stored market energy.

- Social signals highlight retail impatience, often a precursor to major breakout momentum in Bitcoin markets.

The Bitcoin market is currently in a rare period of calm. According to a report by XWIN Research Japan on CryptoQuant, implied volatility has fallen to its lowest level since 2023.

Similar conditions last occurred before a major rally that pushed the price from around $29,000 to $124,000. The question now arises: is the “calm before the storm” pattern repeating itself, or is a different direction ahead?

Signals Point to a Market in Waiting Mode

On-chain data supports this view. Bitcoin reserves on exchanges continue to decline and are now near their lowest point in years.

The fewer coins available for instant sale, the greater the likelihood of a supply squeeze if demand suddenly spikes. On the other hand, this condition indicates that investors are choosing to hold rather than sell their holdings.

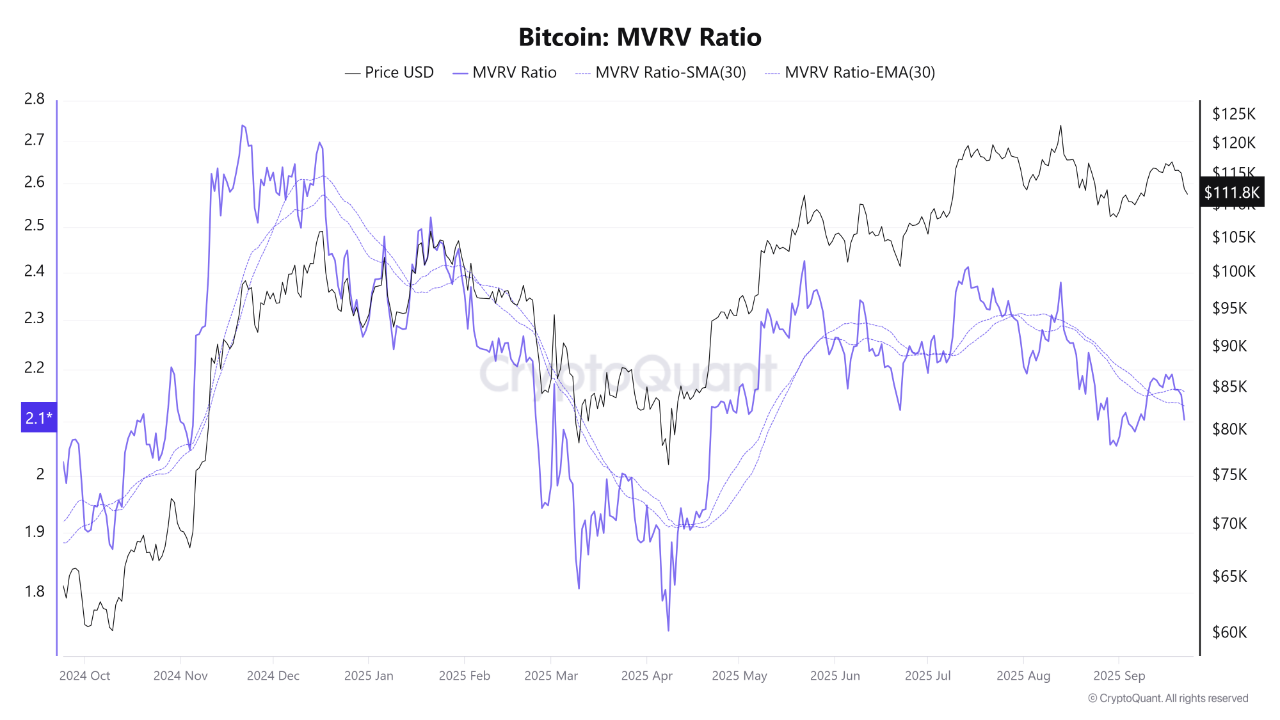

Another signal is seen in the MVRV ratio, which is in the neutral zone of around 2.1. This indicates that investors are neither experiencing significant losses nor making excessive profits.

Source: CryptoQuant

Source: CryptoQuant

In other words, there is almost no strong incentive to rush to sell or close positions. The resulting atmosphere suggests the market is choosing to wait for the next direction.

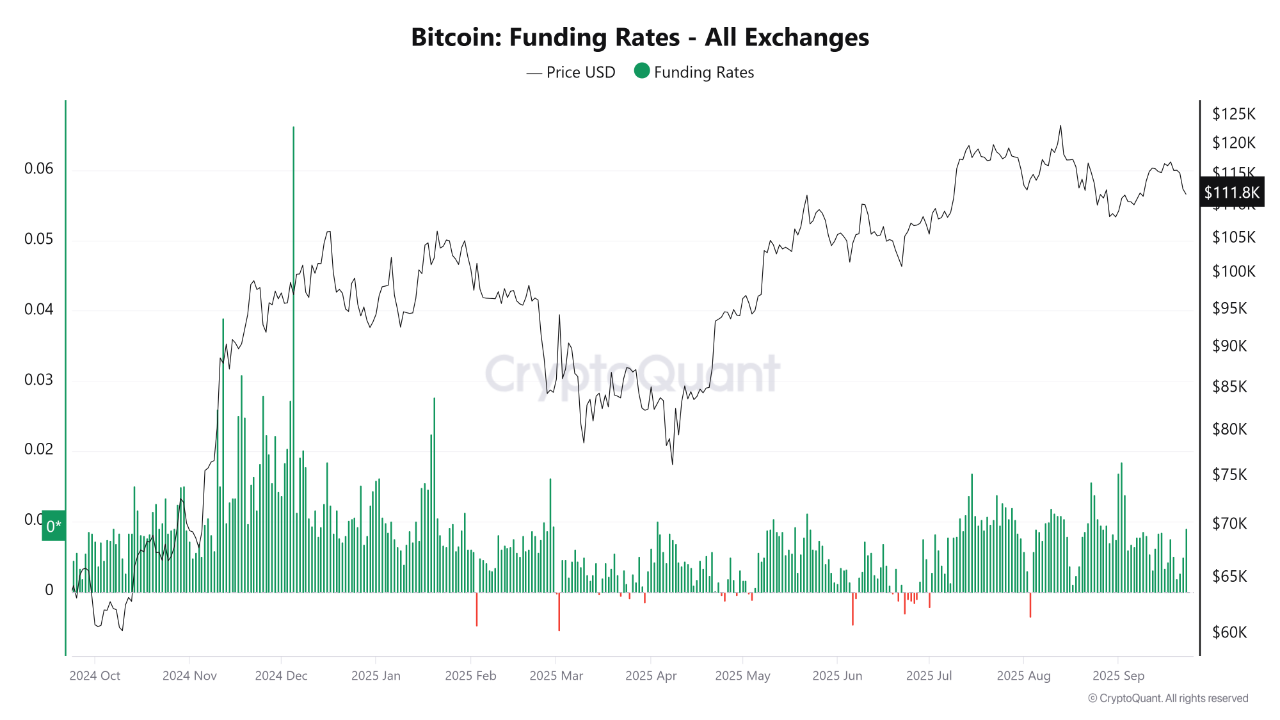

Furthermore, derivatives funding rates on major exchanges are stable. While still positive, their value does not reflect extreme speculation in either the long or short direction.

Source: CryptoQuant

Source: CryptoQuant

This picture aligns with the low volatility occurring, making it seem as if the market is conserving energy rather than expending it more quickly.

Furthermore, a CNF report a few days ago highlighted that the MVRV signal indicates the market is still in the Pre-Euphoria phase.

Historically, this phase often serves as the gateway to Euphoria, the period that typically triggers the strongest upward wave in each major cycle. If the old pattern repeats itself, we may be on the verge of a crucial shift.

Bitcoin Social Buzz Highlights Growing Investor Divide

However, market dynamics are not only evident in on-chain data. Santiment noted that social media is once again abuzz with debate over Bitcoin’s price direction.

Source: Santiment

Source: Santiment

Interestingly, there is a tendency for low price predictions to often open up opportunities for spikes, while high price predictions often signal a correction. Currently, pessimists are citing a range of $70,000–$100,000, while optimists are boldly targeting $130,000–$160,000.

Recent trends indicate increasing impatience and pessimism among retail investors. Ironically, these symptoms often present opportunities for those patiently waiting for momentum. When small traders retreat, the space for large movements often opens up.

On the other hand, views from the traditional financial world are also nuanced. Deutsche Bank stated that there is a possibility of Bitcoin and gold entering central bank balance sheets by 2030. While analysts believe digital assets will continue to grow, they emphasize that they will not replace the US dollar.

Meanwhile, as of the writing time, BTC is changing hands at about $112,550, down 0.58% over the last 24 hours and 3.58% over the last 7 days.

You May Also Like

The Channel Factories We’ve Been Waiting For

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip