SharpLink Boosts Holdings with 575 ETH from Staking Rewards

Highlights:

- SharpLink boosts Ethereum holdings with 575 tokens obtained through staking rewards.

- The company now holds 838,728 ETH, valued at about $3.51 billion.

- SharpLink has accumulated 3,815 ETH through staking since the program launched in June.

One of the world’s largest Ethereum (ETH) holding firms, SharpLink Gaming, boosted its token stores with 575 ETH generated from staking rewards last week. The company announced the latest token accumulation via a tweet on September 23, amid Ethereum’s recent price struggles.

According to the X post, SharpLink has now generated 3,815 ETH through staking after launching the strategy on June 2, 2025. The company also noted that its ETH treasury is fully staked, generating consistent yields. “This is the power of ETH: productive, yield-bearing, compounding,” SharpLink added.

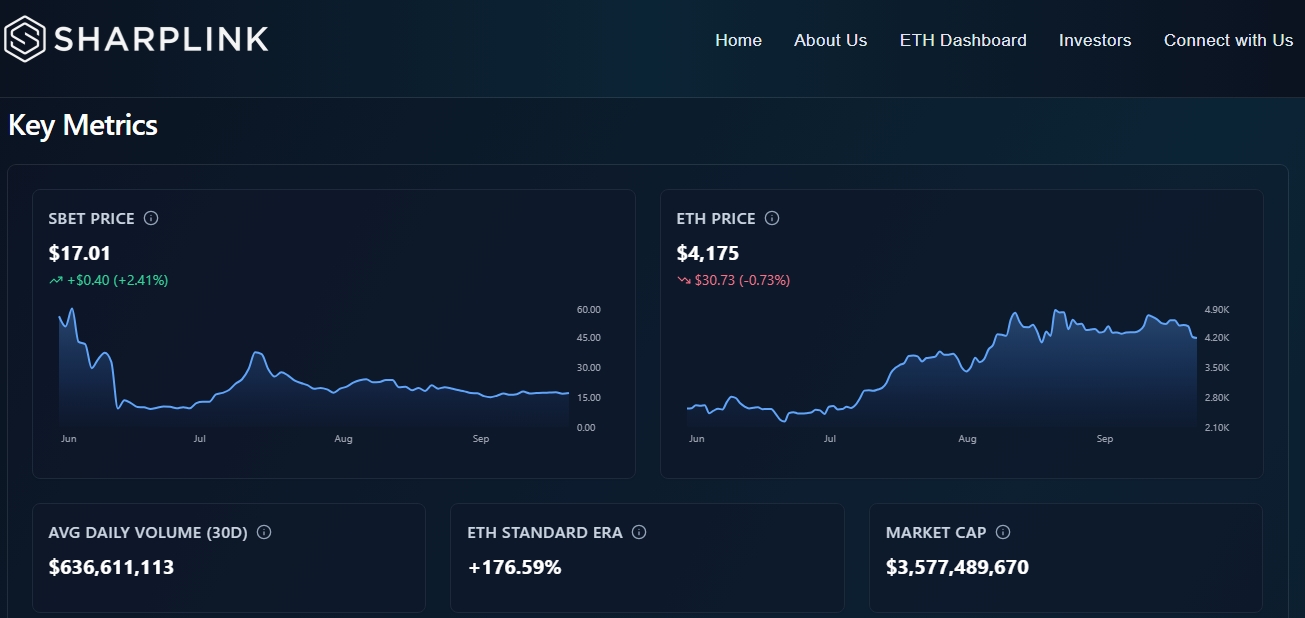

Total ETH Holdings Push Toward 1M Tokens

SharpLink’s Ethereum dashboard showed that the company holds 838,728 ETH, valued at $3.51 billion, at an average cost of $3,603 per token. Unrealised gains from the massive ETH holdings reached $496.86 million. Meanwhile, SharpLink’s shares traded at $17.01, up 2.41% in the past 24 hours. The stock’s average monthly trading volume sits at $636.6 million. Notably, the percentage yield on shares since inception has reached 176.59%, while the total market value is $3.577 billion.

Source: SharpLink ETH Dashboard

Source: SharpLink ETH Dashboard

SharpLink Activities Recap for Previous Weeks

Beyond the tokens obtained through staking, SharpLink didn’t purchase any additional ETH nor conduct share buybacks last week. The company’s most recent buyback was in the week ending September 14, when it repurchased 1,000,000 shares under its $1.5 billion buyback program.

SharpLink repurchased its common stock at an average price of $16.67, bringing its total number of repurchased shares to 1,938,450. The buyback initiative was launched in late August as part of the company’s effort to restore its share value.

That week also saw no funds raised through SharpLink’s at-the-market (ATM) facility program. The company also carries no debt obligations. The ETH concentration index climbed 3.97, almost doubling its June level, highlighting the company’s reliance on Ethereum as its core treasury asset. Meanwhile, net asset valuation (NAV) stood at $3.86 billion, translating to about $18.55 per diluted share. SharpLink views buybacks as the best method to grow its ETH-per-share value when shares dip below NAV.

Joseph Chalom, Co-CEO at SharpLink Gaming, stated:

ETH’s Price Continues to Drop as SharpLink Boosts Holdings

Despite hitting an all-time high (ATH) of $4,946.05 on August 24, 2025, Ethereum is trading at $4,176.77 following a 0.7% decline in the past 24 hours. Within the same timeframe, the asset fluctuated between $4,100.86 and $4,220.47 with a trading volume of $31.16 billion.

Other extended period price change variables also reflected declines, highlighting Ethereum’s struggles. For context, ETH dropped 7.5% 7-day-to-date, 3% 14-day-to-date, and 11.3% month-to-date. Meanwhile, sentiment on Ethereum is bearish with a Fear & Greed Index that is pointing towards fear at 44. Supply inflation is low at 0.3%, volatility is medium at 2.82%, and dominance is 12.98%.

Source: CoinMarketCap

Source: CoinMarketCap

Despite Ethereum’s bearish outlook, institutional investors have continued to accumulate the token. On September 20, Crypto2Community reported that Bitmine added 15,427 ETH worth roughly $69 million to its treasury within an hour. The massive accumulation increased the company’s holdings to 1.95 million ETH, valued at approximately $8.66 billion, maintaining its position as the largest ETH holder.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

The Channel Factories We’ve Been Waiting For

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip