Analyst Predicts a $220K Bitcoin, Saylor Restates His Trust in Bitcoin, While Bitcoin Hyper Presale Hits $18M

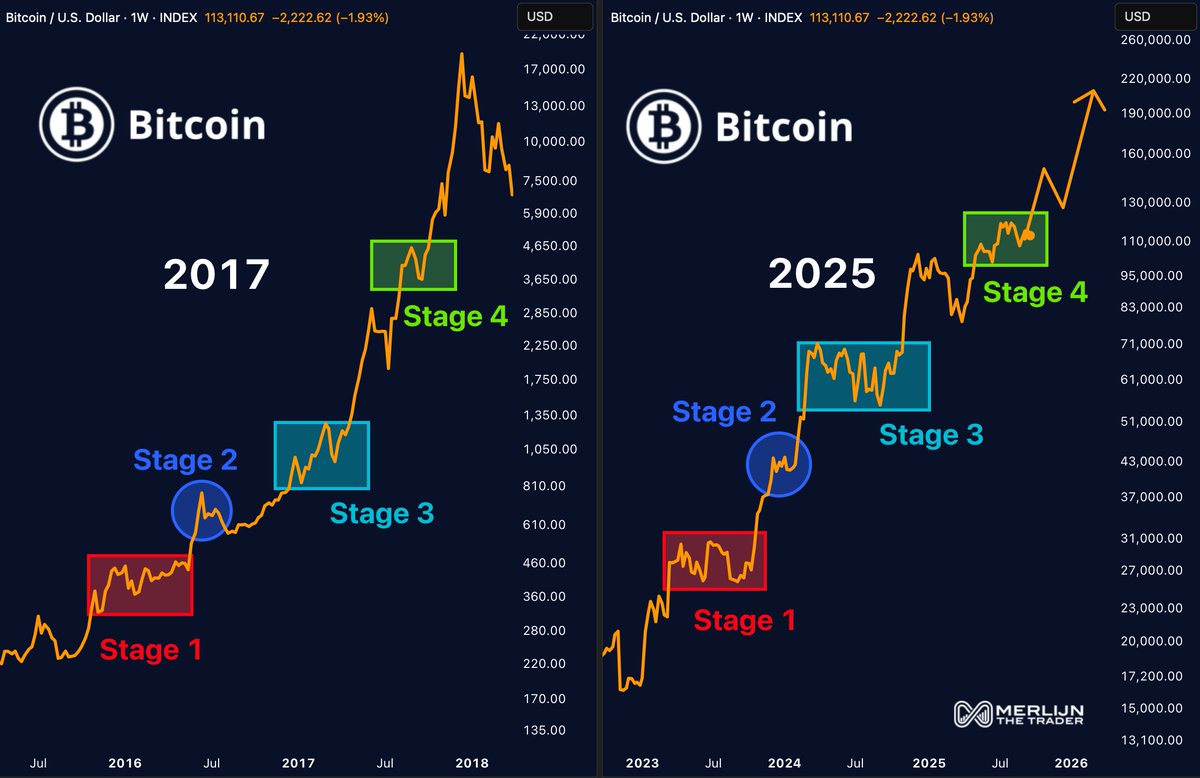

This is what Merlijn The Trader believes based on the four-stage bull fractal, which caused $BTC to soar by 528% in 2017, from around $3,500 to over $21,000. The same pattern is happening in 2025, this time pointing toward a $220K target.

Based on recent developments, including the last FOMC meeting where the Fed cut interest rates by 25 basis points and the GENIUS Act finalizing its first implementation phase in October, Bitcoin promises an explosive end to 2025.

The same appears true for Bitcoin’s upcoming Layer 2 upgrade, Bitcoin Hyper ($HYPER), currently in an $18M presale.

With strong potential for faster and cheaper transactions on the Bitcoin network, Hyper’s rampant presale demonstrates impressive investor support likely to continue into 2026.

Michael Saylor Doubles Down on His Support for Bitcoin

Michael Saylor referred to Bitcoin as money in an X post, stating that everything else is credit.

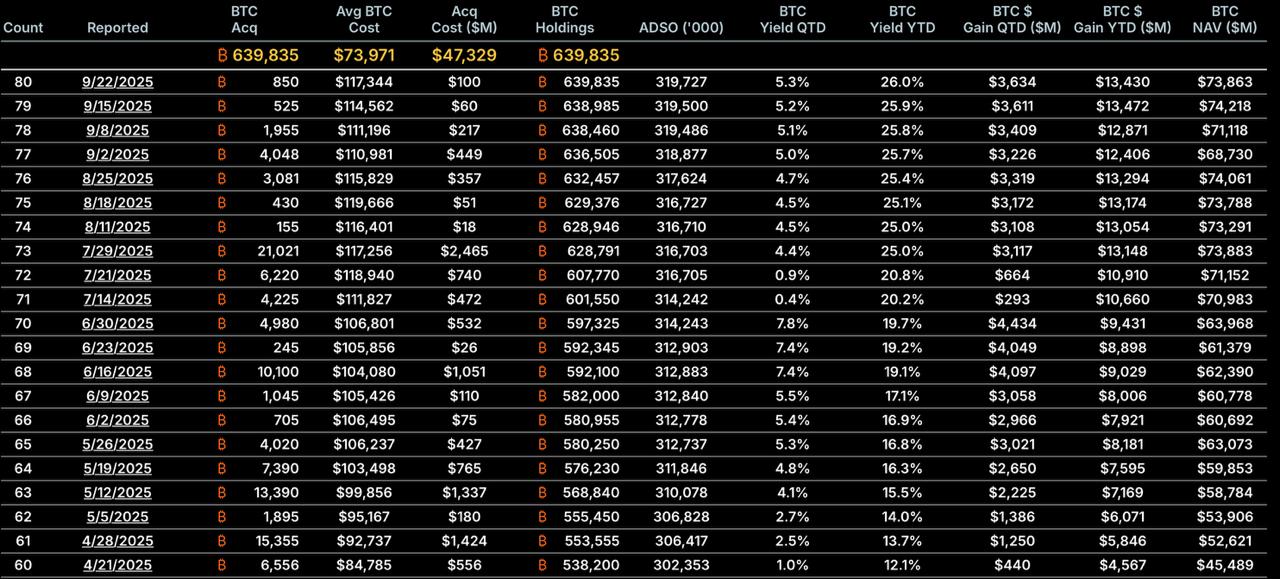

The comment is very appropriate given that Strategy bought $11,044 $BTC over $8B between August and September alone.

This buying strategy enabled the company to establish a $74 billion Bitcoin reserve with no clear end in sight.

The last purchase of 850 Bitcoins on September 22nd occurred as Strategy exploited the dip that followed the most recent FOMC meeting, which caused Bitcoin to drop by 4.8% between the 19th and today, resulting in a $7K loss.

Saylor’s trust in Bitcoin as a game changer isn’t founded on blind faith.

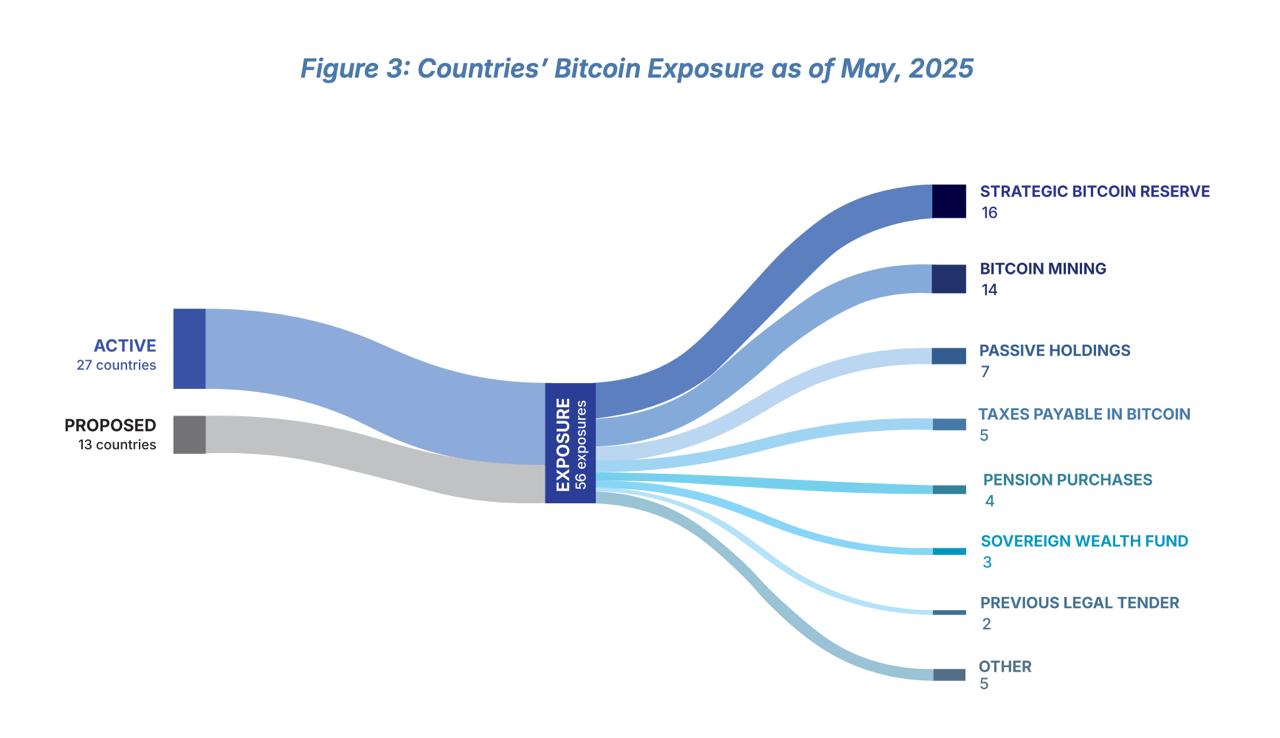

Bitcoin is already reaching groundbreaking milestones worldwide, according to a recent report from Bitcoin Policy Institute, which highlighted a widespread global adoption trend.

As the report shows, 27 countries had exposure to Bitcoin, while 13 more were actively pursuing it legally by the end of May 2025.

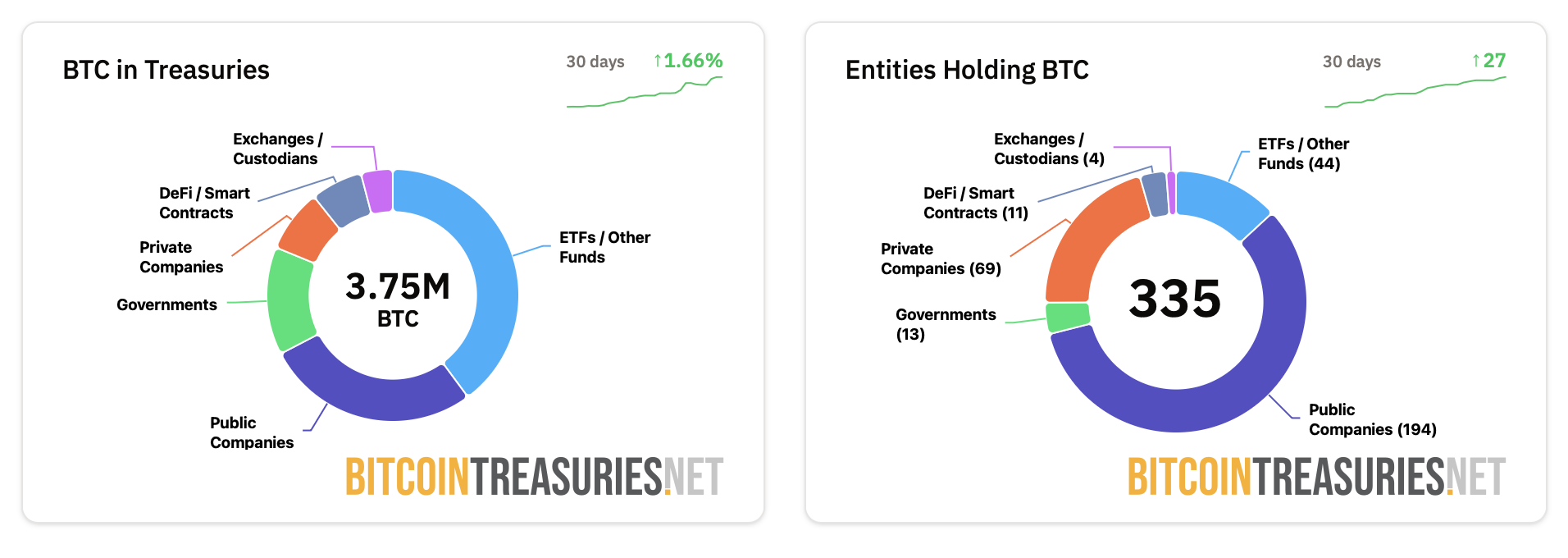

The situation is similar in the public sector, as Bitcoin Treasuries shows. The data indicates that $3.76 million $BTC is locked in treasuries across various sectors, including government, public institutions, private companies, and ETF funds.

Moreover, the accumulation trend is up 1.79%, despite Bitcoin’s poor recent performance.

Aside from Bitcoin’s value as a decentralized asset, its historically low volatility, and its impressive 10-year ROI of 38,906.1%, one more factor could boost Bitcoin’s performance in 2025: Bitcoin Hyper ($HYPER).

How Bitcoin Hyper Turns Bitcoin Into an Institutional-Grade Asset

Bitcoin Hyper ($HYPER) transforms Bitcoin into an institutional-grade asset by addressing the network’s primary problem: its performance limitation.

The Bitcoin network is inherently limited to 7 transactions per second (TPS), ranking it 22nd among the fastest blockchains by TPS. Solana ranks second on that list with a TPS of 796 at the time of writing.

The problem is obvious, and Hyper plans to eliminate it.

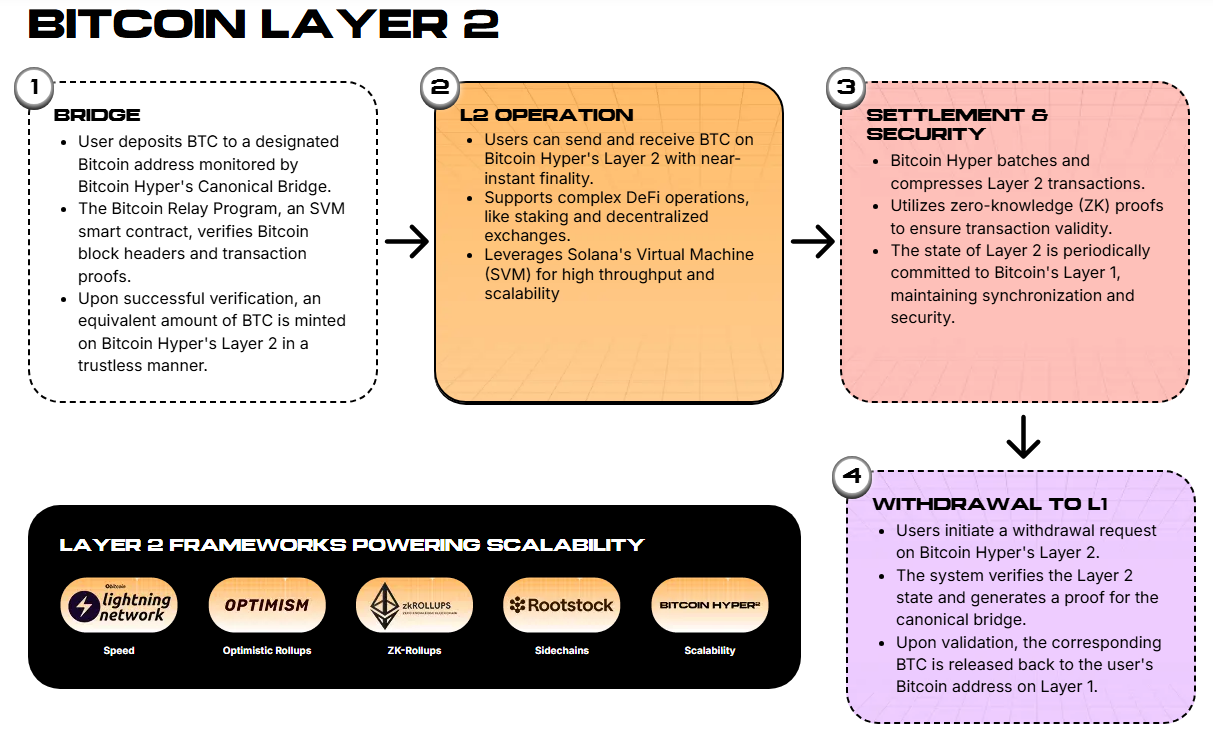

The project depends on several tools, with Solana Virtual Machine (SVM) and the Canonical Bridge being the most impactful.

While SVM accelerates the execution of smart contracts and DeFi apps for a significant performance boost, the Canonical Bridge tackles network congestion and the extremely long confirmation times.

The Bridge depends on the Bitcoin Relay Program to verify and confirm transactions, after which it mints the users’ tokens into the Hyper layer. Traders can use their wrapped Bitcoin within the Hyper ecosystem or withdraw it to the native Bitcoin layer at their discretion.

These tools significantly boost Hyper’s performance, eliminate network congestion, and remove Bitcoin’s fee-based priority system, which favors large, fee-heavy transactions over smaller, cheaper ones.

The result is a quicker and more responsive Bitcoin network with confirmation times of seconds and significantly better scalability.

This promises to make the Bitcoin ecosystem a more attractive option for institutional investors, who handle thousands of transactions per second. This rate is incompatible with the Bitcoin network’s current capacity.

The presale just broke $18M with $HYPER valued at $0.012965.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Analyst Predicts a $220K Bitcoin, Saylor Restates His Trust in Bitcoin, While Bitcoin Hyper Presale Hits $18M appeared first on Coindoo.

You May Also Like

XRP Price Prediction: Ripple CEO at Davos Predicts Crypto ATHs This Year – $5 XRP Next?

What Is Jawboning? Jimmy Kimmel Suspension Sparks Legal Concerns About Trump Administration