JPMorgan and Citigroup Upgrade Riot Platforms on AI Computing Pivot

TLDR

- JPMorgan upgraded Riot Platforms from Neutral to Overweight with price target raised to $19 from $15

- Citigroup also upgraded RIOT to Buy from Neutral, lifting price target to $24 from $13.75

- Both upgrades cite Riot’s pivot into artificial intelligence and high-performance computing as key growth drivers

- JPMorgan assigns 50% probability that Riot secures near-term HPC colocation agreements worth $3.7-8.6 million per MW

- Riot operates 700 MW Rockdale facility and is energizing new 1 GW Corsicana site, positioning it as scaled bitcoin miner

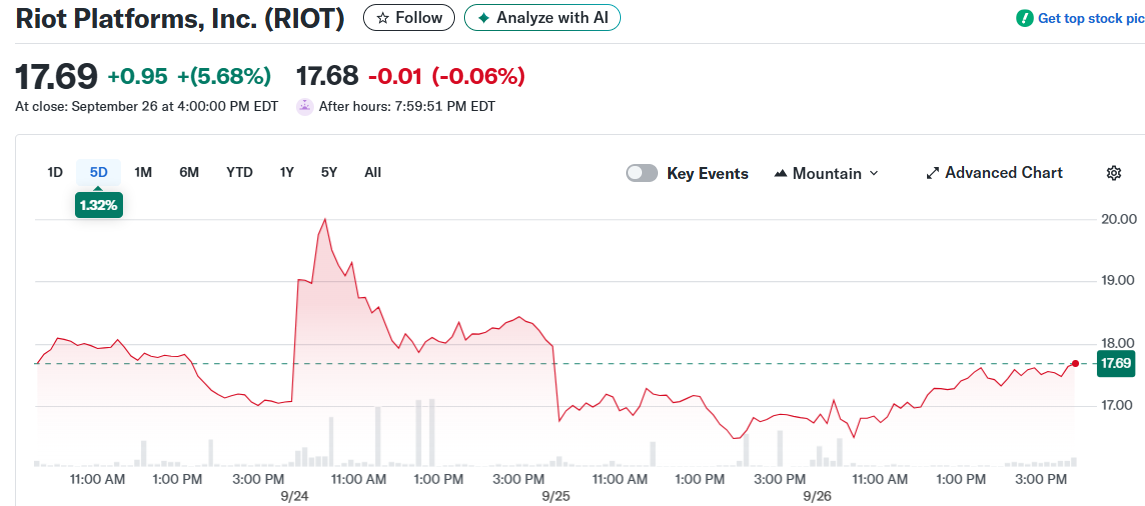

Riot Platforms received two major Wall Street upgrades on Friday as investment banks see potential in the bitcoin miner’s shift toward artificial intelligence services. JPMorgan lifted the stock from Neutral to Overweight while Citigroup upgraded from Neutral to Buy.

JPMorgan raised its price target to $19 from $15. Citigroup increased its target to $24 from $13.75.

Both firms pointed to Riot’s strategic move into artificial intelligence and cloud services. This pivot comes as traditional bitcoin mining profits face pressure from changing industry economics.

Riot Platforms, Inc. (RIOT)

Riot Platforms, Inc. (RIOT)

The upgrades helped Riot outperform the broader mining sector on Friday. Riot shares fell just 1.2% to $16.55 while other miners declined more sharply.

Riot operates the 700 MW Rockdale facility in Texas. The company describes this as one of the largest bitcoin mining facilities in the United States.

The miner is also working to energize its new 1 GW Corsicana site. This expansion will increase its total operational capacity.

High-Performance Computing Potential

JPMorgan analysts assign a 50% probability that Riot will secure near-term high-performance computing colocation agreements. The bank uses Core Scientific’s 800 MW CoreWeave deal as a benchmark for valuation.

HPC colocation contracts carry substantial value. JPMorgan estimates these deals are worth between $3.7 million to $8.6 million per gross megawatt.

The company issued convertible debt to purchase bitcoin directly. It is also actively exploring HPC hosting opportunities.

Financial Performance Remains Strong

Riot reported strong financial results for the second quarter of 2025. Net income reached $219.5 million with adjusted EBITDA of $495.3 million.

Total revenue hit $153.0 million, up from $70.0 million in the same period last year. The increase was driven by an $85.1 million rise in bitcoin mining revenue.

In August, the company produced 477 bitcoin. This marked a 48% increase compared to the previous year.

This represented a slight decrease from July’s production of 484 bitcoin. The month-to-month variance is typical in mining operations due to network difficulty adjustments.

The company held 19,309 bitcoin at the end of August. This represents a 93% increase from holdings in the previous year.

Riot’s stock has delivered strong returns over recent months. The stock posted a 112% gain over the past six months despite Friday’s modest decline.

The post JPMorgan and Citigroup Upgrade Riot Platforms on AI Computing Pivot appeared first on CoinCentral.

You May Also Like

South Korea Prosecution Loses Bitcoin Worth $48 Million

PEPE Price Prediction: Was Pepe’s Price Increase Short-Lived? Why This New Crypto Has The Potential for Long-Term