Pi Network Price Struggles as Market Indicators Point to Further Decline

TLDR

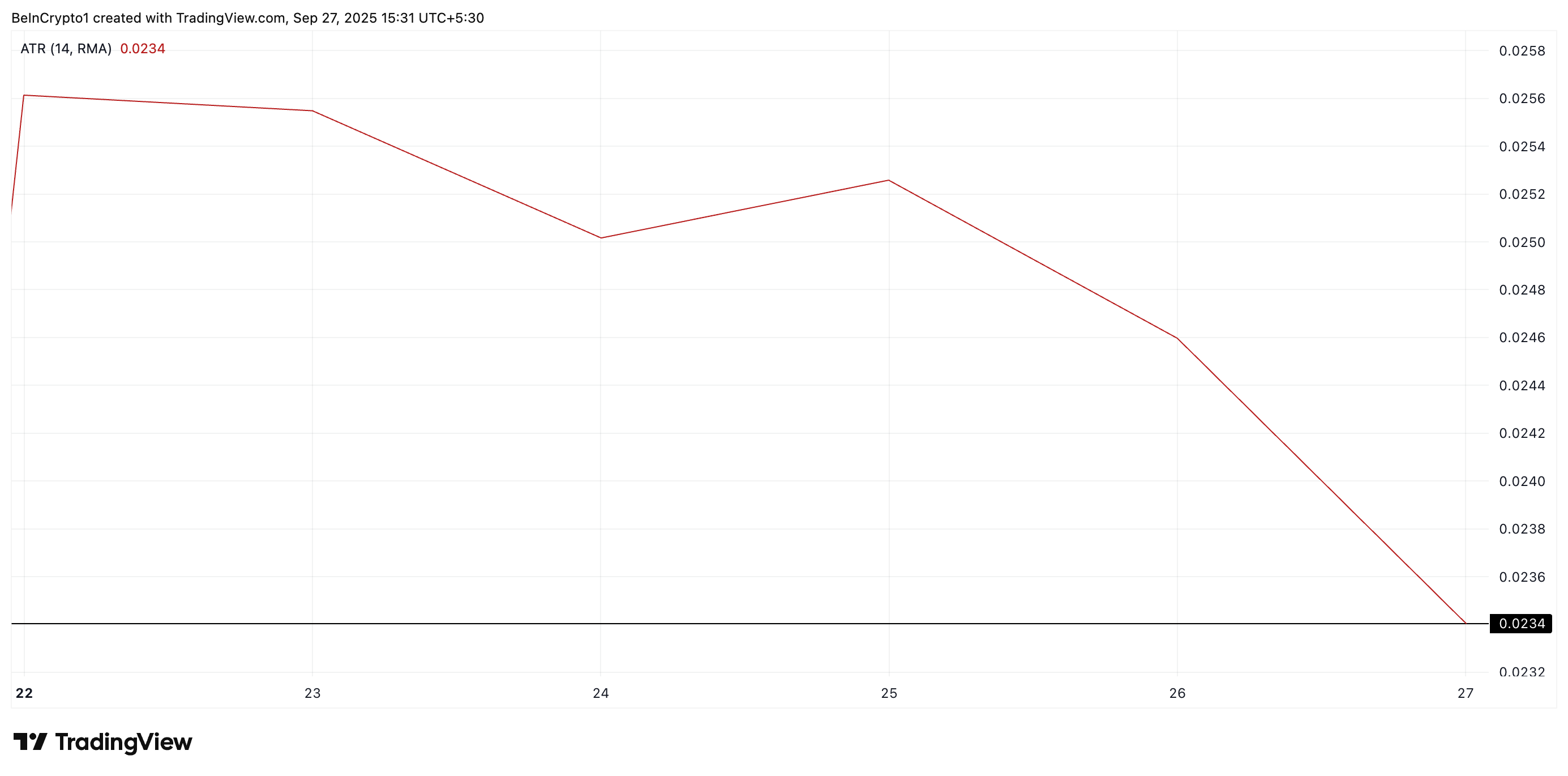

- PI’s ATR has dropped to 0.0234, indicating weak market momentum.

- Pi Network’s price remains below the 20-day EMA, showing bearish trends.

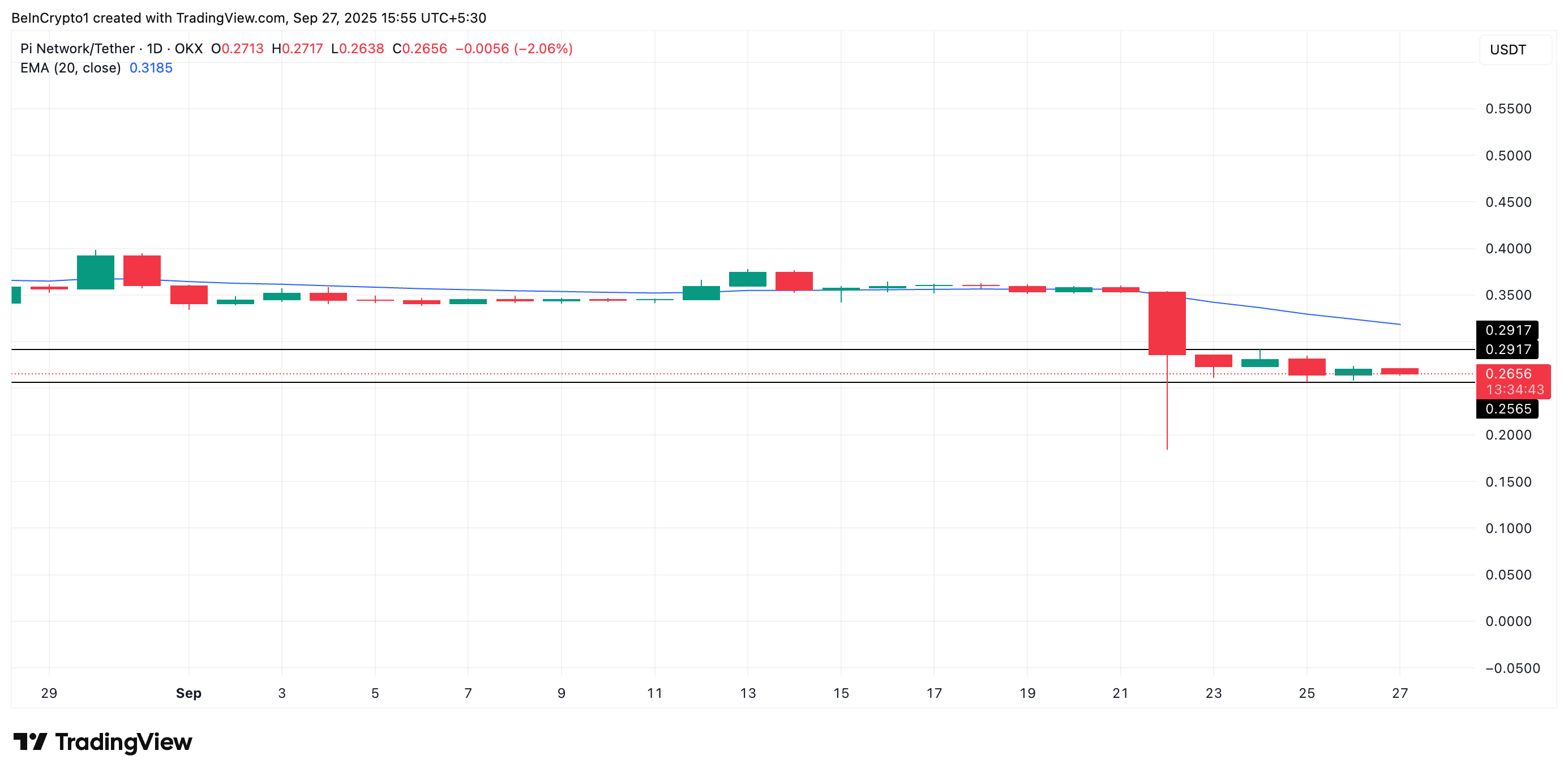

- Support at $0.2565 faces pressure, risking a drop back to the all-time low.

- PI struggles to break resistance at $0.2917, reinforcing downward sentiment.

Pi Network’s native token, PI, is facing troubling signs as its price continues to stagnate. Since hitting an all-time low of $0.1842 on September 22, PI has been trapped in a sideways trading pattern, oscillating between key support and resistance levels. Weakening momentum, reflected by several market indicators, raises concerns that the token could soon break below its current support, leading to another potential price drop.

Weak Momentum and Low Trader Participation

The current price action for PI highlights a decline in market activity. The token’s Average True Range (ATR), which measures price fluctuations, has steadily fallen to 0.0234. This suggests that the level of price movement is shrinking, which typically signals weakening trader participation.

With less market volatility, there is a reduction in both buying and selling pressure, pointing to a possible continuation of the sideways trend or even a breakdown below critical support levels.

The decrease in the ATR could indicate that traders are hesitant to engage with PI at its current price range. As fewer participants enter the market, the chances of the price sliding further down increase. If this trend persists, the support at $0.2565 could be tested, and if it fails to hold, PI may revisit its all-time low.

Struggling Below Key Resistance Levels

Another critical factor influencing PI’s outlook is its position relative to the 20-day Exponential Moving Average (EMA). This moving average is currently acting as a dynamic resistance point, sitting just above the token’s current price at $0.3185.

The 20-day EMA is a key indicator of short-term price trends. When the price is below this moving average, it suggests that sellers are in control, and there is a lack of upward momentum.

At the moment, PI has failed to break above this resistance, confirming that bearish sentiment is prevalent in the market. The token’s inability to climb above the 20-day EMA raises the likelihood of further downside pressure. Traders are showing little interest in pushing the price higher, which suggests the bearish trend is likely to persist unless there is a notable shift in market sentiment.

Risk of Breaking Support Levels

The combination of weak momentum and resistance at the 20-day EMA creates a concerning technical setup for PI. As the token trades closer to its support at $0.2565, there is a growing risk of a price breakdown.

If this support level fails to hold, PI could move towards its all-time low of $0.1842. This would mark another significant drop for the token, further solidifying the bearish outlook for the short-term future.

Given the current market conditions, PI seems vulnerable to more selling pressure. With dwindling participation and a lack of positive news or developments to boost sentiment, the risks of a further decline outweigh any potential for a short-term rally.

Potential for a Reversal

While the bearish outlook is dominant, there is still a possibility of a price reversal if market sentiment improves. A positive shift could allow PI to break through its resistance at $0.2917.

If this level is surpassed, the token could start to recover, potentially reclaiming the 20-day EMA and initiating a more sustained upward movement. However, this would require a significant change in market conditions or a catalyst that sparks renewed interest in the token.

In summary, PI is currently trapped in a sideways trend, with technical indicators pointing to further downside risk. Unless market sentiment changes, PI faces the possibility of breaking key support levels and revisiting its all-time low. The 20-day EMA will continue to act as a major resistance point, and without renewed demand, the outlook remains bearish.

The post Pi Network Price Struggles as Market Indicators Point to Further Decline appeared first on CoinCentral.

You May Also Like

X allows crypto ads again as X Money beta rollout approaches

XRP Holders Shift to Caution as $650 Million Flows to Binance During Rising Tensions