XRP-focused DeFi services expand with cbXRP support on Base, Flare networks’ staking model

- Flare expands XRP’s role in DeFi with $100M in XRP from Vivo Power and increasing liquidity.

- Moonwell becomes the first on the Base ecosystem to extend support for cbXRP, a tokenized version of XRP by Coinbase.

- The expanding role of XRP in DeFi offers holders greater flexibility in accessing on-chain services.

The role of Ripple’s XRP token is expanding the broader Decentralized Finance (DeFi) market with the extended support of multiple platforms. Flare’s constant effort to boost XRP DeFi (XRPFi) attracted $100 million from Vivo Power, an electric vehicle services company.

Beyond staking, new branches of XRPFi emerge on the Base ecosystem’s Moonwell, offering extended support for XRP via tokenized cbXRP, opening the gates for other DeFi services.

Moonwell launches first-ever cbXRP market on Base ecosystem

Moonwell, a lending app on the Base ecosystem, announced extended utility for cbXRP, a 1:1 backed tokenized version of XRP by Coinbase. This begins the lending and borrowing of cbXRP on Base.

For the new DeFi service, XRP holders must exchange their tokens for cbXRP on Coinbase to borrow USD Coin (USDC) against it. With the borrowed USDC, XRP holders will have DeFi exposure without selling their XRP.

VivoPower and USDT0 on Flare boost XRPFi

VivPower pledged a $100 million investment in XRP for institutional yield gains through a partnership with Flare last week. It aligns with Vivopower’s goal to become the world’s first XRP-focused digital asset enterprise.

Adding a DeFi layer to XRP, Flare offers FXRP, a 1:1 tokenized, fully non-custodial version of XRP.

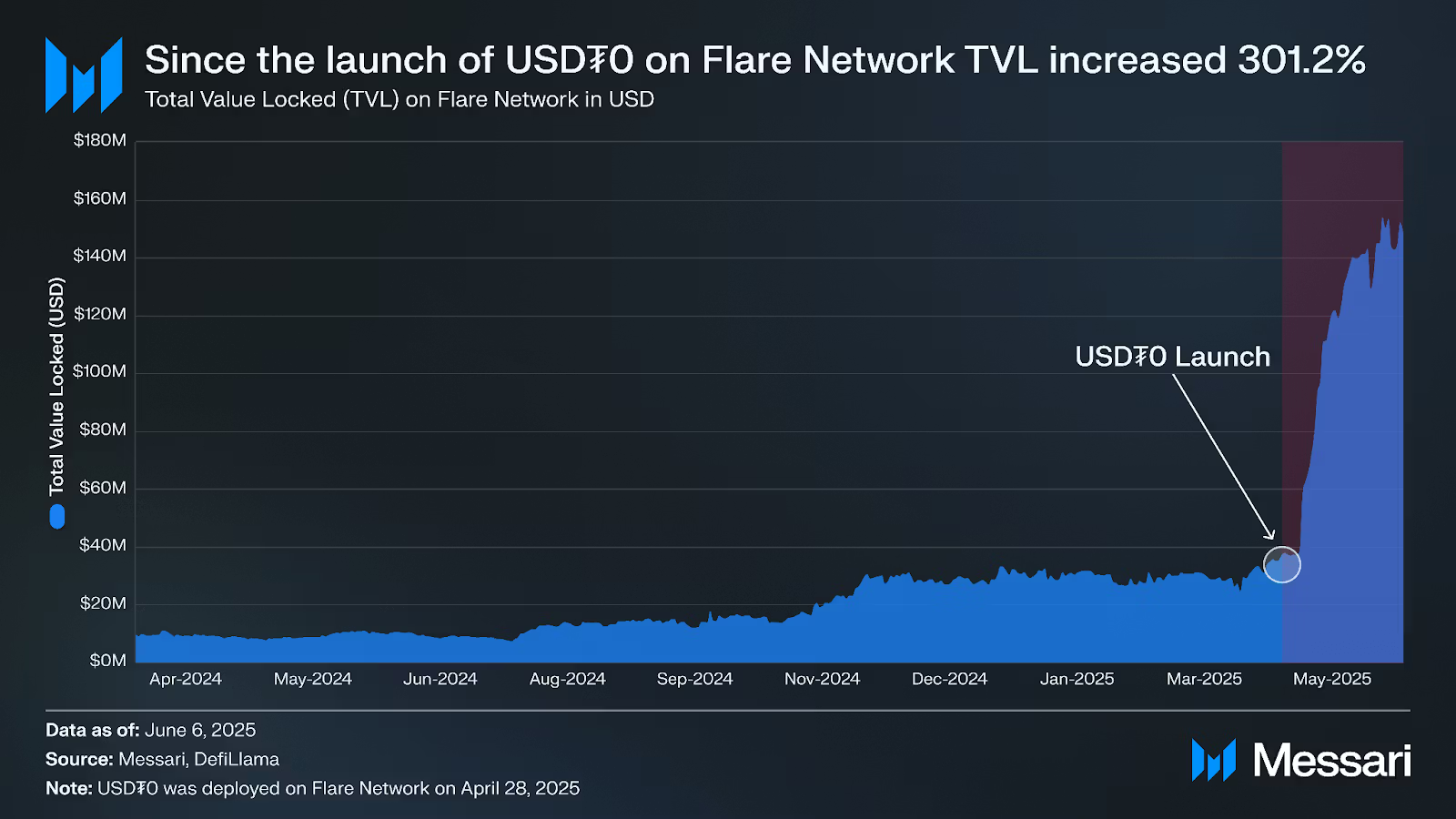

Alongside Vivopower’s investment, a Messari report notes that Flare experiences a liquidity spike with the integration of USDT0, the omnichain version of Tether’s USDT stablecoin, which utilizes LayerZero’s Omnichain Fungible Token standard.

Flare's TVL growth. Source: Messari

The Total Value Locked (TVL) on Flare has surged to an all-time high of $162 million on June 8, from $38 million on April 29. Currently, the DeFiLlama data shows Flare’s TVL stands at $144 million.

Flare TVL. Source: DeFiLlama

Flare also plans to advance XRP’s role in DeFi through liquid staking, which will reward users for staking FXRP with stXRP, similar to Liquid Staking Tokens (LST) earned on Lido DAO.

You May Also Like

GBP/USD rises as Fed rate cut odds boost Sterling

Crossmint Partners with MoneyGram for USDC Remittances in Colombia