Polkadot Community Backs Proposal for DOT-Backed Algorithmic Stablecoin pUSD

The Polkadot community has opened a vote on a proposal for pUSD, a native stablecoin backed entirely by DOT tokens, through a governance referendum currently underway on the network’s “Wish for Change” track.

The proposal, detailed in RFC-155 and authored by Bryan Chen, would deploy the stablecoin on Polkadot Asset Hub using the Honzon protocol previously employed by Acala’s failed aUSD project.

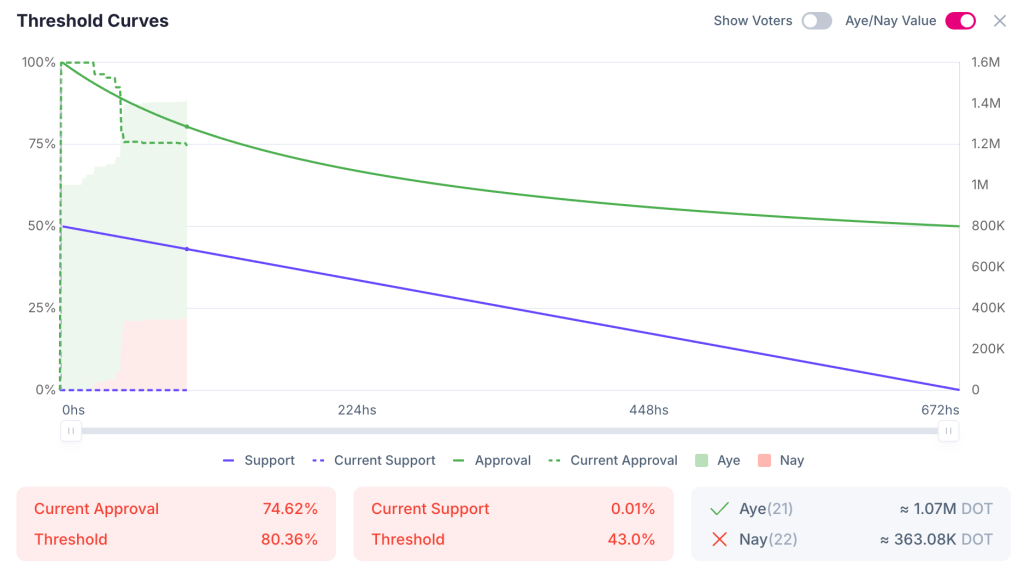

At the time of writing, Aye holds 74.62%, while Nay holds 25.40%, against an 80.40% approval threshold.

Source: Polkadot

Source: Polkadot

Community Split Over Acala’s Technical Legacy

The initiative seeks to reduce Polkadot’s dependence on USDT and USDC, which currently dominate the ecosystem with a combined market cap of $74.05 million, with USDC at 56.79% dominance.

The proposal has generated strong controversy due to its connection with Acala, whose aUSD stablecoin collapsed following a 2022 exploit that damaged trust across the ecosystem.

Multiple prominent community members have voted against the proposal, specifically citing concerns about Acala’s involvement.

TheGlobedotters stated that “no one from Acala should be involved with any stablecoin in the ecosystem, especially a strategic one like this, ever again,” while noting that aUSD’s failure stemmed from liquidity pool misconfiguration rather than Honzon protocol flaws.

The White Rabbit shared similar concerns, voting against the proposal while supporting the concept of a native stablecoin in principle.

The voter outlined two conditions for potential support. First, a clear assurance that no Acala team members would be involved in development; second, explicit Technical Fellowship oversight of governance and risk management.

Another community member noted that “Acala is dead because of AUSD” and warned that rushing implementation could damage Polkadot’s reputation.

Gavin Wood Pushes Multi-Track Stablecoin Strategy

On September 10, Polkadot founder Gavin Wood outlined his vision for the ecosystem’s stablecoin approach, which preceded the pUSD proposal.

Wood emphasized that “Polkadot would be remiss not to have its own native stablecoin” and specified requirements including full DOT collateralization, Polkadot governance control, and DAI-level security guarantees.

He expressed support for Hydration’s upcoming HOLLAR stablecoin while maintaining that a protocol-level DOT-backed stablecoin remains strategically necessary.

Wood also introduced the concept of a “stable-ish” DOT asset that would accept some volatility while avoiding massive collateral requirements.

This middle-ground approach between hyper-volatile DOT and strict dollar pegs would seek to “soften volatility” for users seeking partial stability without full collateralization costs.

Until a pure DOT stablecoin exists, Wood indicated a preference for HOLLAR over USDT and USDC, though he acknowledged that centralized stablecoins may still be needed for validator payouts and practical integrations.

The pUSD proposal arrives as Polkadot implements major tokenomics changes, having approved a 2.1 billion DOT hard cap in September through Referendum 1710 with 81% support.

The network is shifting from its inflationary model of 120 million annual DOT issuance to a declining schedule that will reduce minting to below 20 million by the early 2030s.

The current circulating supply stands at 1.6 billion DOT, with the total supply projected to stabilize near 1.91 billion by 2040 under the new framework.

Global Stablecoin Market Exceeds $300B as Regulatory Framework Solidifies

The pUSD debate unfolds against surging global stablecoin adoption, with total market capitalization surpassing $300 billion for the first time in September.

During this time, Circle’s NYSE debut saw shares rise 400% post-IPO, valuing the USDC issuer at $30 billion, while Tether introduced a U.S.-compliant stablecoin and is seeking $500 billion in funding.

Given the fast-paced growth of the sector, Treasury Secretary Scott Bessent projects that the sector will reach $3 trillion by 2028 as stablecoins integrate into global payments and decentralized finance.

Citigroup also forecasts a stablecoin market cap between $1.6 trillion and $3.7 trillion by 2030, driven by clearer regulation and institutional participation.

The bank warned that leading issuers could become among the largest U.S. Treasury holders by the end of the decade, potentially disrupting traditional banking through deposit substitution.

The GENIUS Act, signed in July, has provided federal oversight for stablecoin issuers, which has largely aided this growth.

Meanwhile, a consortium of nine European banks, including ING, UniCredit, and Deutsche Bank, is exploring a euro-denominated stablecoin launch to compete with dollar dominance.

As Mark Aruliah of Elliptic stated, European banks need to “move quickly to adopt and scale credible euro-denominated stablecoins” or risk ceding ground to U.S. and Asian competitors.

You May Also Like

SoFi taps BitGo to support distribution of its SoFiUSD stablecoin

The reality of today