SEC Suspends Trading of QMMM Holdings Amid Stock Manipulation Probe

TLDR

- SEC suspended trading of crypto treasury firm QMMM Holdings until October 13 due to potential stock manipulation

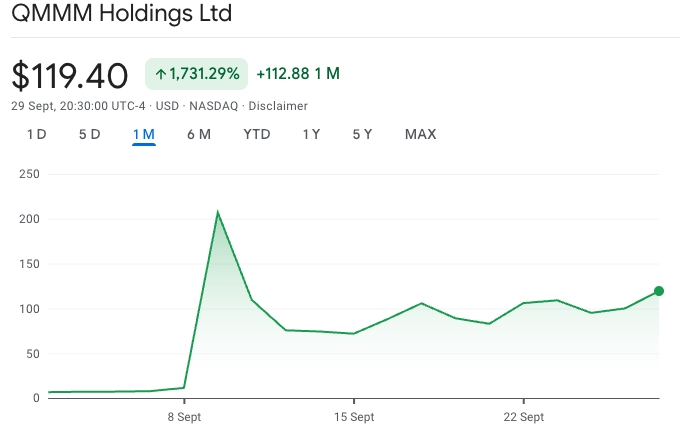

- QMMM shares surged over 1,700% in a month after announcing plans to buy Bitcoin, Ethereum, and Solana

- The halt follows reports that SEC and FINRA are investigating unusually high trading volumes in crypto treasury stocks

- Alleged manipulation involved recommendations via social media designed to artificially inflate price and volume

- The trading suspension is unrelated to the company’s crypto strategy but rather concerns illegal stock promotion

QMMM Holdings, a digital advertising company that recently pivoted to cryptocurrency investments, has had its stock trading suspended by the U.S. Securities and Exchange Commission (SEC) amid concerns of potential market manipulation. The regulatory action comes after the company’s shares surged more than 1,700% in just one month following its announcement to invest in cryptocurrencies.

The SEC officially halted trading of QMMM shares on Monday, stating the suspension would remain in effect for ten trading days until October 13. The regulator cited “potential manipulation” as the primary reason for the action.

According to the SEC notice, the alleged manipulation was “effectuated through recommendations made to investors by unknown persons via social media to purchase” QMMM shares. These recommendations “appear to be designed to artificially inflate the price and volume” of the company’s stock.

QMMM Holdings announced on September 9 that it would allocate $100 million to purchase and hold Bitcoin, Ethereum, and Solana. This announcement triggered a massive price surge, with shares climbing from approximately $6.50 to $119.40 in just one month.

In a single day after the crypto strategy announcement, QMMM stock jumped from $11 to an all-time high of $207. The company joined a growing trend of firms adopting crypto treasury strategies in recent months.

Source: Google Finance

Source: Google Finance

SEC Investigation Extends Beyond QMMM

The trading halt follows a Wall Street Journal report last Thursday revealing that both the SEC and the Financial Industry Regulatory Authority (FINRA) have contacted several companies that recently launched crypto treasury strategies. The regulators are examining unusually high trading volumes and price gains that occurred before public announcements of these crypto pivots.

This timing is critical because SEC rules prohibit companies from selectively disclosing non-public information. Such selective disclosure could allow individuals with prior knowledge to gain unfair advantages in the market before wider public disclosure.

Market experts note that SEC trading suspensions are relatively uncommon. Carl Capolingua, senior editor at Market Index, told Cointelegraph that such actions are “very rare, generally because of the consequences for company management.”

Stock Promotion, Not Crypto Strategy, Under Scrutiny

Industry analysts emphasize that the SEC’s investigation appears focused on illegal stock promotion rather than QMMM’s cryptocurrency strategy itself. Capolingua noted that while the crypto pivot may have made the company more attractive to investors, the crypto strategy “isn’t likely to be an item of scrutiny” for regulators.

The consequences could be severe if the SEC connects the “unknown persons” promoting the stock to company employees or management. Potential penalties include substantial fines or even jail time for those involved in illegal promotion activities.

Trading of QMMM stock will remain suspended until October 10, according to the SEC notice. Neither the SEC nor QMMM Holdings immediately responded to requests for comment from multiple news outlets.

Hong Kong-based QMMM Holdings initially announced that its treasury would start with $100 million worth of cryptocurrency investments. The company’s digital advertising background made this pivot particularly dramatic for investors.

Crypto Treasuries Face Growing Scrutiny

The crypto treasury trend has gained momentum on Wall Street in recent months. Reports indicate that over 200 new companies have announced plans to buy and hold cryptocurrencies as part of their treasury strategies.

These announcements typically boost company stock prices, though not in all cases. Some market analysts have expressed concern that the market for such companies may be overcrowded, potentially leading to problems if the value of a company’s crypto holdings exceeds its overall market value.

IG Australia analyst Tony Sycamore cautioned investors seeking crypto exposure, stating that “these types of Hail Mary plays are not the way to go about it.” This warning highlights the risks associated with companies making rapid pivots to cryptocurrency strategies.

The QMMM situation raises questions about how companies announce and implement crypto treasury strategies. It also demonstrates the regulatory attention such moves can attract, particularly when accompanied by unusual trading patterns.

As the investigation continues, the case may provide insights into how regulators will approach the growing trend of corporate crypto treasury strategies going forward. The SEC’s focus on potential manipulation suggests that while cryptocurrency investments themselves may be legal, how companies market these strategies to investors remains subject to existing securities regulations.

The trading halt will remain in effect until October 13, after which the SEC will determine next steps based on its investigation findings.

The post SEC Suspends Trading of QMMM Holdings Amid Stock Manipulation Probe appeared first on Blockonomi.

You May Also Like

Shifting Tides in Bitcoin: New Challenges Emerge

We see a very good partnership with Venezuela