TRON (TRX) Price Prediction: Can Bulls Defend $0.33 or Will Momentum Shift Towards $0.28?

Despite recent weakness on the charts, TRX Price Prediction remains a hot topic as traders weigh whether the TRX coin can hold its ground. Price has been hovering near key supports, with buyers and sellers locked in a tug of war that could set the tone for the days ahead.

TRX Price Prediction Starting to Lean Bearish

Weekly momentum charts show signs of fatigue, with TRX coin beginning to roll over after months of steady growth. The Moving Average Convergence Divergence (MACD) has started to flatten, while its emerging trends are pointing towards potential downside.

TRX shows fading momentum as bearish signals emerge, with support at $0.33 now under pressure. Source: Ben Kizemchuk via X

Ben Kizemchuk highlighted that TRON’s rally, largely tied to stablecoin optimism, is showing cracks as momentum indicators reverse. If price loses its current support around $0.33, the next key levels lie closer to $0.30 to $0.28 levels.

TRX Coin Struggles Below EMA-50

TRX coin has now spent an extended period trading under the EMA-50, marking the longest drop below this moving average since April 2025. The inability to reclaim this level shows weakening momentum, as the EMA-50 has previously acted as a dynamic support during earlier rallies. Unless buyers step in strongly, this breakdown raises the risk of further downside pressure in the near term.

TRX struggles under the EMA-50, with failure to reclaim $0.34 risking a move towards $0.30. Source: Jesse Peralta via X

Jesse Peralta noted that the sustained rejection under the EMA-50 is troubling for TRON, as it reflects a shift in trend dynamics. For traders, reclaiming this moving average around $0.34 will be essential to restore confidence. If TRX fails to push back above, the path lower could extend towards $0.30 and even $0.28.

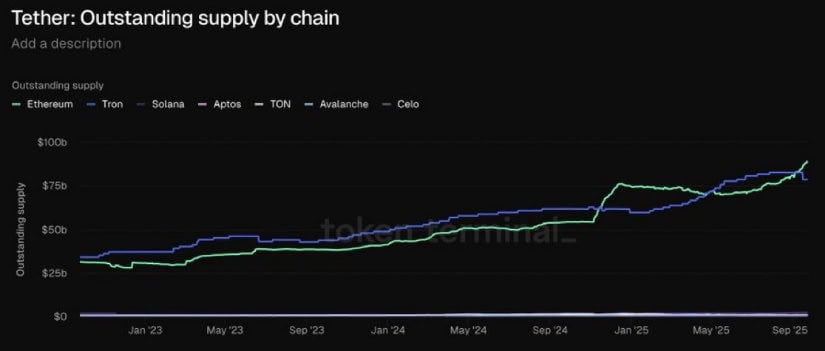

Ethereum’s Stablecoin Dominance Pressures TRON

A major shift in stablecoin supply has added to TRON’s challenges. Fresh data shows Ethereum’s USDT supply climbing above $89 billion, overtaking TRON’s long-standing lead. This signals that stablecoin issuers are shifting preference back to Ethereum, potentially eroding TRON’s dominance in this sector.

Ethereum’s USDT supply has overtaken TRON’s lead, raising concerns over TRX’s weakening stablecoin dominance. Source: CryptoTweets via X

CryptoTweets pointed out that TRON’s stablecoin advantage, once its strongest fundamental driver, is weakening. If this trend continues, the network risks losing its competitive edge, which may weigh on medium-term TRX valuations.

Dip Buying Interest Still Present

Not all outlooks are bearish. Crypto Anbu argued that recent dips could actually be constructive, giving bulls a chance to reload at favorable levels. The price is still holding within a broader ascending channel, meaning buyers remain in control as long as $0.32 to $0.33 holds.

TRX holds within its ascending channel, with dip buying interest hinting at a possible rebound from $0.32–$0.33. Source: Crypto Anbu via X

This perspective suggests that while the network faces short-term pressure, accumulation at these levels could create a healthier base for future rallies. Historically, TRX coin has seen strong rebounds from similar consolidation ranges.

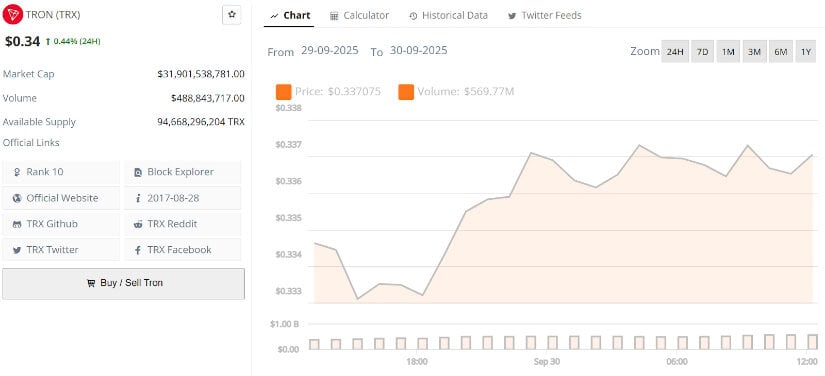

TRX Coin Technical Analysis

Short-term charts are showing consolidation around $0.334 to $0.336, with resistance capped at $0.342. A breakout above this band would be the first signal of renewed strength, potentially opening the door to $0.36 in the near term.

TRON consolidates near $0.334–$0.336 levels. Source: Mehmet Gizik via X

Mehmet Gizik outlined a simple scenario where TRX continues to respect its range before trending higher. For now, traders are watching $0.330 as the key level, a decisive break below could expose further downside, but holding it strengthens the case for a recovery.

Final Thoughts

TRON finds itself at a crossroads. On one side, price struggling below EMA-50 and Ethereum’s growing dominance in stablecoins raise structural concerns. On the other hand, technical charts still show resilience, with dip buying interest hinting at potential upside if critical supports hold.

TRON coin is trading at around $0.34, up 0.44% in the last 24 hours. Source: Brave New Coin

The next few weeks will determine whether TRX consolidates into a base for recovery or slips further under the weight of bearish momentum. For now, participants remain divided, balancing caution with opportunity as TRX Price Prediction navigates this pivotal stage.

You May Also Like

X3 Acquisition Corp. Ltd. Announces Closing of $200,000,000 Initial Public Offering

North America’s Largest RV Dealers Still Failing Google Core Web Vitals–Overfuel Reports Nearly 79% Failure Rate for Second Year