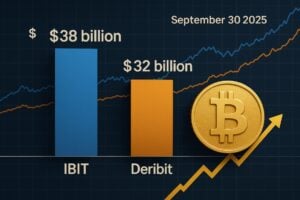

IBIT surpasses Deribit: Bitcoin options at around $38B, shift towards regulated markets

As of September 30, 2025, the open interest on options linked to IBIT reached approximately $38 billion, surpassing Deribit’s $32 billion, according to snapshots from CoinGlass and Skew.

In this context, the overtaking indicates a shift towards regulated markets, recalibrating the liquidity map on Bitcoin; the phenomenon is consistent with institutional flows observed after the launch of spot ETFs.

IBIT (iShares Bitcoin Trust) is managed by BlackRock, as indicated in the official product documentation from BlackRock, and financial analysts have linked the increase in open interest to a greater preference for regulated and reportable custodial vehicles Reuters.

According to the data collected by our analysis team and confirmed by the mentioned snapshots, the growth observed in recent weeks is mainly attributable to volumes on liquid expirations and institutional hedging operations.

Industry analysts note that the transition to regulated venues tends to reduce certain informational asymmetries, while increasing the risk concentrated on a few liquidity nodes.

In brief

- IBIT is defined as the spot Bitcoin ETF with declared assets amounting to approximately $84 billion and 770,000 BTC held, although these figures require further verification [data to be verified] BlackRock.

- The options linked to IBIT amount to approximately 340,000 BTC of open interest; the global share stands at IBIT 45%, Deribit 41.9%, and CME around 6% (snapshot as of 09/30/2025).

- The market leverage, estimated at 45%, is indicated by Checkonchain and is close to recent highs.

The numbers of the overtake: the snapshot

The comparison between crypto-native platforms and regulated channels enters a new phase. Indeed, the growth of options on IBIT attracts institutional flows, particularly attentive to compliance and custody.

Quotes and Volumes — Recent Snapshot

- Open interest IBIT: approximately $38 billion (snapshot 09/30/2025)

- Open interest Deribit: approximately $32 billion (snapshot 09/30/2025)

- Asset IBIT (spot ETF): approximately $84 billion [data to be verified]

- BTC held by IBIT: 770,000 [data to be verified]

- OI options linked to IBIT: approximately 340,000 BTC

BTC Options Market Share

| IBIT (options on ETF) | 45% |

| Deribit | 41.9% |

| CME | ~6% |

| Others | ~7% |

Why it matters: institutional players, pricing, and liquidity

The surge of IBIT indicates that a growing portion of the risk on Bitcoin is shifting towards infrastructures with regulatory oversight. For large investors, this results in reduced friction for hedging operations, more manageable margins, and greater clarity in reporting.

For the market, it equates to price formation more anchored to precise rules, while still creating new dependencies on a few liquidity hubs.

Asset managers favor instruments with segregated custody, known clearing, and transparency in requirements, elements that impact implied volatility, skew, and hedging costs.

It should be noted that the immediate effect is greater depth on the most liquid maturities and tighter bid/ask spreads during peak activity.

Growing Risks: Concentration, Leverage, and Correlations

IBIT and Deribit, combined, account for almost 90% of the global open interest in BTC options. This concentration heightens exposure to potential liquidity shocks and synchronized behavior of hedging algorithms.

The relationship between derivatives and the spot market highlights how approximately 340,000 BTC of OI in “IBIT-linked” options are related to the 770,000 BTC held by the ETF, indicative of an estimated leverage of 45% (according to Checkonchain).

That said, a particularly sensitive ecosystem emerges to abrupt price movements, especially near expirations.

What to monitor immediately

- The gamma exposure of operators and the possibility of a “pin at expiration”.

- The dynamics of the basis between ETFs, futures, and perpetuals.

- The flows on CME and the possible migration of volatility from Deribit to regulated venues.

- Possible misalignments between the open interest on options and the creations/redemptions of the ETF shares.

Deribit, CME and the others: an evolving balance

Deribit maintains its appeal among crypto-native traders, thanks to the depth on exotic strikes and detailed expirations.

The Deribit community continues to provide a significant contribution to price discovery in certain volatility structures, while institutional platforms like CME occupy a more limited share (about 6%) in BTC options.

It is important to note that some news about extraordinary operations or acquisitions (such as the potential purchase of Deribit by Coinbase for $2.9 billion) has not been confirmed by reliable primary sources.

Overall, the competitive comparison is played on liquidity, listing, and quality of infrastructure, rather than on M&A operations.

Essential Timeline

- 2016: Deribit establishes itself as a leader in BTC options.

- November 2024: launch of options on spot BTC ETFs, including those linked to IBIT (USA) [data to be verified].

- September 30, 2025: snapshot showing IBIT above Deribit in terms of open interest on linked contracts.

Glossary and Methodology

- IBIT: refers to the iShares Bitcoin Trust (spot Bitcoin ETF) with options listed on regulated markets in the USA; data regarding its size and the number of BTC held need further verification [data to be verified].

- Open interest (OI): represents the value or quantity of open and not closed derivative contracts, expressed in USD or BTC.

- Leverage (Checkonchain): proprietary indicator that measures the net risk position in the system, calculated as the ratio between open interest and spot value/assets under custody.

- “IBIT-linked” Options: derivatives based on the IBIT ETF and related structures, used for hedging or arbitrage.

- Market share: percentage of the global open interest attributable to each platform or product.

Operational Implications

For institutions, using a regulated ETF like IBIT facilitates compliance operations, simplifies margin netting, and allows for mandate-based hedging.

For the retail and OTC market, this could translate into more orderly access, albeit with less extreme leverage compared to typical offshore platforms.

In conclusion, the direction is clear: greater governance and transparency, but also an increased risk of domino effects in case of shock. The sustainability of this configuration will depend on the diversification of venues and the effectiveness of market making.

You May Also Like

Now Supports Coinbase’s Crucial Crypto Futures For Institutions

Academic Publishing and Fairness: A Game-Theoretic Model of Peer-Review Bias