Will the Rebound in Cryptos Last?

Following a decline last week, the crypto market's recovery, driven by a $200 billion injection, has pushed the total market value back above the $4 trillion mark.

On Monday, Bitcoin ETFs saw net inflows of $522 million, while Ethereum ETFs attracted $547 million, with both the top tokens exceeding the market average of $1 billion for all US-listed exchange-traded funds.

Under Bitcoin Spot ETFs, Fidelity’s FBTC led the pack, attracting $299 million. ARK 21Shares Bitcoin ETF secured the second position with $62 million, as the majority of others recorded positive performance.

The 12 Bitcoin spot ETFs currently manage $150 billion in assets, accounting for 6.6% of Bitcoin’s overall market capitalization.

The sole exception was BlackRock’s iShares Bitcoin Trust, which experienced a slight net outflow of $46.6 million.

For Ethereum, with $202 million in a single day, Fidelity's Ethereum Fund was the top in inflows. The iShares Ethereum Trust, managed by BlackRock, increased by $154 million.

Currently, $27.5 billion, or around 5.4% of Ethereum's circulating market capitalization, is held by ETFs that invest in the cryptocurrency.

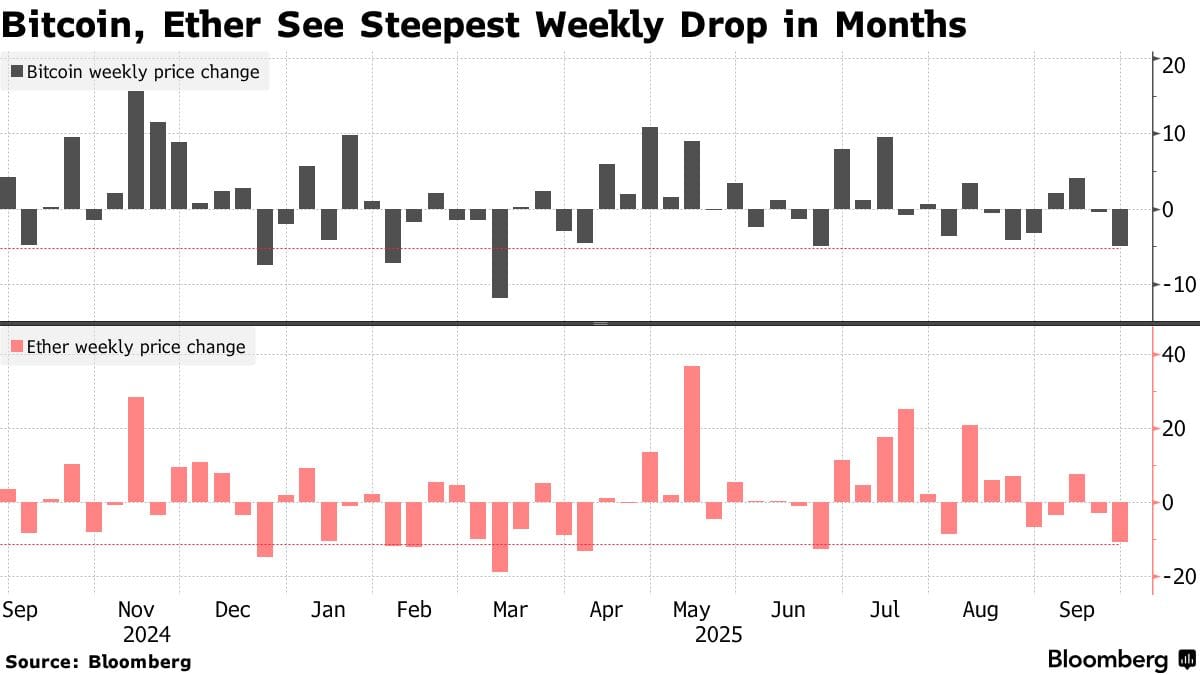

The reversal in ETFs comes after the value of cryptos plummeted last week, with the market losing about $300 billion.

The biggest coins were hit hard as a chain reaction of leveraged positions unwound, causing market sentiment to plummet.

The general risk mood improved on Friday, which led to a slight increase in Bitcoin and Ether prices. This came after a report showed that a key inflation indicator rose at a slower rate last month. With this new information, the Fed will have more room to maneuver as the job market cools.

The latest optimism about the bull market's potential to continue this week has come in as we head into 'Uptober,' and Bitcoin is at the forefront of this upward trend.

Source: CoinGecko

Source: CoinGecko

The OG token was last trading around $113,500, up over 1.3%, while Ether was holding above $4,170. Bitcoin's price hit a high of $115,970 briefly earlier this month, but has since fallen slightly.

After failing to break $4,000 for a few days, Ethereum has surged 3%.

Source: CoinGecko

Source: CoinGecko

Gold Soars At the Cost of the Dollar

In the broader financial markets, the biggest risk at the moment is a US government shutdown.

Gold is the winner, with stocks and the dollar taking a hit from a potential shutdown if Congress does not pass a temporary spending bill.

That makes the recovery in cryptos sweet as bets have returned for digital assets as a safe haven asset alongside gold.

The 0.5% advance in gold puts it in line for its biggest monthly gain since 2011, as it surpassed $3,850 per ounce.

With interest rates being lowered by the Federal Reserve, global trade tensions, and doubts about US exceptionalism adding to its allure, gold has had an astonishing 47% rise this year.

The dollar had a completely opposite reaction, with the gains in September nearly nullified in just a few days of trade.

Members of Congress are expected to meet with President Trump as the prospect of a government shutdown on October 1 looms.

Surprisingly, the most powerful set of Wall Street stocks suddenly seems irrelevant.

That comes as Wall Street continued its upward journey even after the Fed boss's comments on the rate trajectory being a challenge.

Still, data has since divided market watchers on the need for more rate cuts.

While certain data points to weakness in the jobs market, higher inflation readings, and an economy still humming, have others question the need for further rate cuts this year.

Trump's tariffs have also played a key role in bets against stocks, with a divide in global and Wall Street equity moves.

Elsewhere

Blockcast

Bridging TradFi & Crypto: Reap's Daren Guo on Stablecoin Innovation

In this episode of Blockcast, Takatoshi Shibayama interviews Daren Guo, co-founder of Reap, a company pioneering stablecoin infrastructure for modern finance. Daren shares his journey from a traditional finance background, having been part of Stripe's growth team, to becoming a key player in the crypto space. He also discusses the transformative role of stablecoins in global payments, particularly their impact on cross-border transactions and financial inclusion in emerging markets.

Like what you hear? Subscribe to Blockcast on Spotify, Apple Podcasts, or wherever you listen.

You May Also Like

Will Bitcoin Go Back Up Past $80K in March? XRP and Solana Rally While Pepeto Offers More

Metaplanet raises $1.4B to fuel BTC purchases and U.S. subsidiary launch