No Accident: The Powerful Factors Behind Bitcoin’s Late-September Rally

Bitcoin climbed sharply at the end of September 2025 after a run of heavy selling left the market tense. Based on reports, the rebound followed a series of events that together eased selling pressure and drew fresh money into the crypto market.

The move touched off debate among traders about whether this is a short-term bounce or the start of a stronger leg up into Q4 2025.

Bitcoin’s strong rebound in late September 2025 was no accident, according to a recent analysis by XWIN Research Japan. It came from overlapping forces — a weaker dollar, record-breaking gold, steady inflows into large funds, and signs of renewed accumulation — that gave the rally a strong foundation.

Macro Shifts Fueled The Move

According to central bank announcements, the Federal Reserve’s September 17 rate cut weakened the dollar. Gold hit record highs as cash moved toward hard assets.

XWIN Research said investors often park cash in gold first, then shift some of that capital into Bitcoin when they feel risk appetite returning. Add concerns about the growing US fiscal deficit. That pushed some investors toward assets seen as inflation-resistant, and Bitcoin was one of the beneficiaries.

Institutional Appetite Added Momentum

Reports have disclosed that the SEC eased ETF listing rules, clearing the way for new XRP and DOGE products. That change gave large funds more confidence to allocate to crypto.

Major funds such as BlackRock’s IBIT and Fidelity’s FBTC continued to attract notable inflows. Money from big players matters. It signals that the move was not driven only by retail traders.

Traders focused on a critical price barrier between $108,000 and $110,000, where it provided extreme support during the reversal. Simultaneously, momentum indicators led the oversight committee to see oversold conditions, leading to some short covering.

Long-term holders had previously taken profits while short-term sellers largely capitulated which made it less likely for more individuals to add immediate selling pressure to the market and ultimately began to stabilize prices in the market. This combination of technical relief was compounded by changing trader behavior, and propelled the sentiment from fear towards cautious optimism.

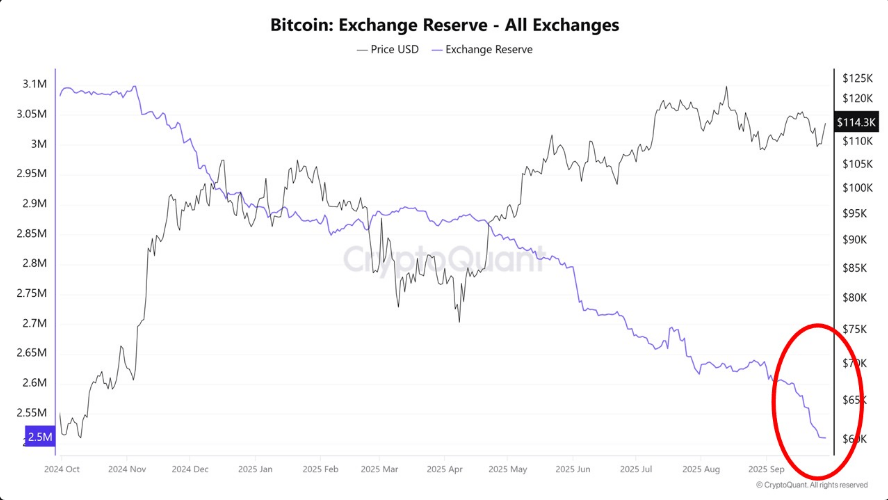

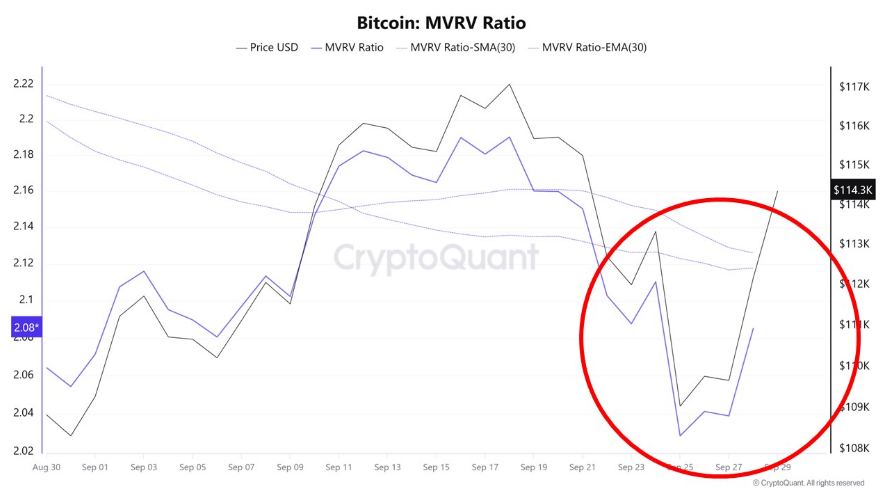

On-Chain Metrics Suggest AccumulationAt the same time this was happening, exchange reserves dropped substantially, as coins were being removed from exchanges and came off-long-term storage. Based on the analysis, the MVRV ratio that previously dipped during the selling phase, was beginning to recover as market value was rising relative to the realized value.

Featured image from Unsplash, chart from TradingView

You May Also Like

Australian regulators ease regulations on stablecoin intermediaries

Tech Firm’s Bold Bitcoin Move Yields Growth But Undercuts Profitability