European Central Bank Picks Tech Partners for Digital Euro

The European Central Bank selected ten technology companies on October 2, 2025, to build the infrastructure for its planned digital euro.

Five Critical Components

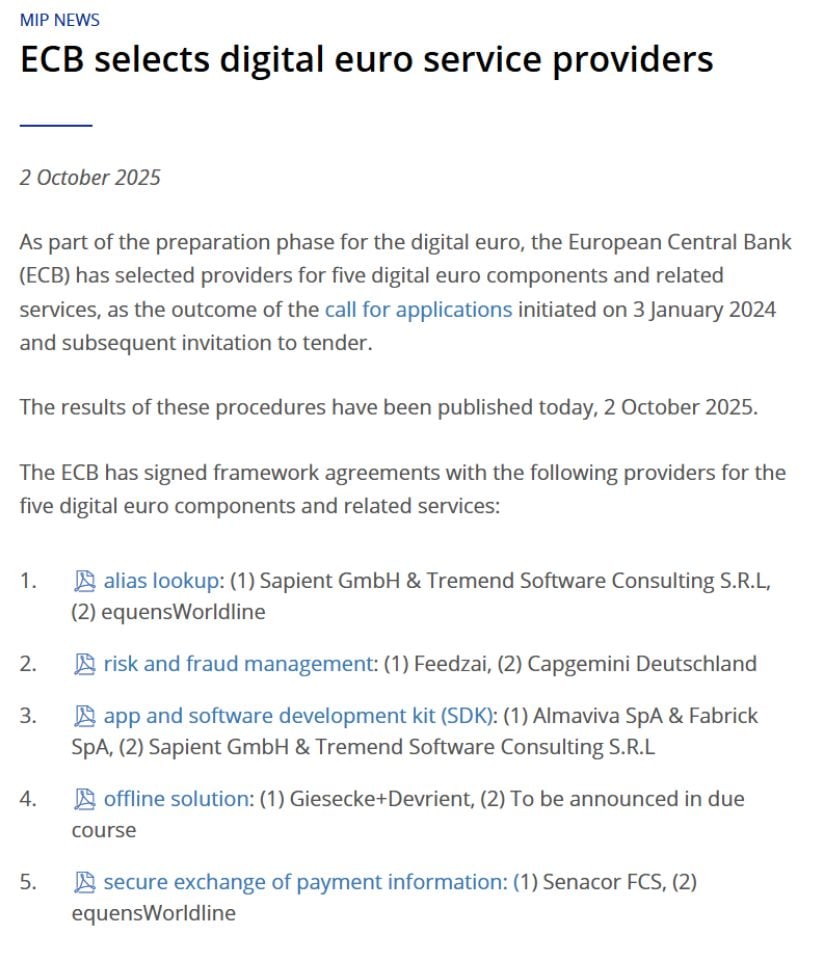

The ECB signed agreements with companies to handle five key parts of the digital euro system. The central bank started this process in January 2024, reviewing applications from over 50 companies before making final selections.

Portuguese startup Feedzai won the contract for fraud detection and prevention, working alongside consulting firm PwC. The fraud management component carries an estimated value between €79.1 million and €237.3 million. Feedzai’s AI-powered platform will analyze every digital euro transaction across the eurozone, providing fraud risk scores to help banks decide whether to approve payments.

German security company Giesecke+Devrient, partnering with Nexi and Capgemini, secured the contract for offline payments. This feature allows users to make payments without internet connection while maintaining cash-like privacy. Money stores directly on devices like smartphones or cards, with no records kept by banks, payment companies, or the ECB.

Sapient GmbH and Tremend Software Consulting will handle alias lookup services, making it possible to send money using phone numbers or email addresses instead of complex account numbers. Italian companies Almaviva and Fabrick will develop the digital wallet apps and software tools. German firm Senacor FCS will manage secure information exchange between financial institutions.

Each component has a first-ranked and second-ranked provider. The ECB will work with top-ranked companies initially, turning to backup providers only if necessary.

Privacy and Security Take Center Stage

The partner selections reveal what matters most to the ECB. Privacy protection and fraud prevention dominate the choices.

Source: @ECB

The offline payment solution addresses the biggest concern many Europeans have about digital currencies. Dr. Ralf Wintergerst, CEO of Giesecke+Devrient, explained the significance: “This milestone underscores our commitment to innovation and security in digital payment solutions while preserving the privacy and resilience that citizens expect from cash.”

Payments settle locally between devices with no third-party involvement. No bank, payment provider, or central authority can track these transactions. The system works even without power or internet connection.

For online payments, the ECB plans strong privacy protections including pseudonymization and encryption. The central bank has stated it will not be able to identify users or track their purchases from the payment data it receives.

Feedzai’s fraud detection system must balance security with privacy. CEO Nuno Sebastião described the challenge: “With tens of billions of transactions expected across the eurozone, success depends on AI that can adapt as quickly as fraud evolves.”

Timeline Stretches to 2029

The digital euro’s preparation phase runs through October 2025. At that point, the ECB Governing Council will decide whether to move forward with the next development phase.

However, the actual launch depends on European Parliament approval of the Digital Euro Regulation. ECB Executive Board member Piero Cipollone recently stated that mid-2029 represents a realistic launch target.

The framework agreements signed this week don’t involve immediate payments. They establish terms for future work. Actual development of the components will only begin after the Governing Council decides to proceed and EU legislation passes.

These agreements include flexibility to adjust based on changes to the legislation. This protects both the ECB and technology partners as lawmakers debate and modify the regulatory framework.

Political Hurdles Remain High

The digital euro faces serious political challenges. European Parliament approval remains the biggest obstacle.

Lawmakers have raised concerns about privacy, the impact on commercial banks, and whether the ECB can reliably operate such a massive consumer system. A March 2025 outage in the ECB’s Target 2 payment system, which handles large interbank transactions, intensified these doubts. The system failed to settle transactions for a full day.

Euro-area finance ministers recently agreed on customer holding limits for the digital currency, providing some progress. But parliamentary action has been slow since the European Commission first proposed legislation in June 2023.

The legislative schedule ahead includes tight deadlines. After a progress report expected in late October, lawmakers will have six weeks to propose amendments and five months for negotiations.

Europe’s Response to Dollar Dominance

The digital euro aims to reduce Europe’s dependence on non-European payment systems. Currently, most digital payments flow through American companies like Visa, Mastercard, and PayPal.

US support for dollar-backed stablecoins has increased urgency at the ECB. President Trump signed the GENIUS Act on July 18, 2025, establishing a federal regulatory framework for stablecoins.

Cipollone noted that the spread of US stablecoins threatens to divert deposits away from European banks. The digital euro represents Europe’s effort to maintain control over its own payment infrastructure.

Meanwhile, private alternatives are moving faster. Nine major European banks announced plans in September 2025 to launch their own regulated euro stablecoin by mid-2026. Germany launched EURAU, its first regulated euro stablecoin, in July 2025.

The digital euro would work alongside cash and bank deposits, not replace them. The ECB designed it as a public good that benefits society rather than a profit-making venture.

The Bottom Line

The ECB’s selection of technology partners marks real progress after five years of digital euro discussions. But the path from signed agreements to actual launch stretches years into the future.

Success requires coordination among the ECB, national central banks, European institutions, commercial banks, technology providers, and hundreds of millions of citizens. Political approval remains uncertain. Public acceptance is not guaranteed.

The digital euro may reshape European payments by the end of the decade. Or it may become another delayed government project overtaken by faster private alternatives. The technology foundation is now being built. Whether anything stands on that foundation depends on decisions yet to be made in parliamentary chambers across Europe.

You May Also Like

Landmark Court Ruling Rejects Terrorism Financing Claims

The U.S. Commodity Futures Trading Commission unveiled a new logo, claiming it will usher in a "golden age" of innovation.