1inch Co-Founder Sees CEXes Becoming DeFi Front Ends — Best Wallet Token Emerges as Best Crypto to Buy

He went on to explain in a Bitcoin News interview that CEXes are inefficient by design, hinting at how they’ll stop being the main locus of trade in the future.

Failure to adapt to new DeFi technology might render CEXes obsolete. In a more positive scenario, their role might shift to providing a friendly UI to decentralized trading, managed by smart contracts.

As more trades rely on aggregated liquidity across chains and protocols, the logic of trading may shift away from individual centralized order book systems.

Furthermore, according to Kunz’s vision, non-custodial solutions are already increasingly popular; further proof that decentralization is the true of finance.

One standout non-custodial wallet that has been making waves in recent months is Best Wallet, a next-gen crypto app designed to dominate Web3. At the center of the Best Wallet ecosystem is the Best Wallet Token ($BEST), which is now in presale and creating waves.

1inch Rebrands and Expands, Leading the Shift to DeFi and Self-Custody

1inch isn’t just a DeFi front end. It’s shifting toward becoming a fully-fledged infrastructure provider that powers other exchanges and wallets via APIs.

By expanding its offerings to include non-custodial swap capabilities for exchanges and wallets, 1inch enables more platforms to adopt DeFi features without needing to reinvent the wheel.

A notable example of this shift is Coinbase integrating 1inch’s swap API into its app, enabling non-custodial token swaps directly within Coinbase’s infrastructure.

While the online platform will retain its brand and interface, it will outsource the trade execution and routing to DeFi infrastructure, a move that underscores a major CEX’s bold step towards adopting a hybrid model.

On another note, 1inch recently introduced intent-based cross-chain swaps, which connect Solana and EVM chains, thereby improving multi-chain interoperability. They also upgraded their route discovery algorithm, which offers 6.5% better swap rates.

While 1inch works towards strengthening the DeFi backbone, non-custodial wallets like Best Wallet, powered by the $BEST token, fulfill the growing need for secure, user-friendly on-boarding to DeFi and crypto.

Best Wallet & $BEST Token: Secure Self-Custody and the Power of a Web3 Ecosystem

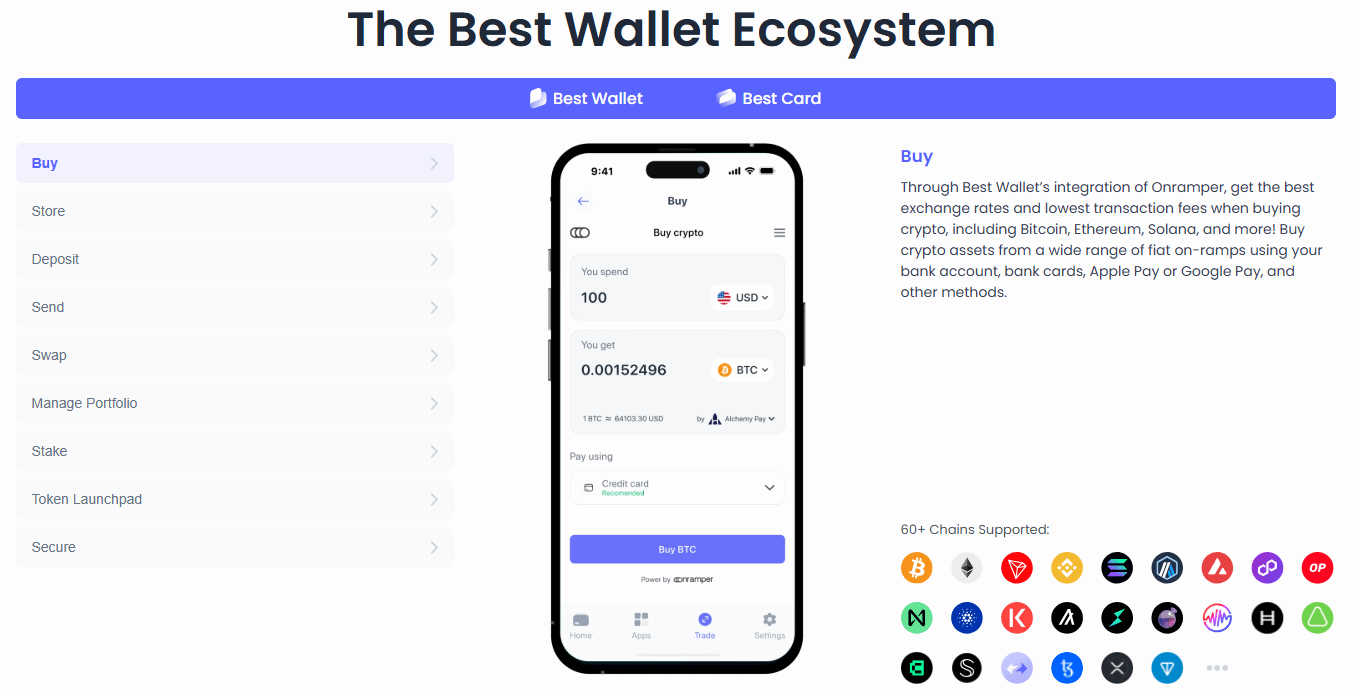

Best Wallet is a self-custody hot crypto wallet giving you complete control to buy, sell, and swap assets across popular networks like Bitcoin, Solana, BSC, and Ethereum.

This mobile-first wallet app, launched in 2023, has already earned the trust of over 500K users worldwide, as it offers next-generation features to protect user keys. Some of the stand-out features of the Best Wallet include:

- A launchpad to find and join new, vetted token presales,

- Built-in DEX enabling low-cost cross-chain swaps,

- No-KYC signup, swaps, and decentralized transfers,

- Lower fees and higher staking yields for $BEST token holders,

- Effortless on- and off-ramping with fiat (KYC might apply).

Currently, Best Wallet enables you trade across six major blockchain networks. With upcoming support for over 60 chains, you will gain access to a much wider range of tokens, dApps, and DeFi opportunities.

This means greater flexibility, interoperability, and a truly all-in-one crypto wallet experience as the ecosystem expands.

Through the Best Wallet app’s ‘Upcoming Tokens’ feature, you can sift through promising presale projects — unlocking opportunities long before they reach the mainstream market.

More token-enabled perks are coming. The presale puts aside 30% of its funds towards product development and its treasury, with plans to launch a crypto debit card, NFT integrations, and derivatives trading in phase 3.

Currently in presale, $BEST has already raised $16.2M+, with today’s price at $0.025735 per token. Staking rewards stand at an impressive 82% APY, and if our expert $BEST price prediction proves accurate, one token could reach $0.143946 by the end of 2026.

To put this into perspective, a $500 investment into $BEST today could grow to approximately $5,090 in just one year, that’s combining staking rewards with projected price appreciation (a 10.2x return).

Whales are already stacking their bags with $BEST worth $70.2K and $50.9K, signalling strong conviction in the project.

The next price jump is expected tomorrow, and staking rewards will gradually taper as more investors join the project.

Secure $BEST tokens today at a lower price.

This is not financial advice. Please always do your own research before investing in crypto.

You May Also Like

VOOI V2: Gasless, Cross-Chain Trading with CEX Speed and DeFi Control

Vitalik Buterin to Ethereum Developers: Build It Like It Has to Last Without You