CleanSpark Sells $48.7M in Bitcoin, Hits 13,000+ BTC Treasury in September

Bitcoin mining company CleanSpark closed September with a strong showing, holding 13,011 BTC in its treasury, reflecting significant improvements in operational efficiency and production. The company’s latest update underscores its strategic focus on balancing Bitcoin sales with expanding its mining capacity amid industry headwinds.

- CleanSpark’s Bitcoin holdings increased, with 13,011 BTC held at September’s end.

- The company mined 629 BTC in September, a 27% rise year-over-year, and sold 445 BTC for approximately $48.7 million.

- Operational efficiency improved by 26% compared to the previous year, with an average hashrate of 45.6 EH/s.

- Despite positive financials, the industry faces challenges including rising energy costs and tariff risks on imported mining rigs.

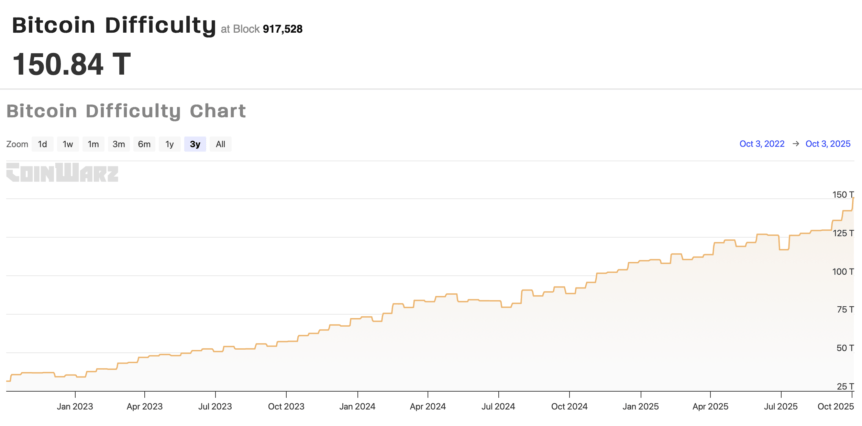

- Bitcoin’s mining difficulty has hit record highs, demanding more computational power and energy usage from miners.

Bitcoin miner CleanSpark wrapped up September with notable achievements, maintaining a Bitcoin treasury of 13,011 BTC following another month of increased efficiency and output. The company reported a 27% increase in Bitcoin mined compared to September 2024, reaching 629 BTC. Simultaneously, CleanSpark sold 445 BTC for nearly $48.7 million at an average price of $109,568, reinforcing its strategy of balancing production with revenue generation.

The company highlighted a 26% year-over-year rise in fleet efficiency, coupled with an average operating hashrate of 45.6 exahashes per second (EH/s). Since April, CleanSpark has been selling part of its mined Bitcoin to fund operations and has established an institutional trading desk to facilitate sales. Notably, in August, the company generated $60.7 million from the sale of 533.5 BTC.

Following these positive results, CleanSpark’s NASDAQ shares increased by over 5%, with a weekly gain exceeding 23%, reflecting investor confidence. Additionally, the broader market for Bitcoin miners is flourishing, with the combined market capitalization of 15 major publicly traded mining companies reaching a record $58.1 billion in September — more than double the figure early in the year.

CleanSpark shares performance. Source: Yahoo Finance## Bitcoin mining faces new pressures

While investor enthusiasm for publicly traded mining companies persists, the industry contends with rising operational costs and regulatory hurdles. In August, U.S. Customs and Border Protection (CBP) reported that some of CleanSpark’s 2024 mining rigs, believed to be manufactured in China, could attract tariffs as high as $185 million. Similarly, Iris Energy, the largest Bitcoin miner by market cap, is challenging a separate $100 million tariff dispute with authorities.

As previously reported, tariffs on China-made mining equipment stand at 57.6%, with rigs from Indonesia, Malaysia, and Thailand facing tariffs around 21.6%. These costs compound as Bitcoin mining difficulty hits new records, requiring miners to deploy significantly more computational power and energy to produce the same amount of Bitcoin — a trend that could impact profitability across the sector.

Bitcoin mining difficulty over 3 years. Source: Coinwarz.com

Bitcoin mining difficulty over 3 years. Source: Coinwarz.com

Despite these challenges, the industry remains optimistic about long-term growth, powered by increasing institutional interest and ongoing blockchain innovations in the crypto ecosystem. However, navigating economic headwinds and regulatory roadblocks will be critical for miners aiming to maintain their profitability and expand within the dynamic crypto markets.

This article was originally published as CleanSpark Sells $48.7M in Bitcoin, Hits 13,000+ BTC Treasury in September on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

While Bitcoin Stagnates, Gold Breaks Record After Record! Is the Situation Too Bad for BTC? Bloomberg Analyst Explains!