Palo Alto Networks, Inc. ($PANW) Stock: Declines Following Turbulent $25B CyberArk Acquisition Talks

TLDRs;

- Palo Alto Networks’ $25B CyberArk deal faced major setbacks before final approval.

- Talks nearly collapsed in July amid pricing disputes and board disagreements.

- CyberArk demanded stronger terms, including a $2B reverse termination fee.

- PANW stock fell 1.01% Friday as investors reacted to new deal disclosures.

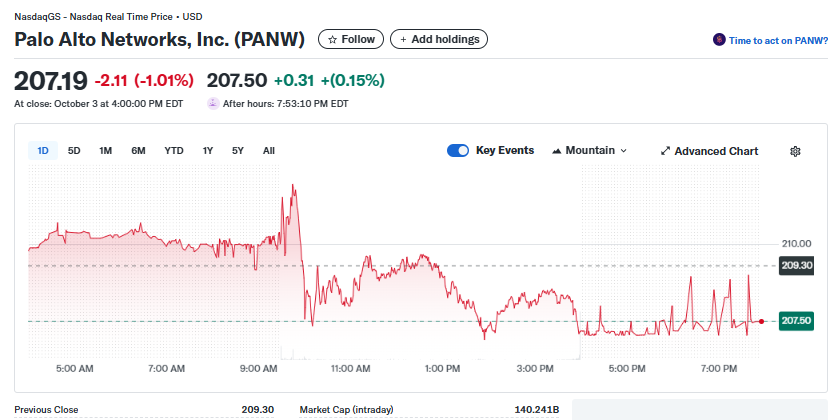

Palo Alto Networks, Inc. (NASDAQ: PANW) shares fell 1.01% on Friday, closing at $207.19, down $2.11 from the previous session.

After hours, the stock edged slightly higher to $207.50, up 0.15% as trading stabilized. The modest decline followed revelations about the chaotic final stages of Palo Alto’s $25 billion acquisition of CyberArk Software Ltd., one of the largest cybersecurity mergers in history.

Investors appeared to react cautiously as new filings detailed the near-collapse of the deal in July. Despite the eventual success of the acquisition, the tense negotiations raised questions about the transaction’s stability and the valuation pressures facing cybersecurity giants in a consolidating market.

Palo Alto Networks, Inc. (PANW)

Palo Alto Networks, Inc. (PANW)

Deal Began with Rejection, Ended in Tension

The story of Palo Alto’s pursuit of CyberArk began in May 2023, when CEO Nikesh Arora first approached CyberArk’s founder and chairman, Udi Mokady, with an acquisition offer. At the time, Mokady flatly declined, insisting CyberArk would remain independent.

Two years later, in June 2025, the conversation resumed under different circumstances. Arora and Mokady met privately on June 17, and by the end of that month, both firms had signed a nondisclosure agreement to reopen talks. Palo Alto submitted its first non-binding all-stock bid on July 1, valuing CyberArk at $457.99 per share.

Negotiations on the Brink of Collapse

CyberArk countered on July 6 with a sharp demand of $525 per share and a $2 billion reverse termination fee, payable if regulators blocked the deal. Arora balked, calling the terms “excessive,” and returned with $480 per share and no termination fee.

For days, both companies volleyed counteroffers. CyberArk’s board insisted on stronger protection but Palo Alto refused to raise its bid further. The standoff nearly killed the deal on July 10, until Arora agreed to double his termination fee offer to $1 billion, a concession that revived the negotiations.

By mid-July, the two firms signed an exclusivity agreement, locking them into exclusive discussions. But turbulence returned after a Calcalist report claimed Palo Alto might be eyeing another cybersecurity target. Fearing competitors could intervene, Arora accelerated the timeline to finalize the merger.

Final Push to Save the Deal

On July 27, Arora informed Mokady that Palo Alto’s board had withdrawn support for the $495 per-share agreement due to stock price fluctuations, instead proposing $475.21.

The announcement nearly derailed discussions yet again. However, after multiple back-channel talks and internal reassessments, both boards finally approved a revised $25 billion all-stock deal on July 30, 2025.

CyberArk later stated the final offer “provided the best combination of value and shareholder protection.”

Investor Sentiment and Industry Impact

Despite the headline value, the deal’s rollercoaster negotiations appeared to weigh on investor confidence. Analysts noted that Palo Alto’s short-term stock dip reflects market uncertainty about integration costs and the company’s long-term M&A strategy.

Still, the acquisition cements Palo Alto’s dominance in enterprise cybersecurity, expanding its portfolio into privileged access and identity management , key growth sectors as AI-driven cyber threats evolve.

As integration begins, investors will be watching closely to see whether Palo Alto’s $25 billion gamble delivers on its promise or becomes a cautionary tale of ambition meeting market volatility.

The post Palo Alto Networks, Inc. ($PANW) Stock: Declines Following Turbulent $25B CyberArk Acquisition Talks appeared first on CoinCentral.

You May Also Like

Solana Price Prediction 2026: Mercado Bitcoin Research Says BTC Bottom Is Near as Pepeto Offers What DOGE SHIB and PEPE Never Could

Top 2 Cryptos That Will Create the Most Millionaires in 2025