Michael Saylor Tells MrBeast To Buy Bitcoin Even As He Pauses Strategy Buying

Michael Saylor is urging popular YouTuber Jimmy Donaldson, also known as MrBeast, to buy Bitcoin even as Strategy hits the brakes on its own BTC accumulation.

Saylor’s message to the YouTube megastar came after MrBeast posted about the rapid progress of AI on X, which he says poses a potential threat to YouTubers’ income.

“When AI videos are just as good as normal videos, I wonder what that will do to YouTube and how it will impact the millions of creators currently making content for a living,” MrBeast said. ”Scary times.”

Saylor, a long-time advocate for Bitcoin, replied by saying, “Buy Bitcoin MrBeast.”

Strategy Pauses Its Bitcoin Accumulation As BTC Trades Near ATH

Strategy is the largest corporate holder of Bitcoin, and is well-known for pioneering the crypto treasury trend when it started accumulating BTC back in 2022. Since then, 344 entities have accumulated 3.88 million BTC collectively.

SaylorTracker data shows that Strategy has 640,031 BTC valued at $79.36 billion.

Strategy Bitcoin holdings (Source: SaylorTracker)

The company’s most recent purchase was on Sept. 29, when it bought 196 BTC. Prior to this acquisition, the firm had purchased BTC for eight consecutive weeks.

But the company is taking a break from its Bitcoin buying, as indicated by a recent X post by Saylor.

“No new orange dots this week,” Saylor wrote in a post on X, signaling that there will not be a new BTC purchase announcement this week.

The decision to pause the company’s BTC accumulation comes as the leading crypto soared to a new all-time high (ATH) above $125K on Oct. 5.

The crypto king has since pared gains and trades at $123,841.96 as of 7:17 a.m. EST, according to CoinMarketCap data. At the current price, Strategy’s unrealized year-to-date (YTD) gain on its BTC position stands at around $14.42 billion.

Bitcoin Exchange Flows Drop To Six-Year Low As ETF Inflows Soar

If MrBeast decides to act on Saylor’s recommendation, it could lead to some additional buying pressure on BTC’s price.

Upside pressure on Bitcoin is already strong, with spot BTC ETFs (exchange-traded funds) pulling in their second-biggest weekly inflows last week. During this period, investors poured more than $3.2 billion into the funds, data from Farside Investors shows.

Most of those inflows were into IBIT, the spot BTC ETF belonging to asset management giant BlackRock. Last week, around $1.8 billion flowed into the product, accounting for more than half of the inflows seen for spot Bitcoin ETFs during the period.

That strong demand is also accompanied by a decrease in the number of Bitcoin that is available to buy on exchanges. On-chain data from Glassnode shows that there is just 2.83 million BTC on centralized exchange platforms, marking a six-year low in the available amount.

The last time that there were fewer coins stored on exchanges was early June 2019. Back then, BTC was trading at $8,000 and was in the depths of a bear market.

“Hearing exchanges are out of Bitcoin,” wrote VanEck’s head of digital asset research Matthew Sigel on X. “Monday 9:30am might be the first official shortage.”

MrBeast May Be Buying ASTER

It is unclear whether MrBeast will take Saylor’s advice and buy Bitcoin, but several on-chain tracking firms have highlighted buying activity around Aster (ASTER) that they believe is linked to the YouTuber.

One of those firms is PRIME X, which alleged that the YouTuber spent $320,000 on ASTER tokens. According to the report, the purchase brought MrBeast’s total holdings to roughly $1.28 million.

Another on-chain analytics firm, Lookonchain, also revealed that wallets linked to MrBeast had deposited $1 million in Tether’s USDT stablecoin before acquiring over 500,000 ASTER tokens at an average price of $1.87.

The YouTuber quickly denied the transactions in an X post.

“Never heard of that coin, and that’s not my wallet,” he wrote on X.

You May Also Like

Ethereum Price Prediction: ETH Targets $10,000 In 2026 But Layer Brett Could Reach $1 From $0.0058

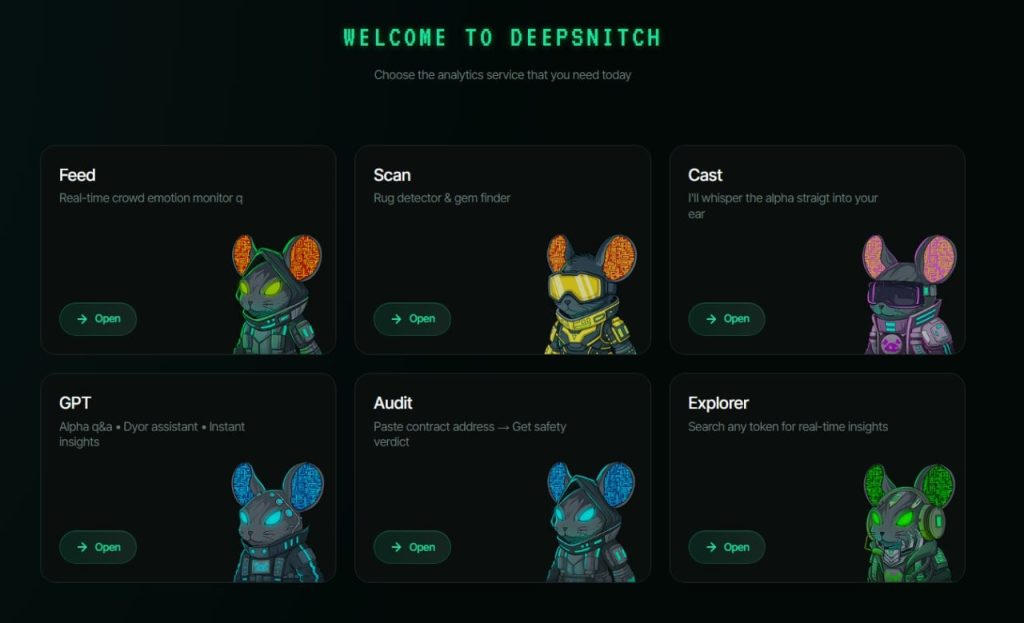

XRP Price Prediction March Update: Ripple and Aave Consolidate While DeepSnitch AI Surges 170%+ and Raises $1.8M