Crypto treasury firms might face limits as crypto volatility declines, VanEck warns

VanEck analysts note that active DATs are underpricing volatility to keep funding crypto buys, but falling swings and limited liquidity could make this harder. If market excitement and volatility drop, investor premiums and mNAVs may fade too.

- VanEck analysts say some of the most active DATs, like BNMR, are underpricing volatility to attract traders and fund more crypto purchases.

- But with cryptocurrency swings trending down and liquidity limited, this strategy may not work as smoothly in the future.

- Eventually, premiums and mNAVs that investors currently count on could fade if market excitement and volatility decline.

Some companies have found a curious way to keep riding the crypto wave, but it’s not as simple as buying cryptocurrencies. Instead, they’re playing a financial game that depends on swings in their own stock and the broader crypto market, as VanEck analysts say the so-called digital asset treasuries, or simply DATs, are growing fast but rely heavily on volatility to keep their strategies working.

By September of this year, DATs held about $135 billion in assets, with more than half concentrated in MicroStrategy, VanEck noted in a recent market overview.

As the analysts explain, DATs are using stock and options sales to boost their crypto holdings, rather than buying more coins directly. Some of them now trade at premiums to the value of their digital asset holdings, with the analysts suggesting this happens because “the market [assigns] a premium to entities that have a credible long-term ability to increase per-share digital asset exposure.”

To pull this off, DATs often sell securities tied to the volatility of their own stock. VanEck analysts note that to “reap the benefits of the volatility of their common shares (and the underlying digital assets), these entities must price the volatility they are selling well below the implied volatility of options.” The setup allows sophisticated traders to buy cheap volatility and hedge against pricier options. Over time, the volatility of the two positions tends to converge, which can create profits for the traders.

How BNMR shows game in action

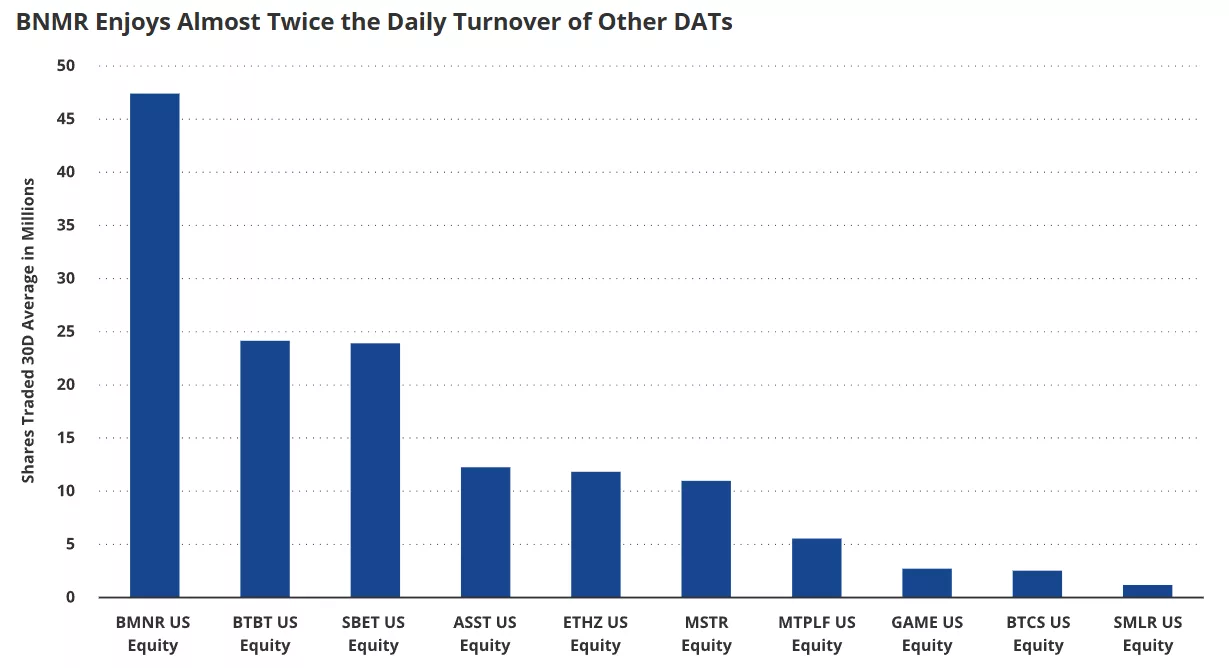

Bitmine’s BNMR share provides a clear example of how this works in action. VanEck analysts highlight that BNMR is “the most widely traded DAT by nearly a factor of two,” yet it still has to underprice volatility to attract buyers.

Bitmine Immersion, the largest ETH-focused DAT with more than $11 billion in Ethereum (ETH) holdings, recently sold shares at $70 while the stock was trading at $61.39. These shares came with two warrants to buy more stock at a higher price. Using options math, each warrant is worth roughly $20, meaning the total package was worth about $104.61, but investors paid only $70.

VanEck analysts describe this as BNMR “underpricing volatility by selling warrants at a steep discount,” giving speculators an extra opportunity if they can handle the options risk. The analysts also point out that DATs are essentially “volatility reactors,” borrowing Michael Saylor’s term. They need consistent market swings to fund more crypto purchases. However, cryptocurrency volatility has been trending down for nearly a decade, and the analysts now warn that if this trend continues, DATs may find it harder to finance further crypto acquisitions.

They suggest that as investor excitement fades and more digital asset products become available, mNAVs, which is also known as market-adjusted net asset values, should therefore “fade because investors can no longer count on most DATs to expand their treasuries consistently.”

Risks and limits

Another trend VanEck analysts highlight is that DATs may actively compress implied volatility by selling options or warrants to generate cash. Saylor confirmed that Strategy would do this “under circumstances where he could not issue shares due to MSTR mNAV <1.”

But the analysts warn that if Bitcoin experiences a prolonged drop, other DATs could also see declining mNAVs. While they might sell options to raise cash, this would reduce implied volatility across the sector, and over time, this could deplete the “volatility well” that DATs rely on to keep buying crypto.

Liquidity, or the lack of it, is another key concern. VanEck analysts note that many new DATs “are encountering […] the lack of deep and liquid markets for the secondary trading of their securities (particularly options).” Without established options markets, DATs must offer large discounts to attract investors, which means their ability to expand treasuries is closely tied to active trading and volatility.

For investors, VanEck analysts suggest the space offers both opportunity and caution. DATs provide a way to gain exposure to digital assets while still participating in traditional markets, using mechanics like discounted warrants and underpriced volatility. But the same structures that make them interesting also make them sensitive to market trends. Falling volatility could limit their growth, reduce mNAVs, and curb opportunities for speculative gains.

You May Also Like

Liquid crypto funds have a DeFi problem nobody talks about

The Federal Reserve cut interest rates by 25 basis points, and Powell said this was a risk management cut