Gold and Silver Rally May Drive Investors Toward Bitcoin Next – Here’s Why

TLDR

- Gold hit $4,000 per ounce and silver reached a 45-year high above $50, but precious metals may be overheated after rallying over 50% this year

- Bitcoin remains undervalued compared to gold, positioning it for potential rotation from precious metals investors seeking alternative stores of value

- The US dollar is on track for its worst year since 1973, down over 10% year-to-date and losing 40% of purchasing power since 2000

- VanEck analysts predict Bitcoin could reach $644,000 in equivalent value if it captures half of gold’s market cap

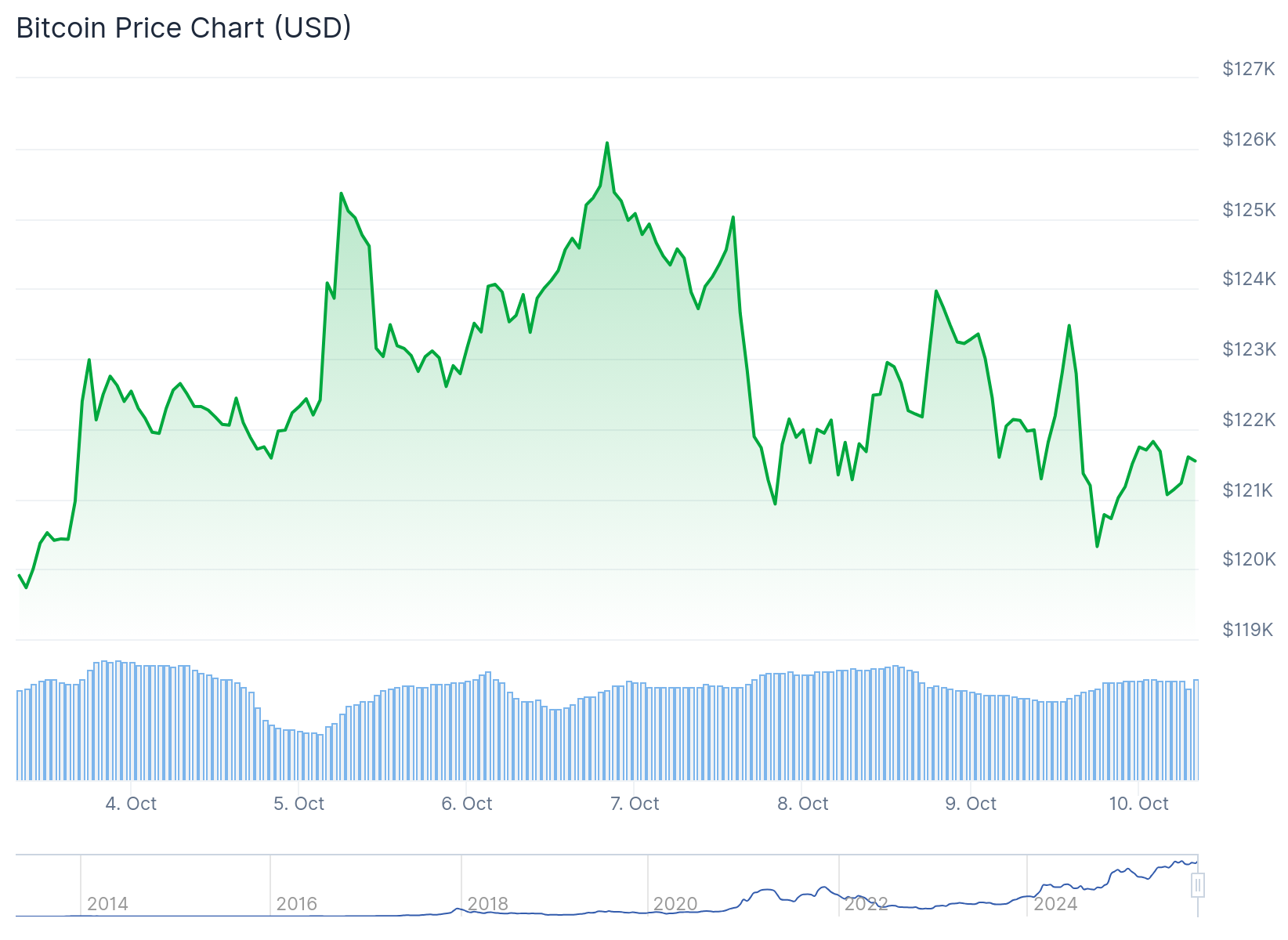

- Bitcoin hit a record high above $126,000 in October as investors seek hedges against currency debasement and inflation

Gold reached a record high above $4,000 per ounce in 2025, while silver climbed to a 45-year peak above $50. These gains come as investors seek protection from US dollar weakness and economic uncertainty.

Nic Puckrin, founder of Coin Bureau, believes the precious metals market may be overheated after gold’s 50% rally this year. Goldman Sachs forecasts gold could reach $4,900 per ounce by the end of 2026.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

Bitcoin hit a record high above $126,000 in October during the same period as the precious metals surge. The cryptocurrency remains undervalued relative to gold according to several market analysts.

The US dollar is experiencing its worst performance since 1973. The currency has dropped more than 10% year-to-date and lost 40% of its purchasing power since 2000.

Market analysts at the Kobeissi Letter noted that dollar debasement has caused simultaneous rushes into both safe-haven assets and risk assets. This unusual pattern suggests investors are repricing assets for a new monetary policy era with higher inflation.

Bitcoin Price Predictions Based on Gold

VanEck analysts predict Bitcoin could reach $644,000 in equivalent value if the cryptocurrency captures half of gold’s market cap. Matthew Sigel, head of digital asset research at VanEck, presented this analysis based on gold’s current market performance.

The prediction considers Bitcoin’s upcoming halving cycle and historical price patterns. Previous halving events have typically led to price increases as the mining reward decreases.

Joe Consorti, head of growth at Bitcoin custodian Theya, stated that gold’s price surge pushes Bitcoin’s fair value floor to $1.34 million. This calculation assumes Bitcoin continues gaining adoption as a digital store of value.

Some analysts remain skeptical of Bitcoin’s current valuation against gold. Peter Schiff argued that Bitcoin would need to reach $148,000 to match its previous record high when priced in gold.

Investor Rotation from Precious Metals

Puckrin expects investor attention to shift toward alternative assets that serve as inflation hedges. These include commodities, tokenized real assets, and Bitcoin.

Younger investors are increasingly choosing Bitcoin over gold as a store of value. Surveys show growing preference for Bitcoin among younger generations in emerging markets.

Matt Hougan, chief investment officer at Bitwise, expects Bitcoin to surge in Q4 as currency debasement continues. Investors are piling into safe-haven assets to preserve wealth during this period.

Both gold and Bitcoin serve as hedges against fiat currency inflation and geopolitical uncertainty. The assets attract different investor demographics but fulfill similar portfolio roles.

Bitcoin’s recent all-time high came as precious metals reached historic levels, demonstrating the parallel demand for alternative stores of value during dollar weakness.

The post Gold and Silver Rally May Drive Investors Toward Bitcoin Next – Here’s Why appeared first on CoinCentral.

You May Also Like

V20.2 Upgrade Sparks Break Above $0.23 Trendline

Nvidia Stock Analysis as a Fresh Headwind Emerges