Luxembourg’s Sovereign Wealth Fund Becomes First In Eurozone To Buy Bitcoin

Luxembourg’s sovereign wealth fund has become the first in the Eurozone to invest in Bitcoin after it allocated 1% of its $730 million portfolio to spot BTC ETFs (exchange-traded funds).

The investment follows a revision of a mandate for the Intergenerational Sovereign Wealth Fund (FSIL), which allows it to invest up to 15% of its portfolio into alternative assets, including crypto. It can also buy into other alternative assets such as real estate and private equity.

The FSIL was launched in 2014 and is intended to build up a reserve for future generations. Most of its capital is allocated to high-quality bonds.

Symbolic Weight

While the investment is only worth about $7.3 million, it carries symbolic weight and could also motivate other sovereign wealth funds in the Eurozone to invest in the largest crypto by market cap.

“Some might argue that we’re committing too little too late; others will point out the volatility and speculative nature of the investment,” said Bob Kieffer, Director of the Treasury, Luxembourg.

“Yet, given the FSIL’s particular profile and mission, the Fund’s management board concluded that a 1% allocation strikes the right balance, while sending a clear message about Bitcoin’s long-term potential,” Keiffer added.

The recent move comes amid “measured confidence in a maturing digital-asset market,” according to Luxembourg Finance Agency communications head, Jonathan Westhead.

He said that Bitcoin ETFs offer a way for the fund to gain regulated exposure to BTC, without the operational and technical complexity of custodying coins directly. According to Westhead, the investment products also offer “innovation with accountability.”

European nations including Finland, Georgia, and the UK currently hold Bitcoin. However, most of this crypto was sourced through criminal seizures, data from Bitbo shows.

US Spot Bitcoin ETFs Continue Their Inflows Streak

The investment from the FSIL into Bitcoin ETFs comes amid a multi-day positive-flow streak for the investment products in the US.

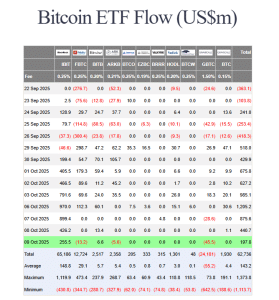

After $197.8 million flowed into the US funds on Oct. 9, the products’ inflows streak has been extended to nine days, according to data from Farside Investors.

Spot Bitcoin ETF flows (Source: Farside Investors)

The inflows in the latest session were led by BlackRock’s IBIT, which pulled in $255.5 million on the day.

IBIT is now on the verge of hitting the $100 billion assets under management (AUM) milestone as well, according to Bloomberg ETF analyst Eric Balchunas. In a recent X post, he noted that IBIT’s AUM is around $99 billion. He also said that IBIT managed to overtake “an ETF legend,” VIC, to become the 19th-biggest ETF overall in terms of AUM.

Bitwise’s BITB was the only other US spot Bitcoin ETF to record net positive daily flows yesterday, with $6.6 million added to its reserves.

Meanwhile, Fidelity’s FBTC, ARK Invest’s ARKB, and Grayscale’s GBTC all recorded net outflows on Oct. 9. FBTC saw $13.2 million outflows, while ARKB and GBTC saw respective outflows of $5.6 million and $45.5 million.

The remaining funds recorded no new flows on the day.

Following yesterday’s inflows, the US spot Bitcoin ETFs have pulled in over $5.9 billion since Sept. 29.

Global Crypto ETFs Attract Record Inflows

The continued inflows for US spot Bitcoin ETFs follows a record week for crypto investment products globally.

In the week ending on Oct. 4, the global inflows for the crypto products hit $5.95 billion. US-based products attracted the majority of this capital, with $5 billion of that inflow.

However, there were also inflows of $563 million in Switzerland, and $312 million in inflows in Germany. Both were new records.

Breaking the inflows down by crypto shows that BTC drew the most. Bitcoin’s inflows reached $4.55 billion. Ethereum saw the next-biggest inflows of $1.48 billion, while Solana and XRP pulled in $706.5 million and $219.4 million, respectively.

Year-to-date inflows for crypto products also recently surpassed the total amount seen in 2024, according to James Butterfill, head of research at CoinShares.

You May Also Like

SAND Bearish Analysis Feb 2

CME Group to launch options on XRP and SOL futures