How to empower the most popular L2 network? A look at the BASE token economics proposal

By Achim Struve, Outlier Ventures

Compiled by AididiaoJP, Foresight News

Since several of our portfolio companies are building on Base, we have a strong interest in the success of this ecosystem.

This proposal aims to build community engagement by outlining a token design that challenges traditional L2 models. It solves the fundamental revenue-growth paradox through an adaptive quote currency mechanism. The BASE token represents an opportunity to redesign L2 economics from first principles.

BASE Token Discussion: Redesigning L2 Token Economics

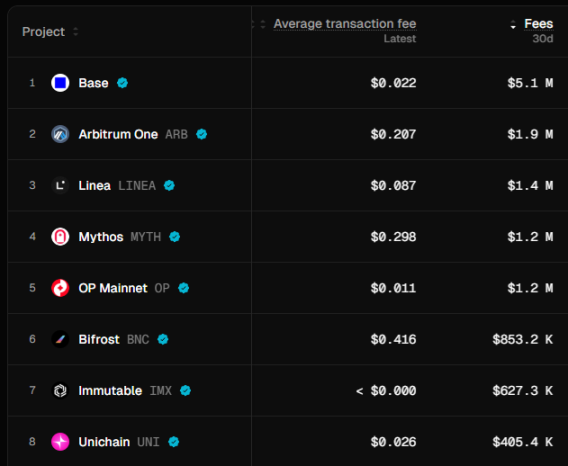

Layer 2s face a fundamental economic challenge: competitive pressure to keep transaction fees low erodes revenue generation. Base boasts $4.95 billion in TVL, 1 million daily active users, and $5.1 million in monthly transaction fees, primarily due to its native connection to Coinbase, competitively low fees of just $0.02 per transaction, and deep integration with the broader EVM-based ecosystem.

source

This proposal outlines solutions for designing a possible token for Base. It's not just about staying ahead, it's about establishing leadership. A key recommendation is to reduce reliance on fees as a primary revenue source. Combining a quote currency mechanism implemented with a proven bribery mechanism with adaptive economics creates sustainable value capture for Coinbase, Base, and the BASE token.

BASE Token Opportunities

Traditional L2 focus on transaction fees ignores the primary value driver of successful cryptoassets. As @mosayeri observed, "The crypto community has long misjudged the value accumulation narrative for L1 assets, assuming that the primary driver is transaction fees." The value of ETH and SOL primarily comes from being locked in AMM pools as the quote currency, not from gas fees.

This presents an opportunity for BASE to establish itself as the primary quote currency on whitelisted approved Base Ecosystem DEXs. Rather than competing for dwindling fee revenue, BASE can generate demand through real liquidity demand across trading pairs.

Quote currency mechanism

Users lock up BASE tokens to receive veBASE (voted escrow BASE), which provides governance rights over the fee distribution algorithm. VeBASE holders channel rewards to an AMM pool that uses BASE as its quote currency, with the distribution ratio automatically adjusted based on network health metrics. Ecosystem growth directly increases demand for locked BASE tokens, as they are tied to liquidity incentives.

This system builds on the established quote currency concept of Virtuals, while adding a voting escrow mechanism similar to Aerodrome, but without redistributing liquidity pool fees to voters. A portion of sequencer revenue is used to sustainably generate incentives for voting on the BASE denominated pool. This applies even after the initial launch phase. Furthermore, unlike static allocation models, dynamic fee allocation responds to real-time conditions via fine-tuned machine learning algorithms. These algorithms analyze network utilization, DEX trading volume patterns, and ecosystem growth metrics to determine overall incentive distribution.

This mechanism will trigger a Curve Wars-like liquidity competition, with protocols accumulating BASE governance tokens to ensure liquidity incentives. As the Base ecosystem expands, more protocols will demand BASE liquidity, reducing the circulating supply and creating natural demand pressure. This approach also provides opportunities for large-scale token swaps with leading protocols already established on Base, further strengthening decentralized ownership within the ecosystem. Base can use tokens from other ecosystems to build its own BASE quote liquidity pool. Trading fees collected from the protocol's own liquidity can serve as a sustainable, long-term revenue stream.

Adaptive economic system

Current L2 token designs use fixed distribution schedules and are unable to respond to changing market conditions. BASE introduces a complex adaptive system that goes beyond simple fee adjustments like Ethereum’s EIP-1559.

Building on previously published adoption-adjusted attribution principles, BASE implements a dynamic emissions plan that responds to ecosystem demand signals through two strategic allocation pools:

- Distribution-focused allocation pools (Coinbase Strategic Reserve, Protocol Treasury, Community, and User): receive increased emissions during periods of strong KPI performance to optimize value distribution when adoption is high.

- Growth and Construction Allocation Pools (Ecosystem Fund and Builders, Validators, and Infrastructure): Receive increased incentives during periods of weak KPI performance to stimulate development and network security when additional support is most needed.

The Growth and Construction Allocation Pool includes all quote currency pool incentives, distributed through the Ecosystem Fund to protocols using BASE as their primary trading pair. This directly aligns the adaptive emission system with quote currency value capture.

Emissions never reach zero during the vesting period of any allocation pool, and the system adjusts the relative weights between allocation pools based on market conditions and ecosystem health. Machine learning models analyze multiple factors to prevent governance bottlenecks while ensuring optimal stakeholder alignment across market cycles.

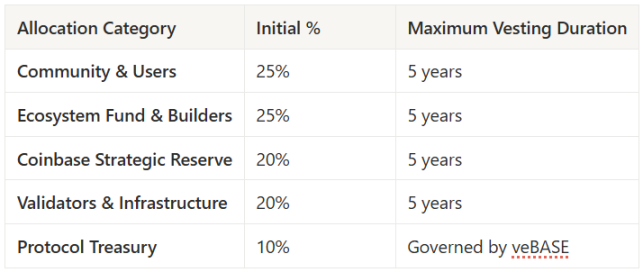

BASE token distribution framework

Examples of BASE token distribution and maximum vesting periods. Actual vesting periods may change depending on the precise adaptive emission parameterization.

Key Features:

- Adaptive Emission System: All allocations use a dynamic schedule, with the allocation-focused allocation pool receiving increased emissions during periods of strong adoption, and the Growth & Build allocation pool receiving increased incentives during periods of weakness.

- COIN Shareholder Alignment: Coinbase’s 20% Strategic Reserve creates direct value alignment without regulatory complexities.

- Progressive decentralization: Validator incentives (20%) ensure network security during the launch phase, while community allocation supports sustainable decentralized ownership of BASE tokens.

- Balanced Development: Equal weight between community rewards and ecosystem development ensures success in both adoption and builder retention.

The final distribution requires extensive token engineering analysis, legal review, and community input to achieve economic sustainability, regulatory compliance, and user alignment.

Strategic value and impact on Coinbase

Tokenizing Base represents a fundamental shift in revenue diversification. While Base currently generates modest sequencer fees (kept low for competitive reasons), tokenization could immediately create over $4 billion in value through strategic reserve holdings.

The current model faces limitations. Brian Armstrong mentioned the emphasis on low fees, recognizing that higher fees drive users to competitors offering token incentives, creating a revenue-growth paradox.

Tokenization breaks this paradox by shifting incentives from fee extraction to ecosystem acceleration and value accumulation. A 20% strategic reserve aligns Coinbase's interests with the long-term success of Base while removing the pressure to maximize fees. Token emission funds growth without impacting the balance sheet, enabling competitive rewards that match other L2 incentives.

The strategic impact goes beyond immediate returns through multiple revenue diversification opportunities. Tokenization enables Coinbase to offer institutional custody services for BASE holdings, generating recurring custody fees while positioning itself as the premier institutional gateway for BASE exposure. The Coinbase One integration reduces customer acquisition costs by offering subscribers BASE rewards, discounts, and platform perks, creating stickier customer relationships and higher lifetime value.

Allocation Strategy

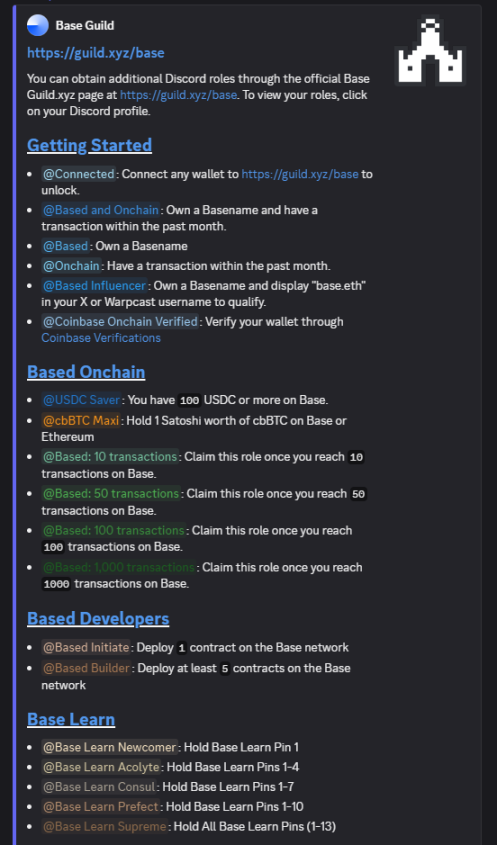

The distribution strategy should balance Coinbase's customer base with Base ecosystem participants. While @Architect9000 suggested "airdropping only to Coinbase One members" for Sybil protection and customer alignment, a fair distribution needs to include active Base chain users and verified builders from the Discord community.

Roles earned on the Base community Discord server can be used to measure user consistency and commitment and are tied to an individual's BASE airdrop allocation.

This dual approach ensures CEX user retention and true L2 ecosystem participation.

Tokenization positions BASE as institutional-grade collateral bridging TradFi and DeFi. As @YTJiaFF noted, "With COIN backing, the BASE token will serve as a secure bridge between public companies and crypto assets." Institutions can custody their BASE holdings at Coinbase and simultaneously use them as both on-chain collateral in DeFi protocols and off-chain collateral in traditional credit markets. This dual-collateralization capability creates the first crypto token designed specifically for the corporate credit market, enabling traditional financial institutions to access crypto liquidity while maintaining regulatory compliance through established custodial relationships.

The path to progressive decentralization

The transition follows a three-phase approach, balancing innovation with stability. As @SONAR observes, Base has achieved “decentralization in Phase 1 of 3,” and “once Phase 2 arrives, fees will need to be paid to third-party sequencers,” making tokenization a strategic necessity.

Phase 1: Coinbase maintains control of the sequencer while initiating token incentives and community governance for fee allocation. In this controlled environment, the quote currency model is validated through some basic KPI-driven incentive allocation.

Phase 2: A hybrid model, with an initial set of decentralized validators requiring BASE staking, with Coinbase reserving three permanent seats to ensure transitional stability. This phase introduces prediction market governance (Futarchy), where veBASE holders stake on the success of the implementation, and market proof-of-stake proposals are fast-tracked for approval.

Phase 3: Full decentralization, open validator participation, and complete community control. Coinbase transitions to a regular network participant while maintaining strategic token holdings. Advanced cross-chain MEV coordination becomes operational, and institutional credit markets expand into traditional finance.

Market positioning and competitive advantages

BASE enters a landscape where existing L2 tokens struggle to capture network value. Despite significant ecosystem growth, ARB, OP, and MATIC continue to underperform ETH, highlighting structural issues in traditional L2 token design. These protocols face selling pressure from token unlocks without matching demand.

BASE's quote money model solves these structural problems by creating real utility demand through AMM-quoted liquidity deposits. This generates organic buying pressure that scales as the ecosystem grows, moving beyond speculative utility to necessary infrastructure participation.

Competitive differentiation goes beyond token design and extends to regulatory clarity, institutional access, and enterprise-grade compliance. Coinbase’s regulatory expertise provides an advantage unmatched by decentralized competitors, while the quote currency model creates a clearer definition of utility and reduces securities classification risk.

Conclusion: A Decisive Choice Between Fee Capture and Exponential Value

The fundamental question is not whether Coinbase should launch a token, but whether they should capture limited fee revenue or create exponential value through tokenization.

The current revenue structure indicates that $180 million will be generated over three years ($5 million per month x 12 months x 3 years). On the other hand, strategic BASE tokenization can be achieved through token distribution ($10 billion initial fully diluted valuation x 0.2 = $2 billion) and due to

- Quote currency demand

- Adaptive intelligent incentive distribution

- POL provides revenue comparable to current sequencer fees

- Ecosystem acceleration

- Valuation of another $2 billion

And create a comprehensive value of approximately US$4 billion.

These are conservative estimates, assuming valuations are in line with other L2s, and adjusted for current fees and TVL data. Note that the Coinbase premium is not included.

This represents a significant value creation opportunity for Coinbase. The quote currency model solves the growth-revenue paradox while positioning BASE as the infrastructure for the expanding BASE ecosystem. The early dominance afforded by this L2 token design creates a competitive advantage that can further strengthen BASE's leading market position.

For the broader crypto ecosystem, BASE tokenization could signal a further maturation of L2 economics, moving beyond a reliance on transaction fees toward true utility-driven value capture. As @jack_anorak observed, “The BASE token was a product decision. Base needed a token incentive, and it had to be blockspace neutral.”

Coinbase’s choice between constrained fee capture and exponential tokenized value represents a defining moment that will determine the trajectory of BASE and Coinbase’s position in the crypto landscape.

You May Also Like

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release

US Treasury Backs Limited Framework for Crypto Mixers