The Math Behind Blockchain Scheduling and Transaction Fee Mechanisms

Table of Links

Abstract and 1. Introduction

1.1 Our Approach

1.2 Our Results & Roadmap

1.3 Related Work

-

Model and Warmup and 2.1 Blockchain Model

2.2 The Miner

2.3 Game Model

2.4 Warm Up: The Greedy Allocation Function

-

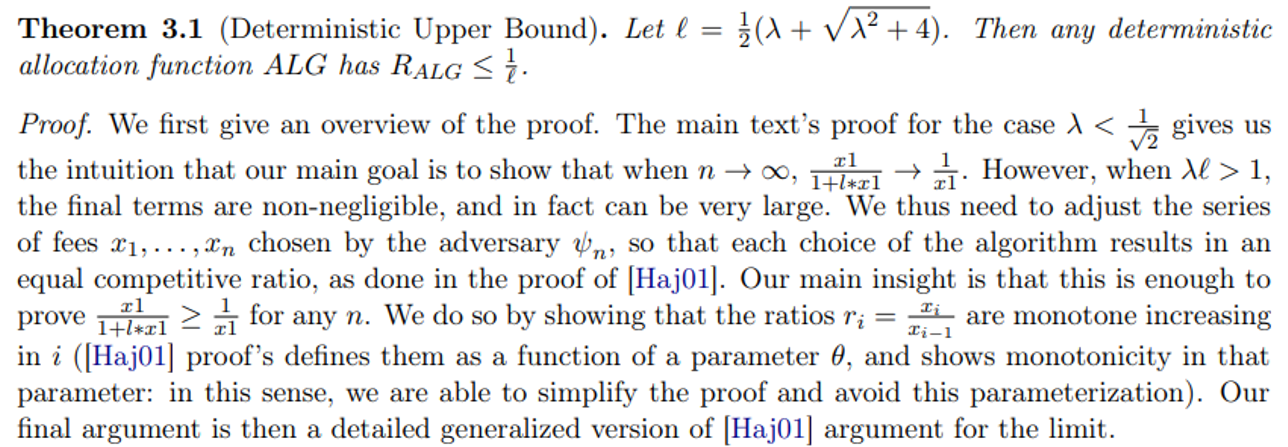

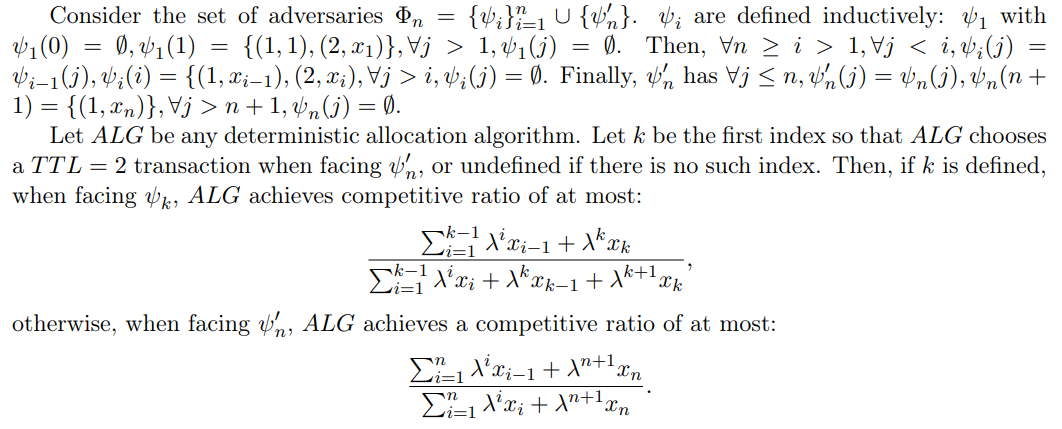

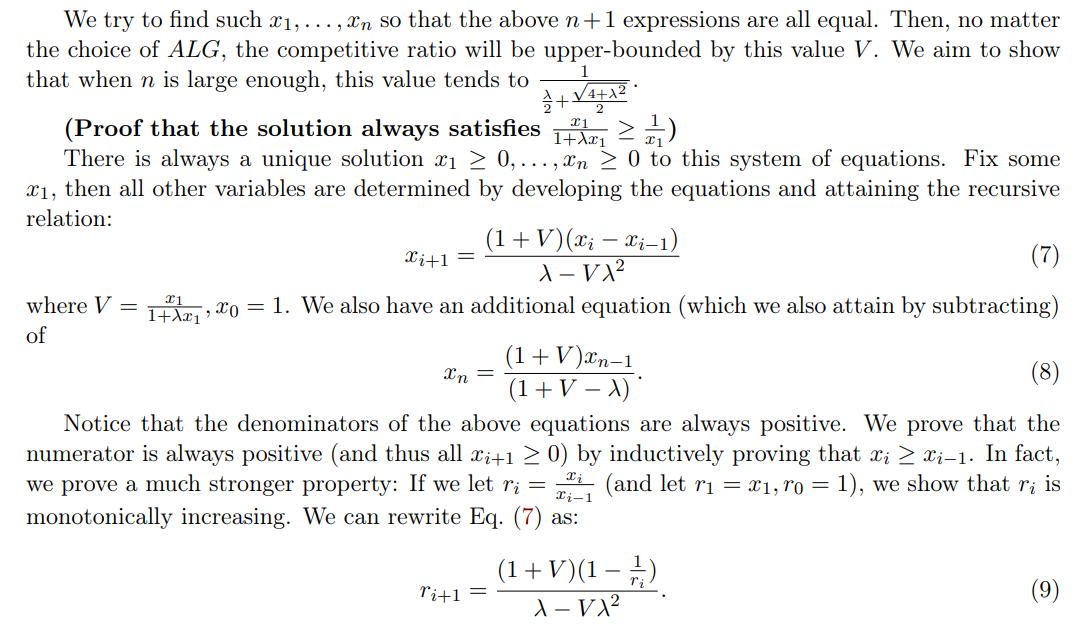

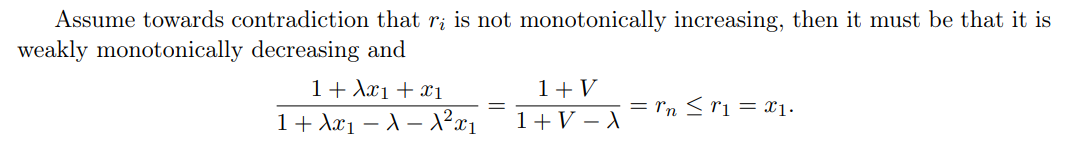

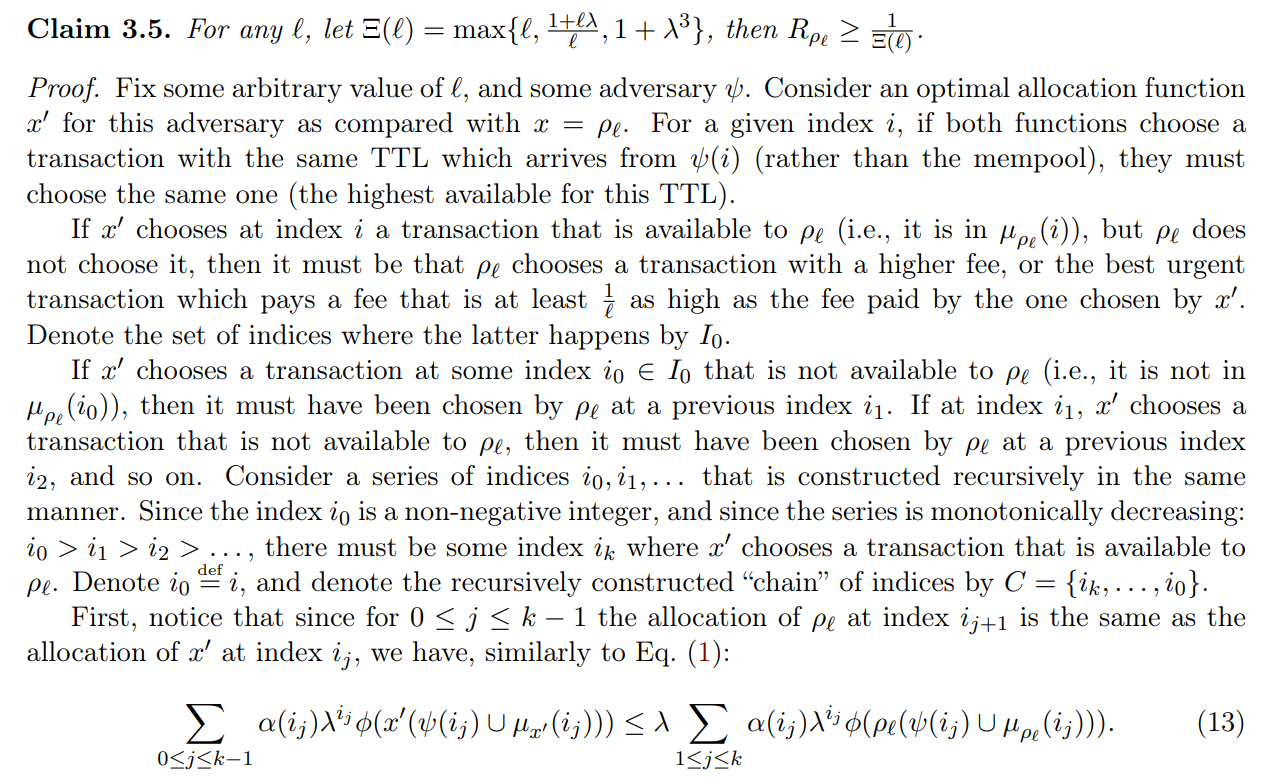

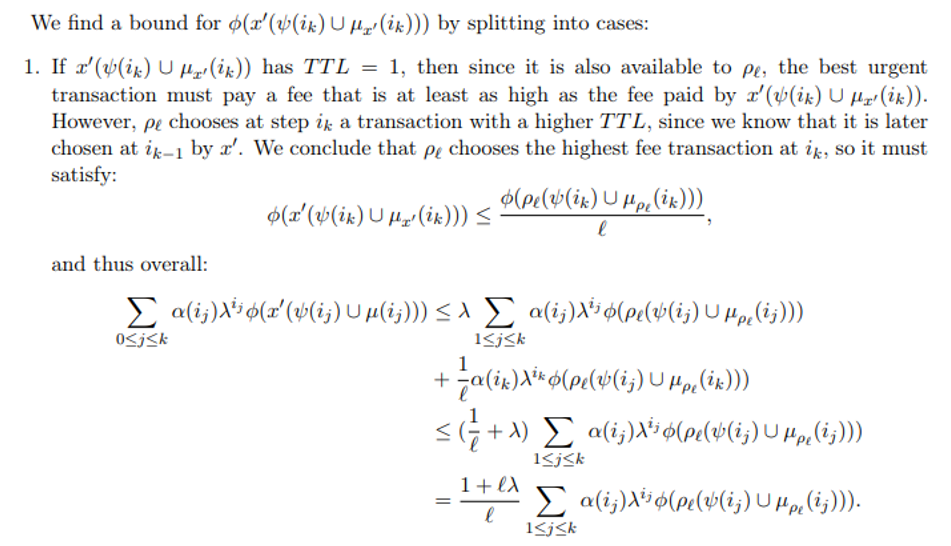

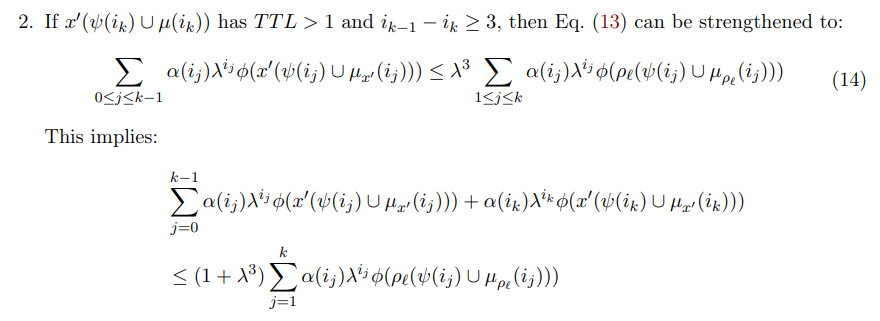

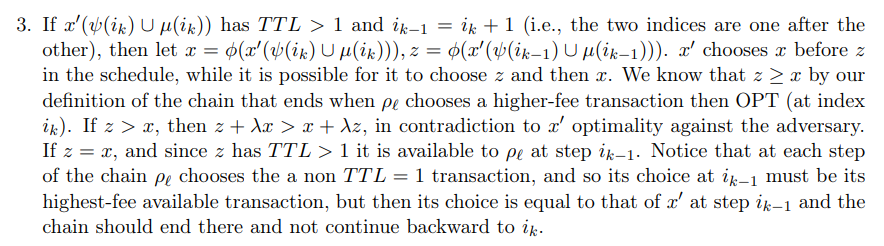

The Deterministic Case and 3.1 Deterministic Upper Bound

3.2 The Immediacy-Biased Class Of Allocation Function

-

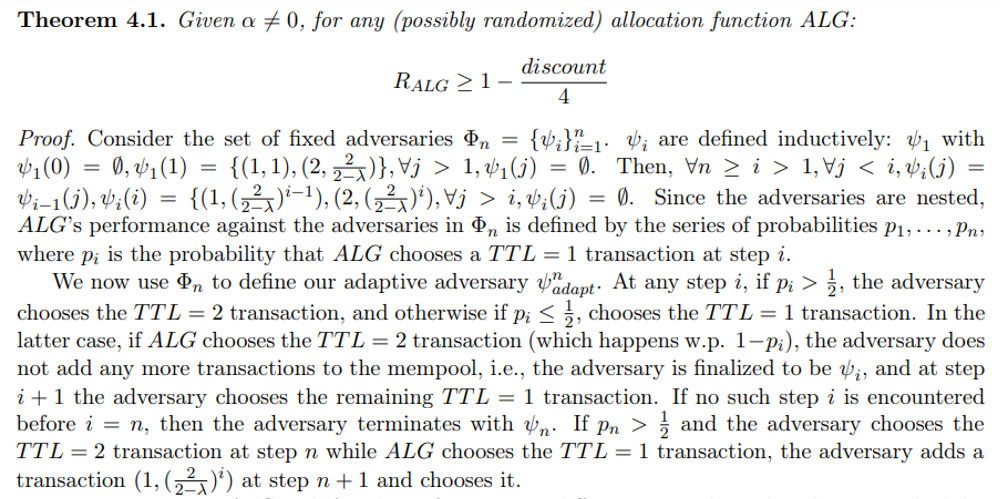

The Randomized Case

-

Discussion and References

- A. Missing Proofs for Sections 2, 3

- B. Missing Proofs for Section 4

- C. Glossary

\

A: Missing Proofs for Sections 2, 3

\

\ \ \

\ \ \

\ \ \

\ \ \

\ \ \

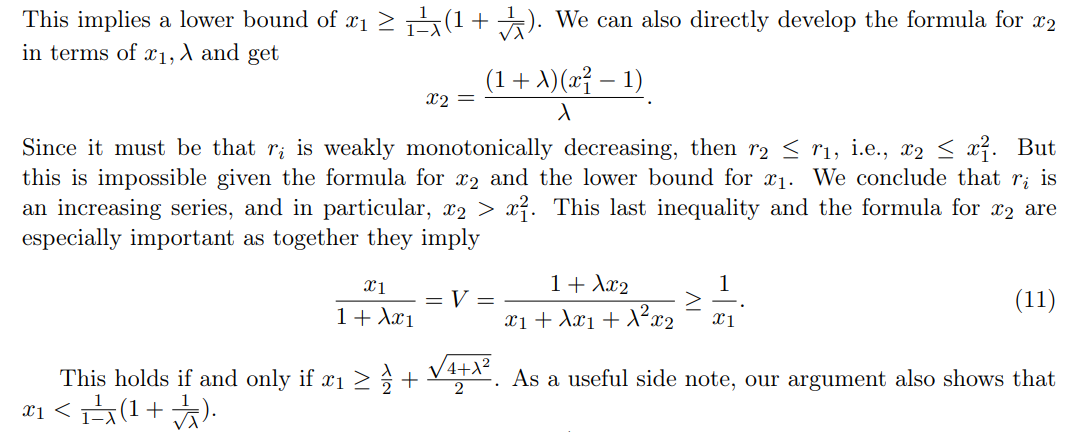

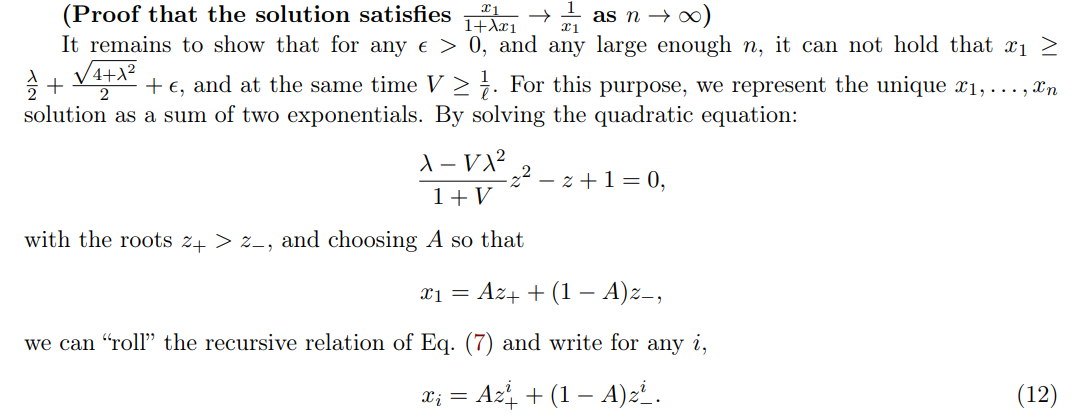

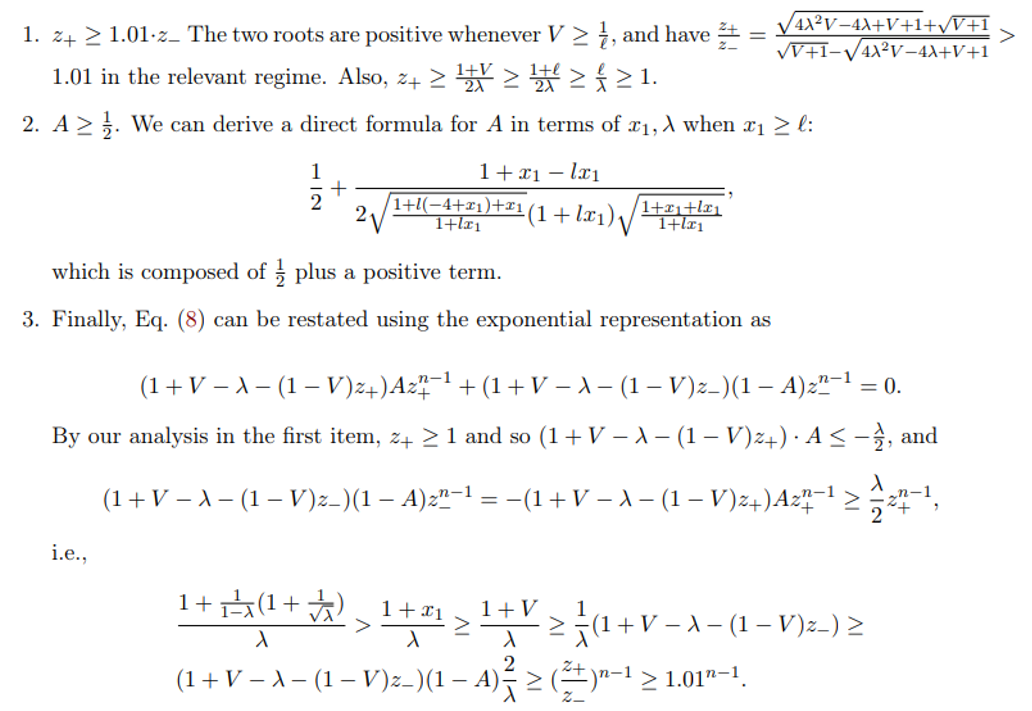

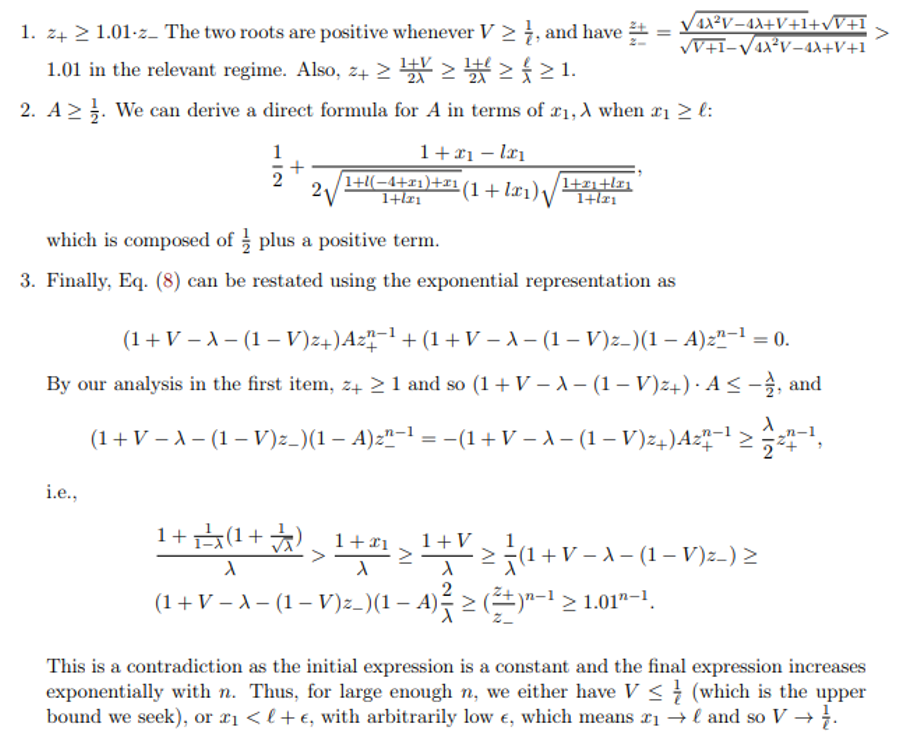

\ \ We now note that a few facts that hold true for any n when x1 ≥ ℓ + ϵ:

\ \

\ \ \

\ \ \

\ \ \

\ \ \

\ \ \

\ \ \

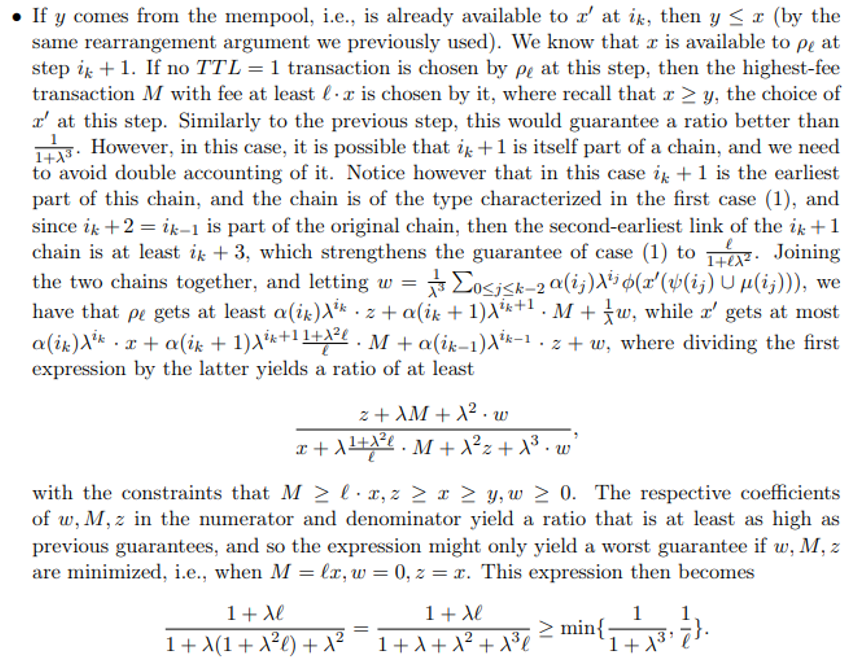

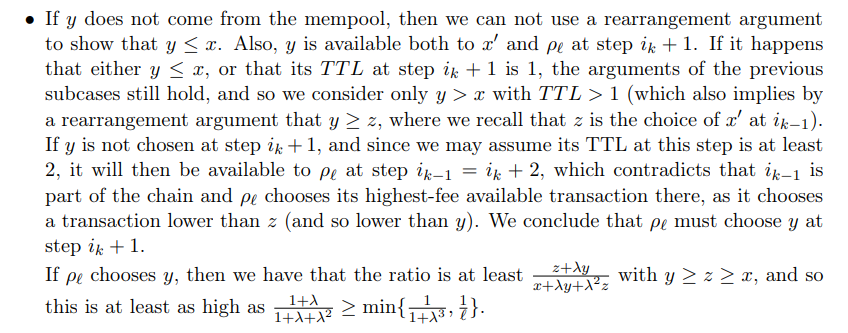

\ \ We separate to several subcases:

\ \

\ \ \

\ \ \

\ \ \

\ \ \

\ \ \

\ \

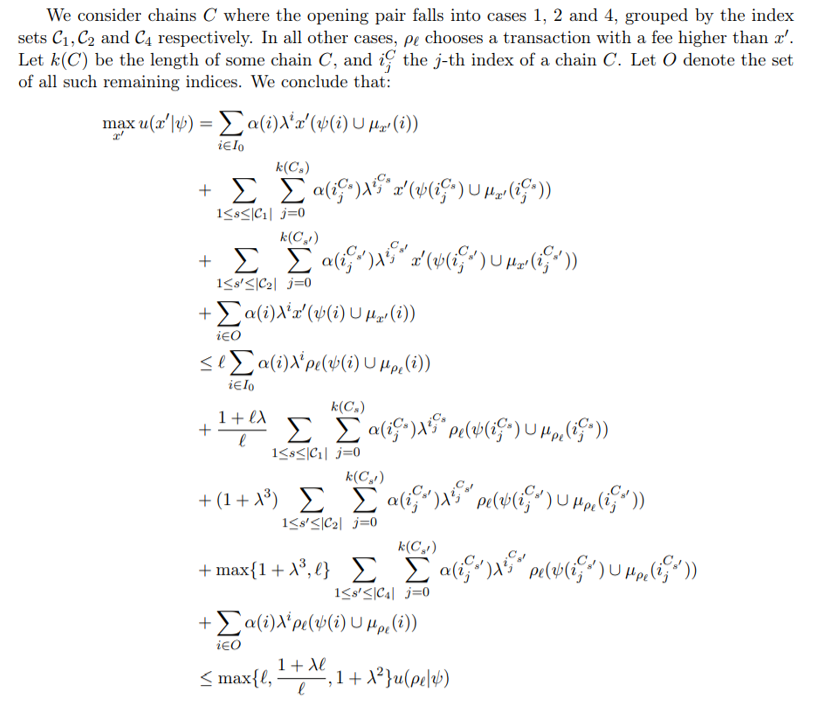

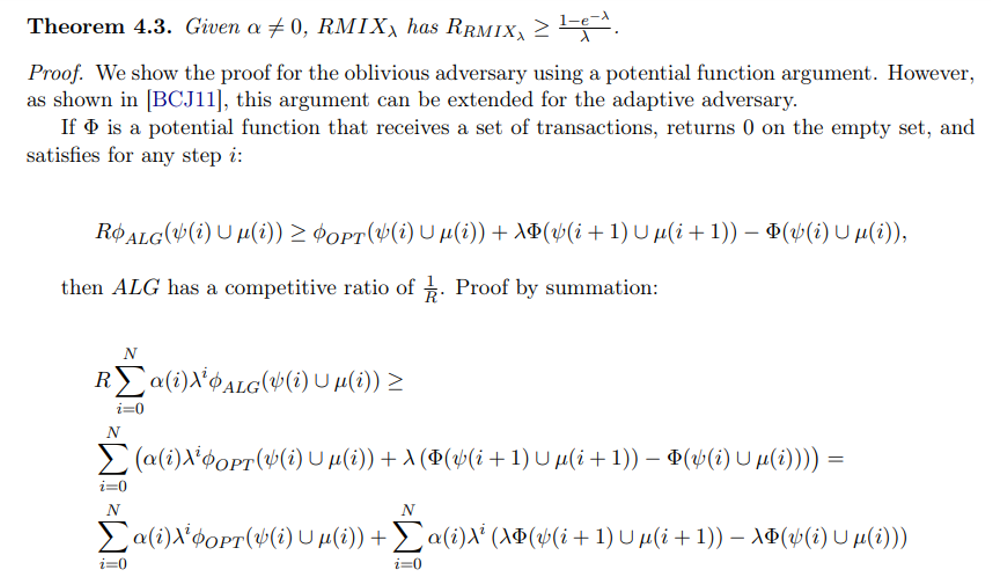

B Missing Proofs for Section 4

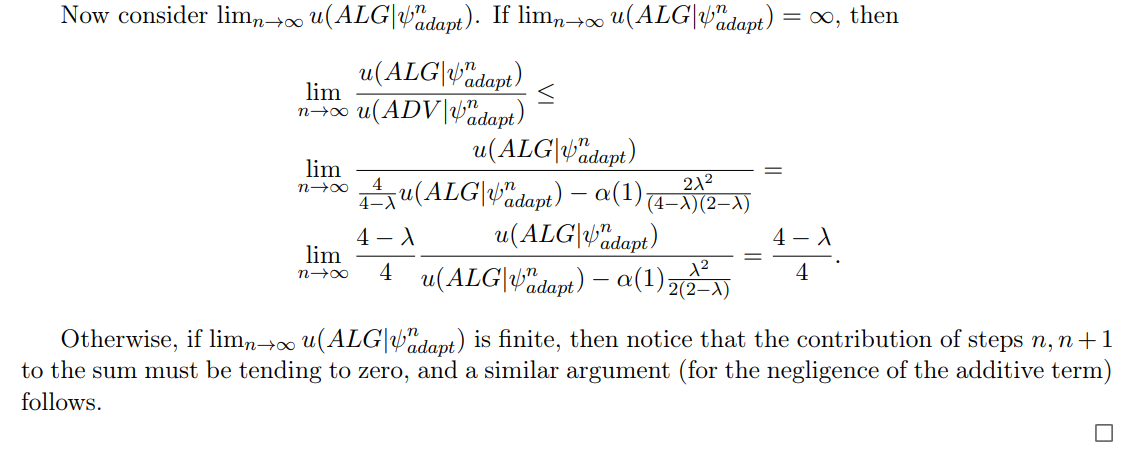

\ We now compare ALG and ADV ’s performance in different steps along the adversary schedule, separating the steps before n and the last two steps.

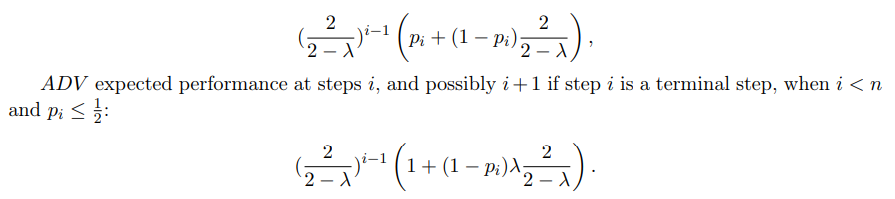

\ Step i < n.

\ ALG expected performance:

\

\ Notice that this amortization of considering the i + 1 is only relevant for ADV, as ALG in such case necessarily has no transactions remaining to choose from at step i + 1.

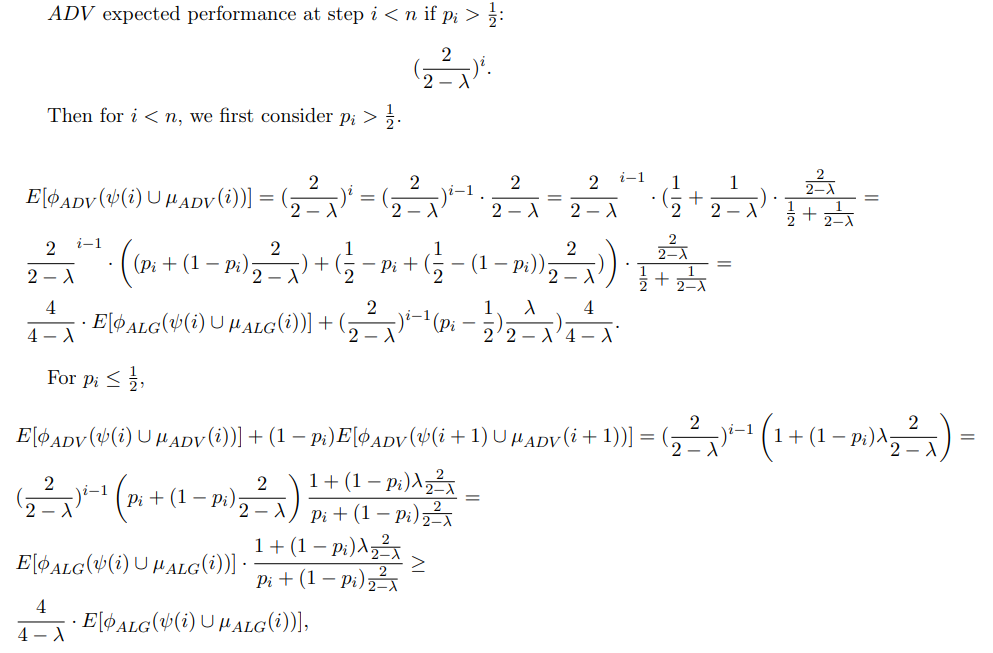

\

\ where the last transition is since for any 0 ≤ λ ≤ 1, the expression

\

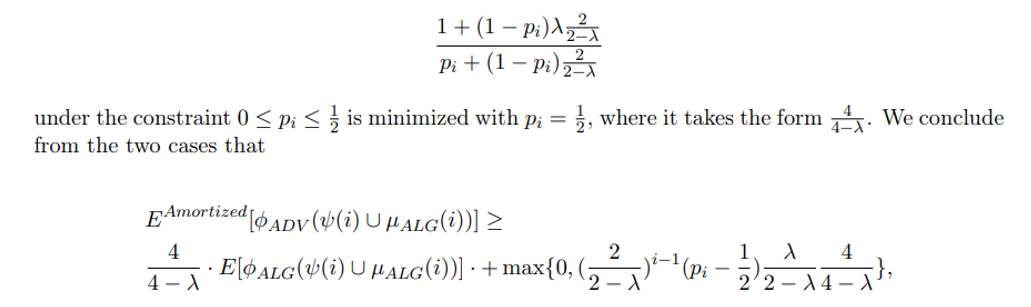

\ We now move on to analyze steps n, n + 1.

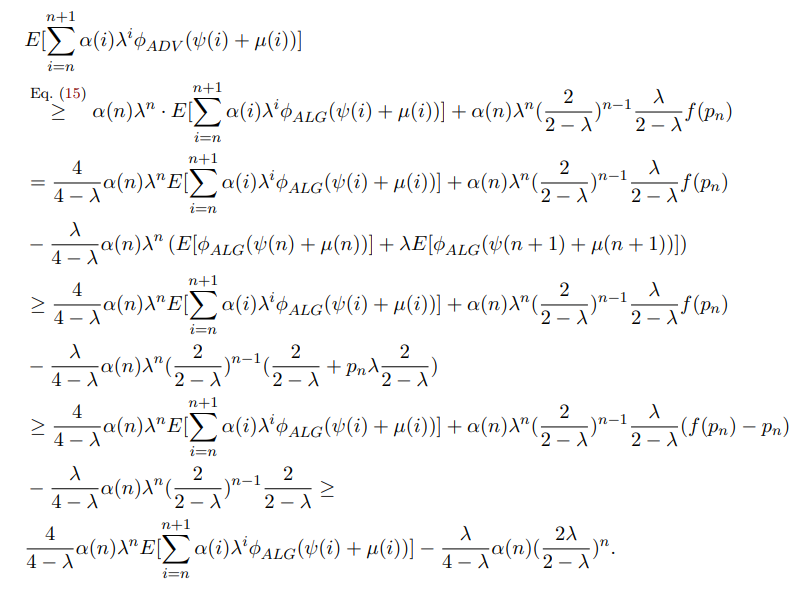

\ ALG expected performance at step n, n + 1:

\

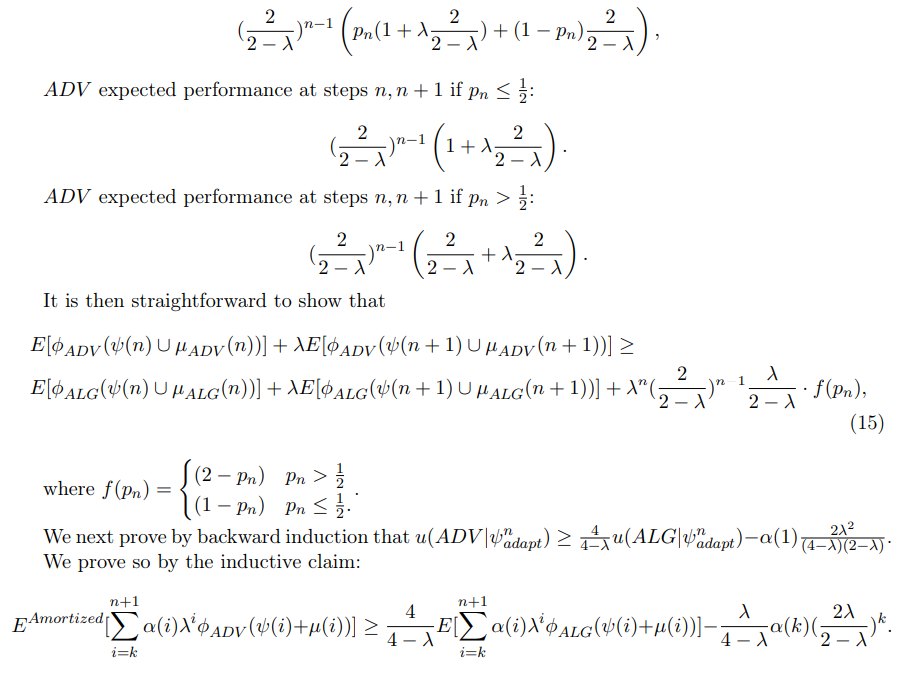

\ As the base case, consider k = n. Then,

\

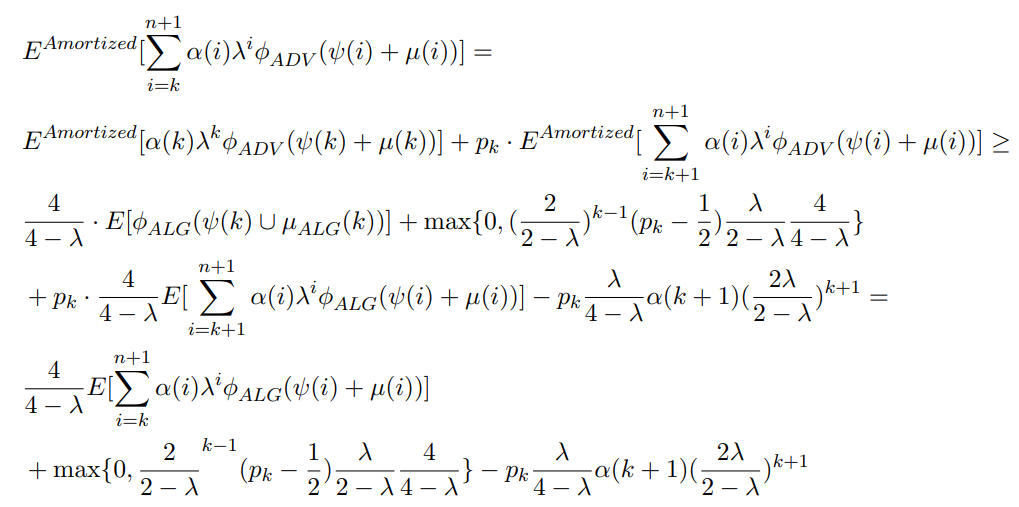

\ For the inductive step,

\

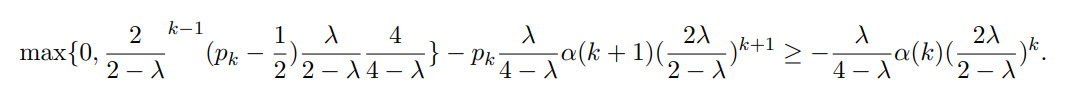

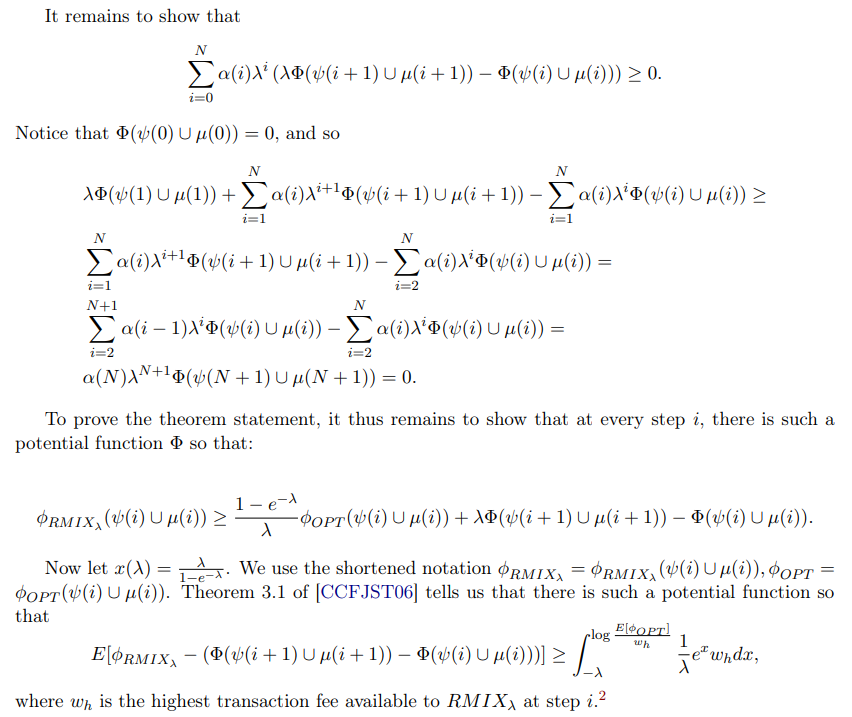

\ We thus need to show that

\

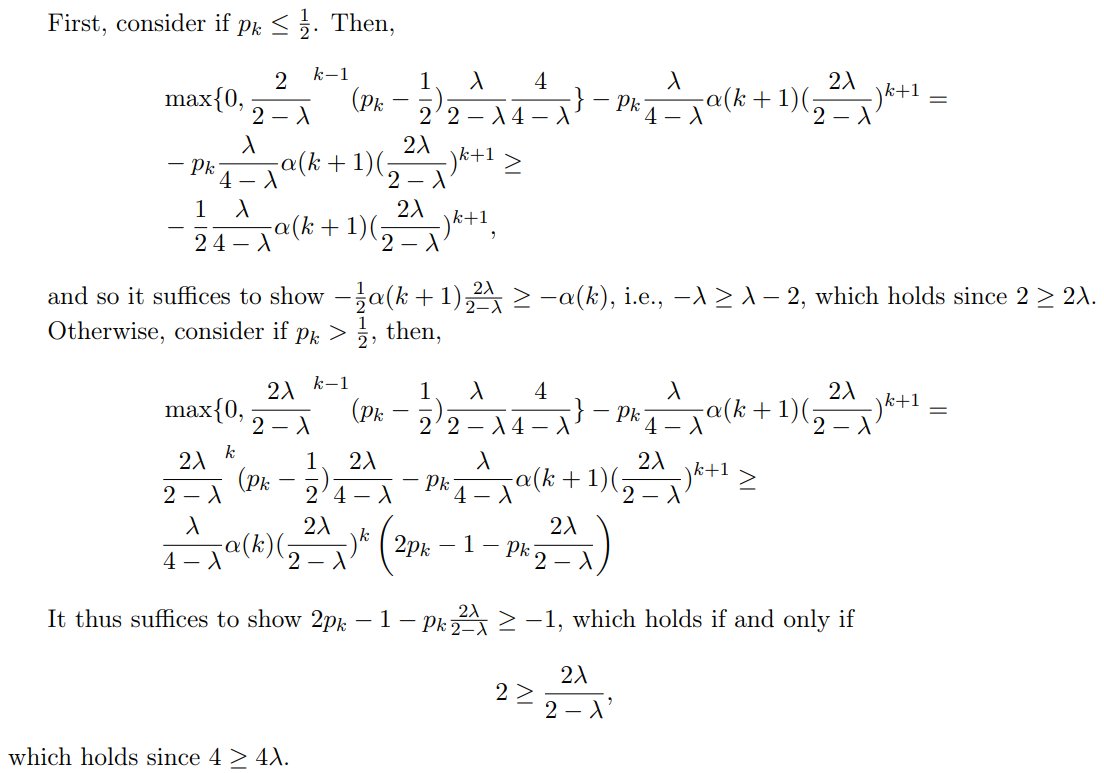

\

\

\

\

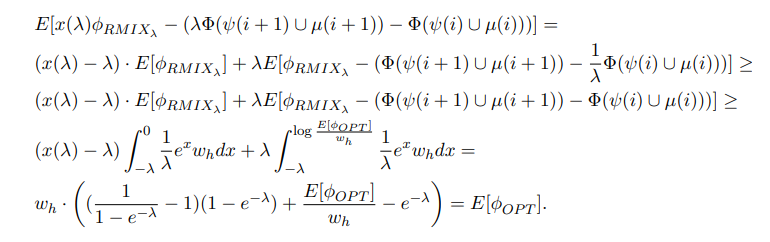

\ With this potential function, we can thus write at step i,

\

\

C Glossary

A summary of all symbols and acronyms used in the paper.

C.1 Symbols

ψ Transaction schedule function.

\ x Allocation function.

\ B Predefined maximal block-size, in bytes.

\ λ Miner discount factor.

\ ϕ Transaction fee of some transaction, in tokens.

\ T Miner planning horizon.

\ ℓ Immediacy ratio for our non-myopic allocation rule.

\ µ TTL of past transactions.

\ α Miner’s relative mining power, as a fraction. u Miner revenue.

\ t TTL of a transaction.

\ tx A transaction.

C.2 Acronyms

mempool memory pool

\ PoS Proof-of-Stake

\ PoW Proof-of-Work

\ QoS quality of service

\ TFM transaction fee mechanism

\ TTL time to live

\ \

:::info Authors:

(1) Yotam Gafni, Weizmann Institute (yotam.gafni@gmail.com);

(2) Aviv Yaish, The Hebrew University, Jerusalem (aviv.yaish@mail.huji.ac.il).

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

[2] The argument of [CCFJST06] is done by showing conditions that hold for any fixed x ∈ [−1, 0], and so they hold for any fixed x ∈ [−λ, 0] as well.

You May Also Like

The Future of MarTech: Key Trends Shaping Marketing Technology Through 2030

Silver Price Forecast: XAG/USD Soars Above $86 as US Dollar Retreats