Metaplanet’s Enterprise Value Tumbles Below Bitcoin Holdings, Stock Plunges 12%

Metaplanet’s enterprise value has slumped below the value of its Bitcoin reserves as the crypto’s price plunge pressures Asia’s largest BTC treasury firm.

The Japan-based company’s mNAV — the ratio of market capitalization plus debt to the value of its crypto holdings — dropped to 0.99 during today’s trading session, Bloomberg reported, citing data from Metaplanet’s website.

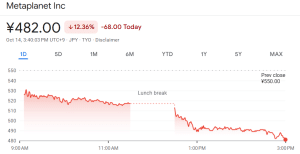

Metaplanet’s share price plunged more than 12% in the past 24 hours, extending a dizzying 70% correction since June, according to Google Finance.

Metaplanet share price (Source: Google Finance)

Metaplanet’s shares are also down more than 19% over the past week

The declining share price is one of the main drivers for the company’s falling mNAV, and the stock remains under pressure.

Looking at the daily chart for Metaplanet’s share price, a major bearish technical flag has been triggered in the past couple of days, with the 50 Simple Moving Average (SMA) crossing below the 200 SMA during this period, TradingView data shows.

Daily chart for Metaplanet stock (Source: TradingView)

Usually, a short SMA like the 50-day crossing below a longer indicator like the 200-day SMA is seen as a continuation signal for a downtrend.

Metaplanet Suspends Stock Warrants For 20 Days

Metaplanet is ranked fourth globally among Bitcoin treasury companies, with holdings of 30,823 BTC, according to data from Bitcoin Treasuries. This BTC was accumulated at an average cost of $108,036 per coin, and has achieved an unrealized profit of 3.73% since April 23, 2024.

The dollar value of that BTC dropped after the crypto market suffered a $19 billion liquidation on Friday. During the market correction, BTC’s price also briefly slid below the $110K mark.

Since then, Bitcoin’s price has recovered to stand at $112,120.71 as of 3:18 a.m. EST after tumbling 2% in the past 24 hours, according to CoinMarketCap data. Still, the king of cryptos has plunged almost 10% in the past week.

Metaplanet announced on Oct. 10 that it has suspended the exercise of its 20th to 22nd series of stock acquisition rights. These rights are financial instruments that give investors the right, but not the obligation, to buy or sell a company’s stock at a strike price that adjusts over time.

That pause means that Metaplanet is essentially halting the sale of common stock to fund more Bitcoin purchases.

Metaplanet CEO Simon Gerovich said this will enable the company to optimize its capital raising strategies in its “relentless pursuit” to expand its Bitcoin holdings

“Metaplanet has a strong foundation for growth and has developed the ability to harness a variety of financing tools,” he said.

Other Companies Continue To Buy Bitcoin

While Metaplanet may be hitting the brakes on its BTC accumulation, the opposite is true for MARA Holdings and Strategy, which both recently announced fresh purchases.

Strategy said yesterday that it acquired 220 BTC for around $27.2 million. Meanwhile, MARA Holdings received 400 Bitcoin worth $46.29 million from FalconX earlier this week.

Strategy is the largest Bitcoin treasury company with its 640,250 BTC, while crypto miner MARA Holdings is ranked second with reserve of 53,250 BTC.

The remaining companies in the top five list are XXI with 43,514 BTC, and Bitcoin Standard Treasury Company, which is ranked one position below Metaplanet with its holdings of 30,021 BTC.

MARA and Strategy shares both gained in the past 24 hours.

You May Also Like

Market Records Largest Long-Term Bitcoin Supply Release In History, Here’s What It Means For BTC

Bitcoin Cash’s rally faces KEY test – Can BCH hold above $500?