Potential Nobel Peace Prize Betting Scandal: Norway Investigates Suspicious Polymarket Activity

Three accounts earned roughly $90,000 in combined profits by correctly betting on Venezuelan opposition leader María Corina Machado, raising serious questions about information security at one of the world’s most prestigious institutions.

The Suspicious Betting Pattern

The unusual activity started around midnight Norwegian time on October 9, 2025—approximately 11 hours before the official announcement. Machado’s odds on Polymarket jumped dramatically from 3.6% to over 70% in just a few hours, driven by bets from newly created accounts with no previous trading history.

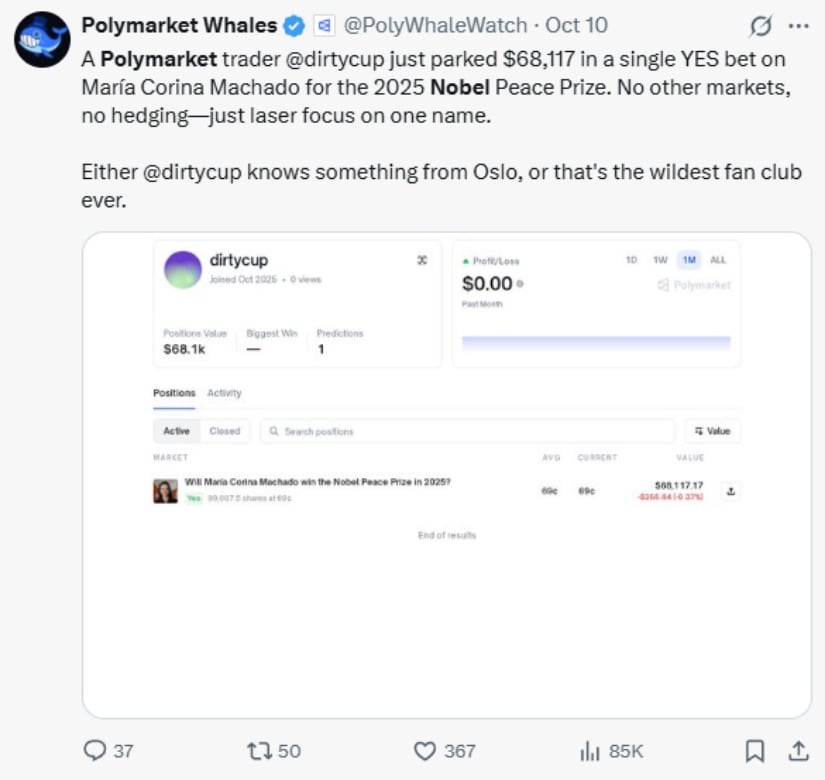

One trader using the handle “dirtycup” placed a $70,000 bet on Machado despite having opened the account just weeks earlier. This single position generated about $30,000 in profit. Another account called “6741” was created specifically for this market and walked away with $53,500. A third account, “GayPride,” reportedly earned $85,000 from the betting surge.

Source: @PolyWhaleWatch

What made this activity particularly suspicious was its timing. The Nobel Committee had finalized its decision on October 6, keeping it secret from everyone except a small group of officials. Yet these traders began placing large bets days later, well before any public speculation pointed to Machado as a frontrunner.

Espionage, Not a Leak

Kristian Berg Harpviken, director of the Norwegian Nobel Institute, initially suggested the organization had been “prey to a criminal actor who wants to earn money on our information.” However, the investigation’s focus has shifted toward a more complex explanation.

Harpviken now says espionage is “highly likely” the cause, rather than an internal leak. “External intelligence gathering can make it appear as if someone on the inside leaked information,” he explained to Norwegian media. He noted that the Nobel Institute has faced espionage attempts for decades from both state and non-state actors motivated by political or economic interests.

Nobel Committee Chairman Jørgen Watne Frydnes supports this view, stating he doesn’t believe there have ever been leaks in the prize’s history. The selection process involves only five committee members and a handful of trusted staff, with nominations sealed for 50 years.

Polymarket’s Explosive Growth

The incident comes at a pivotal moment for Polymarket. Just days before the Nobel controversy, Intercontinental Exchange—owner of the New York Stock Exchange—announced a $2 billion investment in the platform, valuing it at $9 billion. This deal made 27-year-old founder Shayne Coplan the world’s youngest self-made billionaire.

Polymarket processed more than $6 billion in trades during the first half of 2025 alone. The platform allows users to bet on real-world events using cryptocurrency, from elections to entertainment outcomes. It gained massive attention during the 2024 U.S. presidential election when it correctly predicted Donald Trump’s victory while many traditional polls showed different results.

The company is also returning to U.S. markets after purchasing a regulated exchange for $112 million. This followed a 2022 settlement where Polymarket paid a $1.4 million fine to the Commodity Futures Trading Commission for operating without proper registration.

The Legal Gray Area

Here’s where things get complicated: Polymarket’s terms of service don’t prohibit insider trading. The platform operates offshore and falls outside most insider-trading rules that apply to traditional financial markets.

Even if someone connected to the Nobel Committee shared confidential information with traders, it’s unclear whether any laws were actually broken. This represents a major regulatory blind spot as prediction markets grow in popularity and financial backing.

Some economists argue that insider information actually improves market accuracy—which is the whole point of prediction markets. Others say it undermines trust and fairness. The Nobel Institute case may force regulators to address these questions more directly.

This isn’t Polymarket’s first brush with controversy over potential information leaks. The platform has repeatedly faced scrutiny when its markets seemed to predict outcomes with unusual accuracy.

Who Is María Corina Machado?

The 2025 Nobel Peace Prize went to 58-year-old Venezuelan opposition leader María Corina Machado for her work promoting democracy in Venezuela. She founded Súmate in 2002, an organization dedicated to free and fair elections, describing her mission as choosing “ballots over bullets.”

Machado has lived in hiding since last year after Venezuela’s government blocked her from running in the 2024 presidential election. Despite serious threats against her life, she remained in the country, inspiring millions of Venezuelans in their struggle against authoritarian rule.

The Nobel Committee praised her as “one of the most extraordinary examples of civilian courage in Latin America in recent times.” She has become a unifying figure for Venezuela’s previously divided opposition movement.

What Happens Next

The Norwegian Nobel Institute continues its internal review to determine how information may have been compromised. Officials acknowledge they need to strengthen security measures, though they maintain that external espionage is more likely than an internal breach.

Neither Polymarket nor the Nobel Institute has provided detailed public statements about the investigation. Attempts to contact the traders involved have been unsuccessful, with The Wall Street Journal reporting it couldn’t reach the “6741” account holder.

This case marks the first known instance where a blockchain-based prediction market may have exposed confidential information from a major international institution. As prediction markets attract mainstream investment and legitimacy, incidents like this will test how society balances information accuracy with institutional secrecy.

The Nobel Peace Prize market alone accumulated over $21.4 million in trading volume from July through October 2025. With Polymarket’s competitor Kalshi reportedly capturing over 60% of the global prediction market share with $50 billion in annual volume, the industry’s rapid growth shows no signs of slowing.

The Verdict

What began as a potential leak investigation has evolved into a case study of modern information warfare. Whether through sophisticated espionage or lucky speculation, the Polymarket betting surge exposed vulnerabilities in how even the most secretive institutions protect sensitive information. As prediction markets merge with mainstream finance, the Nobel incident serves as a wake-up call about the challenges ahead—for regulators, institutions, and anyone betting their money on the future.

You May Also Like

Trump just made a telling reveal in GOP's looming 2028 war: renowned strategist

Trump’s bogus Iran nuke claim hit with brutal fact check