M&T Bank Corporation (MTB) Stock: Q3 Earnings Top Expectations as Fee Income and Credit Quality Strengthen

TLDR

- Q3 EPS came in at $4.87, beating the analyst estimate of $4.42.

- Revenue rose to $2.51B, above the forecast of $2.44B.

- Net income increased 10% YoY to $792M, supported by higher fee income.

- Noninterest income jumped 24% YoY to $752M, aided by investment distributions.

- The bank repurchased 2.1M shares for $409M, maintaining a CET1 ratio of 10.99%.

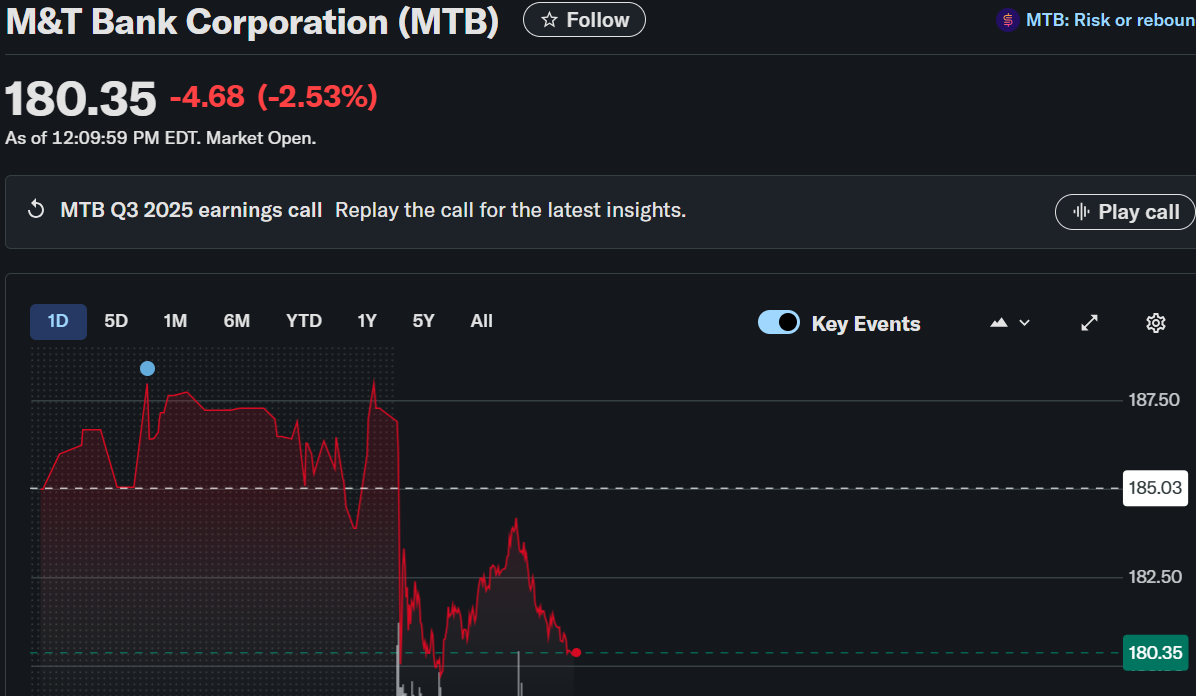

M&T Bank Corporation (MTB) stock traded at $182.73, down 1.24% as of 11:03 AM EDT, after the lender posted its third-quarter 2025 results on Thursday.

M&T Bank Corporation (MTB)

The Buffalo-based bank delivered earnings and revenue that exceeded Wall Street expectations, supported by higher fee income, improved credit quality, and disciplined capital management.

Solid Q3 Performance Driven by Fee Income

For the quarter, M&T Bank reported adjusted earnings per share of $4.87, comfortably above analysts’ consensus of $4.42. Revenue reached $2.51 billion, surpassing the forecast of $2.44 billion. The strong performance was fueled by diversified income streams and higher loan volumes.

Net income rose 10% year over year to $792 million, up from $721 million in the same quarter last year. Taxable-equivalent net interest income increased 2% YoY to $1.77 billion, with the net interest margin improving to 3.68% from 3.62% a year earlier.

Noninterest income surged 24% YoY to $752 million, supported by a $28 million distribution from the 2023 sale of its Collective Investment Trust business and a $20 million gain from its stake in Bayview Lending Group.

Credit Quality and Loan Growth Strengthen

CFO Daryl N. Bible highlighted the bank’s robust fee income and prudent lending approach, noting that M&T’s improved credit metrics reflect its commitment to customer-focused growth.

The allowance for loan losses fell to 1.58% of total loans, compared with 1.62% a year ago. Nonaccrual loans declined 21% YoY to $1.51 billion, demonstrating stronger portfolio health.

Total loans increased 1% year over year to $137 billion, driven by a 14% rise in consumer loans and a 7% increase in residential real estate loans. These gains were partially offset by a 16% drop in commercial real estate loans, reflecting a more cautious stance toward the sector amid changing market conditions.

Capital Strength and Shareholder Returns

During the quarter, M&T repurchased 2.1 million shares for $409 million, underscoring its commitment to shareholder returns. The bank also maintained a Common Equity Tier 1 (CET1) ratio of 10.99%, highlighting strong capital adequacy.

Bible emphasized that M&T’s operational strength and risk discipline allowed it to achieve consistent growth while managing economic uncertainties effectively. The bank’s focus on generating sustainable earnings and supporting local communities remains central to its long-term strategy.

Stock Performance and Outlook

Following the earnings release, M&T Bank shares edged up 0.76% in pre-market trading, reflecting investor confidence in the results. Year-to-date, the stock has gained modestly, supported by solid financial performance and balance sheet stability.

As M&T enters the final quarter of 2025, it remains well-positioned to capitalize on steady loan demand, robust fee-based income, and improving asset quality. The bank’s prudent lending practices and balanced capital allocation are expected to sustain its growth momentum into 2026.

The post M&T Bank Corporation (MTB) Stock: Q3 Earnings Top Expectations as Fee Income and Credit Quality Strengthen appeared first on CoinCentral.

You May Also Like

Hauser’s Stark Warning Charts Reveal Persistent Economic Pressure

Fed Makes First Rate Cut of the Year, Lowers Rates by 25 Bps