Ethereum Dominates 2025 Developer Landscape with Over 16K New Builders

Key Takeaways:

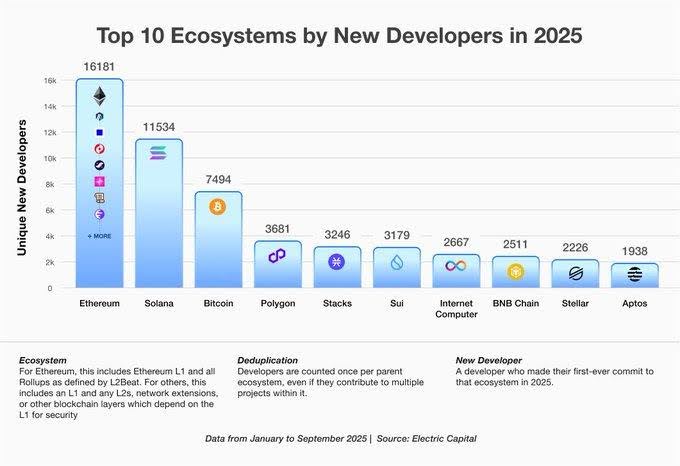

- Ethereum tops the 2025 developer growth chart with over 16,000 new contributors, far ahead of all other blockchains.

- Data from Electric Capital confirms Ethereum retains the largest active developer base, over 31,000 builders globally.

- Despite growing momentum from Solana and Bitcoin, Ethereum remains the #1 ecosystem for new developers entering crypto.

The Ethereum Foundation has reaffirmed Ethereum’s status as the world’s most active and fastest-growing developer ecosystem.

In a post on its official X account, the Foundation shared new data showing that Ethereum continues to attract the highest number of new developers in 2025, strengthening its dominance as the backbone of decentralized innovation and the broader Web3 movement.

Read More: Ethereum Is Stagnating, Digitap Possesses Immense Upside Potential

![]()

Ethereum Leads Global Developer Growth

New information indicates that within the past six months, Ethereum has attracted 16,181 new developers according to updated figures in the Electric Capital 2025 Developer Report, making it the leading blockchain ecosystem in terms of new developers. This is a dominating margin over Solana (11,534) and Bitcoin (7,494) which proves once again that Ethereum is the dominant force in blockchain innovation.

The information also points to the 31,869 active developers of Ethereum, which is almost twice that of Solana, 17,708. The homogeneity of such interaction highlights the unprecedented retention of developers, community participation, and open-source infrastructure at Ethereum.

Over the years Ethereum has been used by new crypto developers as the training ground. It has a large number of documented techniques, developer tools and open source standards such as the EVM (Ethereum Virtual Machine), which help novices to develop, test and deploy applications on various chains.

“By a wide margin, developers new to crypto prefer the Ethereum ecosystem,” the Foundation emphasized in its post, thanking Electric Capital for its data-driven insights and the global developer community for continuing to build on Ethereum.

Why Developers Choose Ethereum

The Power of a Mature and Open Ecosystem

Ethereum’s long-term dominance stems from its deep infrastructure and developer-first environment. Over the past decade, it has built the world’s most active Layer 1 and Layer 2 ecosystem, from Arbitrum, Optimism, and Base to scaling-focused rollups like zkSync.

This multi-layered architecture provides flexibility to developers to create cost-effective decentralized applications (dApps) and remain connected to the secure base layer of Ethereum. This is also because of the interoperability of EVM-compatible chains, where developers can port codes easily, creating a multi-chain development environment around Ethereum.

Other than infrastructure, community-based funding platforms such as Gitcoin and ecosystem grants remain important in fostering innovation. Independent developers and small teams can get early-stage funding to build DeFi tools, social dApps or infrastructure upgrades through these programs which further drives the circle of growth.

Read More: BitMine Ethereum Witnessed an Unrealized Loss of $2.13B in Ethereum

Solana and Bitcoin Keep Momentum, But Trail Behind

Solana and Bitcoin are still the closest competitors of Ethereum but they also work on a different platform. The number of developers of Solana increased dramatically because of its cheap, fast architecture, which is attractive to organizations developing NFT, gaming and DeFi applications. Bitcoin, historically regarded as a store of value, now attracts a new wave of developers with such innovations as Ordinals and Layer 2 solutions such as Lightning Network.

Nevertheless, the two ecosystems encounter difficulties with attracting first-time crypto developers. Solana is not as well-tooled or cross-chain moral as Ethereum, but it is faster. The increase in the number of developers of Bitcoin, despite its positive aspects, is limited to the niche projects not to full-scale dApp ecosystems.

In its turn, Ethereum boasts of its well-established developer ecosystem, industry support and ongoing development like EIP-4844 ( proto-danksharding ) that reduces the gas prices and improves its performance.

How This Shapes the Future of Blockchain Development

The Center of Web3 Innovation

Having more than 31,000 active developers, Ethereum can now be viewed as the central innovation engine behind Web3, including DeFi, non-fungible tokens, and gaming, as well as real-world assets tokenization. Its further dominance brings about the fact that fresh protocols, interoperability standards, and financial primitives are initially developed and piloted within the Ethereum ecosystem before going further.

This change makes Ethereum not only a blockchain but the base of an open internet economy, which even rapidly-growing networks such as Solana, Avalanche, and Sui are trying to copy.

The post Ethereum Dominates 2025 Developer Landscape with Over 16K New Builders appeared first on CryptoNinjas.

You May Also Like

Zwitserse bankgigant UBS wil crypto beleggen mogelijk maken

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets