UK Central Bank Says Stablecoin Caps Are Temporary

Deputy Governor Sarah Breeden used her remarks at DC Fintech Week to outline a more flexible approach, saying the restrictions are meant as a short-term “safety buffer” while the financial system adjusts to new forms of digital money. Once that transition stabilizes, she said, the limits will be lifted.

The move marks an important clarification following months of criticism from crypto firms and financial technology groups, who warned that the proposed thresholds – between £10,000 and £20,000 – would make the UK appear unfriendly to blockchain innovation. Breeden pushed back on that view, stressing that the goal isn’t to suppress adoption but to ensure banks and payment systems can adapt without risking funding for the real economy.

Why the Limits Exist

Behind the cautious rollout is a deeper concern: the Bank fears that rapid movement of deposits from traditional banks into stablecoins could reduce the credit available to households and businesses. Unlike the United States, where financial markets provide much of the economy’s credit, the UK still relies heavily on its banking sector. The central bank wants to slow that migration to give the system time to adjust.

“Our approach is about pacing, not blocking,” Breeden said. “We want stability to evolve alongside innovation – not in conflict with it.”

READ MORE:

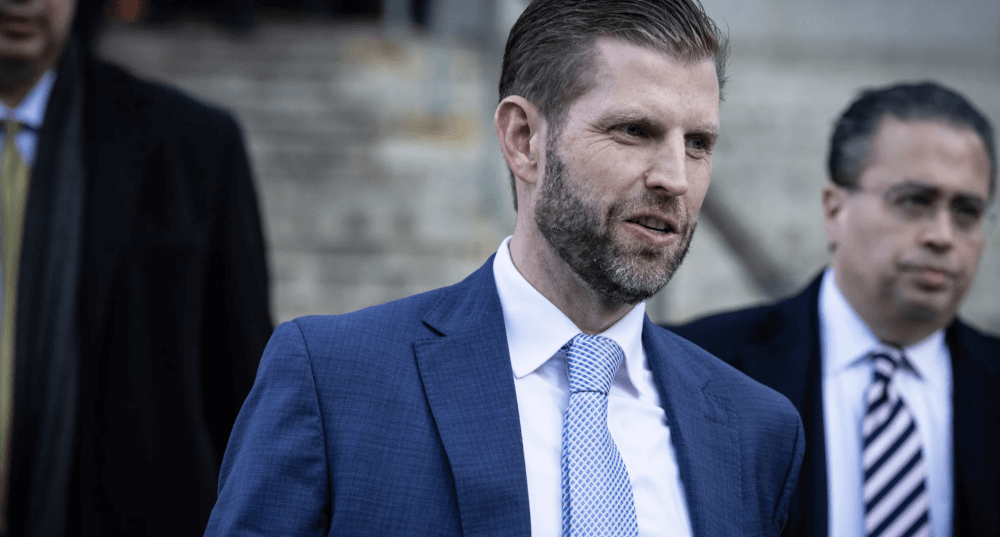

Eric Trump to Bring Trump Real Estate to Blockchain Through WLFI

To that end, the BoE will open a consultation later this year to gather feedback from the public and the private sector. Among the ideas being discussed are higher caps for corporations, exemptions for large retailers, and flexible treatment for companies testing new products inside the country’s digital sandbox – a regulatory pilot zone created for blockchain experimentation.

The Bigger Picture

Breeden also used her speech to restate the Bank’s belief that central bank money should remain the backbone of large-scale settlements, particularly in asset markets. However, she acknowledged that tokenized deposits and regulated stablecoins will likely share space with official money in the future.

She called on financial institutions and new entrants alike to collaborate with regulators, saying that building a secure multi-currency system “will require joint experimentation and shared commitment.”

With her remarks, Breeden appeared to be striking a balance that has so far eluded regulators worldwide: maintaining control over systemic risk while keeping the door open for a digital economy that is expanding far faster than traditional policy frameworks.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post UK Central Bank Says Stablecoin Caps Are Temporary appeared first on Coindoo.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

Trump's border chief insists Americans support ICE – and is shut down by host: 'Come on!'