Florida and Ohio Push Bitcoin as Adoption Soars: Is $HYPER the Next Crypto to Explode?

KEY POINTS:

Florida is proposing new legislation for expanding the state’s treasury with crypto.

Florida is proposing new legislation for expanding the state’s treasury with crypto.

Ohio, meanwhile, has several bills in process covering crypto rights in multiple areas.

Ohio, meanwhile, has several bills in process covering crypto rights in multiple areas.

Bitcoin adoption by retail investors could explode as a result.

Bitcoin adoption by retail investors could explode as a result.

Bitcoin Hyper may increase in value too, thanks to a surge in Bitcoin holders.

Bitcoin Hyper may increase in value too, thanks to a surge in Bitcoin holders.

In Florida, the new legislative session has kicked off with a proposal to allocate up to 10% of specific funds to Bitcoin and other cryptocurrencies, as well as NFTs and tokenized securities. House Bill 183 also allows residents to pay some of their taxes in digital assets, which would be spot exchanged for USD.

Ohio’s Republicans have also led the charge for crypto with a wave of new legislation designed to overhaul the way Ohio’s citizens use crypto in their daily lives. These bills include:

- Senate Bill 57: Creates a new Bitcoin Reserve Fund, facilitating tax payments in Bitcoin

- House Bill 116: Protects the right of crypto owners to pay for goods and services using crypto

- House Bill 18: Allows the state Treasury to expand the reserve fund to other ‘high-value digital assets’

- House Bill 426: Regulates ‘abandoned’ cryptocurrency

It’s no surprise that Ohio’s representatives are pushing ahead with crypto considering the state’s history. Ohio broke new ground as the first state to accept a tax payment in digital assets when Bernie Moreno paid his taxes using crypto in 2018. Moreno is now Ohio’s US senator.

If these bills pass, the resulting crypto ecosystem could be a blueprint for other states to follow. Adoption of crypto in the US would likely boom as a result, sending massive waves of capital inflow towards the whole crypto market.

The Bitcoin price could rise sharply as a result, which could setup Bitcoin Hyper ($HYPER) to be the next crypto to explode. Read on and we’ll tell you more about this Layer-2 solution for Bitcoin designed to lower fees and transaction times by leveraging Solana’s parallel processing capabilities.

Bitcoin Hyper – A Solana-Based Layer-2 For Faster Speeds and Lower Fees for Bitcoin

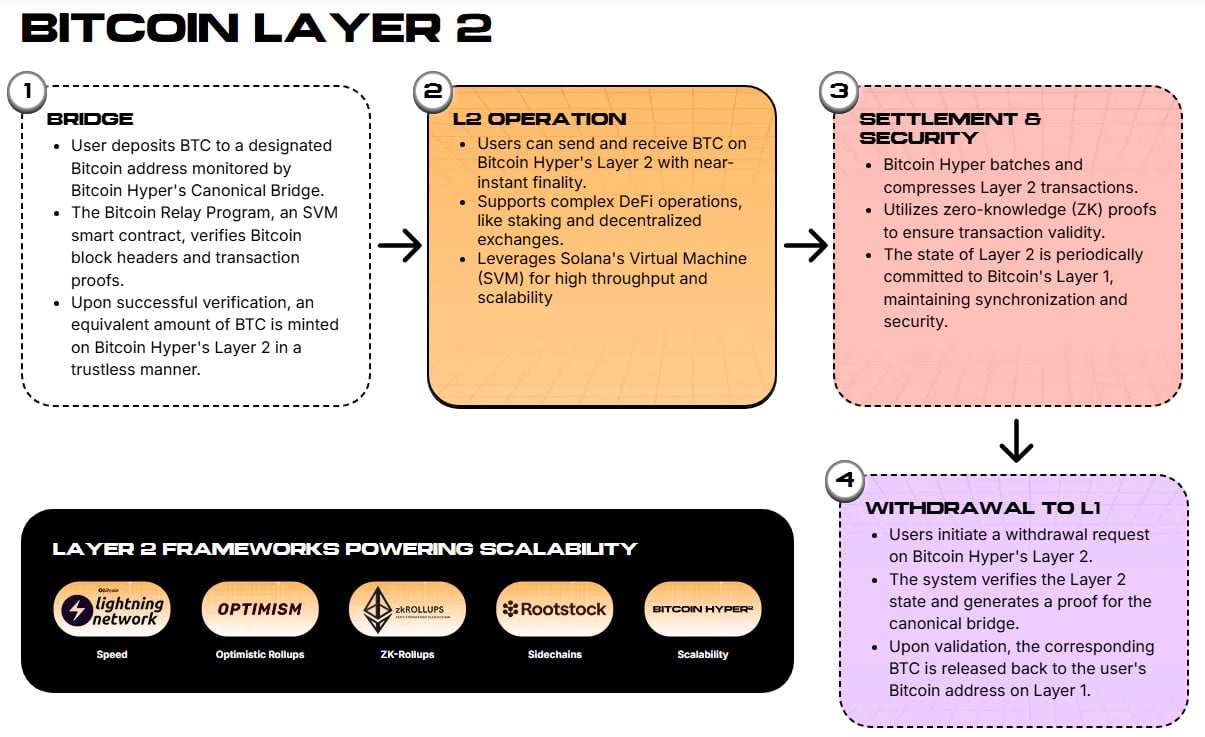

$HYPER is the official token of the Bitcoin Hyper network, a Layer-2 project that plans to bring new capabilities to the aging Bitcoin network by integrating the Solana Virtual Machine (SVM).

Bitcoin has clear value as an investment asset, which is why some US states are looking to integrate it into their public reserves. However, the Bitcoin network clears transactions significantly slower than Solana or Ethereum, and it’s much more expensive to trade $BTC than tokens on those blockchains.

Solving these problems would bring Bitcoin in line with the rest of the Web3 ecosystem, which is where Bitcoin Hyper comes in. Using the SVM to track transactions on the Bitcoin Hyper network, it will allow for lightning-quick $BTC trades that are tracked in a separate ledger and periodically committed.

Integrating Solana into the network also has the added benefit of providing smart contract support. You’ll be able to swap crypto, trade NFTs, and use dApps – all without having to leave the Bitcoin ecosystem as everything’s based on the value of $BTC.

The $HYPER token keeps Bitcoin Hyper working under the hood. It’s the DAO token, so if you want to make proposals on the future direction of the network or vote on existing motions, you’ll need to hold a healthy stack of $HYPER.

Of course, there are other benefits to holding $HYPER. You’ll get reduced fees when running smart contracts or trading crypto over the Bitcoin Hyper network, letting you keep more of your $BTC.

Once the Bitcoin Hyper network is live, smart contract developers will also be able to create dApps, whereby certain features will be exclusive to $HYPER holders only. By making some features exclusive, holding $HYPER will be the only way to get the full Bitcoin Hyper experience, keeping $HYPER in high demand.

Take a look at our comprehensive Bitcoin Hyper review to find out more about this Layer-2 ecosystem, and why investors are flocking to its presale.

Take a look at our comprehensive Bitcoin Hyper review to find out more about this Layer-2 ecosystem, and why investors are flocking to its presale.

The presale, in fact, has already raised close to $24M. A decent amount of whale buys have contributed to the tally, including a significant $379.9K purchase earlier this month.

The presale, in fact, has already raised close to $24M. A decent amount of whale buys have contributed to the tally, including a significant $379.9K purchase earlier this month.

The dynamic nature of the presale means the token price will keep going up, but if you buy in now you can grab your $HYPER for only $0.013125. While you’re at it, you can also stake your tokens for up to 49% APY. Check out out step-by-step guide to buying $HYPER to find out how.

With Florida and Ohio being the latest states to look towards a Bitcoin future, $HYPER could well explode in the not-too-distant future.

Our Bitcoin Hyper price prediction sees it potentially reaching $0.20 by the end of this year, and $1.20 by 2030. Buying in at $HYPER’s current price could mean a 1,425% ROI this year alone – and 9,045% if you HODL your $HYPER for the next five years.

Our Bitcoin Hyper price prediction sees it potentially reaching $0.20 by the end of this year, and $1.20 by 2030. Buying in at $HYPER’s current price could mean a 1,425% ROI this year alone – and 9,045% if you HODL your $HYPER for the next five years.

Ready to invest in the Layer-2 that could be a fundamental factor in Bitcoin’s second wind? Join the $HYPER presale before the next price increase.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

While Bitcoin Stagnates, Gold Breaks Record After Record! Is the Situation Too Bad for BTC? Bloomberg Analyst Explains!