Tesla ($TSLA) Stock: Musk’s $56B Pay Battle Enters Final Round Before Delaware Supreme Court

TLDRs;

-

Tesla shares surged slightly Friday as Elon Musk’s $56 billion pay dispute reached Delaware’s Supreme Court.

-

A 2024 ruling voided the massive compensation, citing conflicts of interest and incomplete shareholder disclosure.

-

Tesla’s board insists shareholders were well-informed and the pay plan drove historic company growth.

-

The case could reshape Delaware’s corporate law dominance as firms relocate to Texas and Nevada.

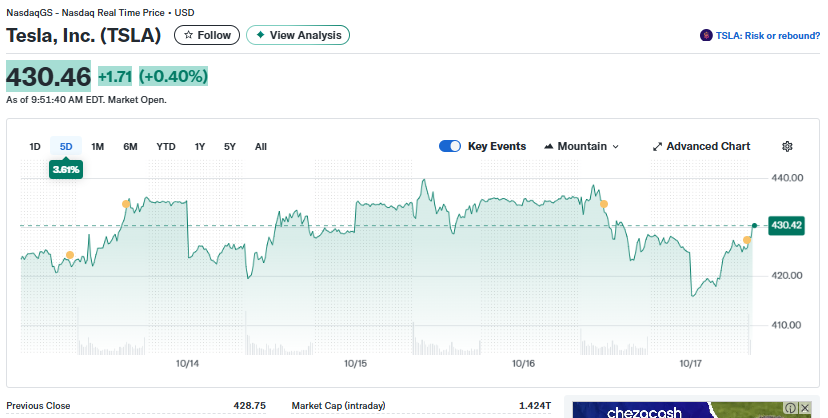

Tesla (NASDAQ: TSLA) shares edged higher Friday, surging 0.40% to $427.49 Friday, as the company entered the final phase of a years-long legal fight over CEO Elon Musk’s $56 billion pay package.

The modest surge came as Tesla’s legal team appeared before the Delaware Supreme Court, seeking to overturn a 2024 decision that voided Musk’s record-setting compensation plan.

The outcome of this high-stakes appeal could have sweeping implications for both Tesla’s leadership structure and Delaware’s reputation as the go-to hub for corporate law. For investors, the hearing marks the culmination of a two-year saga that began when a shareholder challenged Musk’s 2018 compensation deal as unfair and improperly approved.

Tesla, Inc. (TSLA)

Tesla, Inc. (TSLA)

Delaware’s Reputation Faces Scrutiny

Delaware has long been the legal home of U.S. corporations thanks to its business-friendly courts and predictable laws. But the Musk decision triggered what observers are calling a “Dexit”, with Tesla, Dropbox, and venture capital firms like Andreessen Horowitz reincorporating in Texas or Nevada.

The shift has forced Delaware lawmakers to rethink its corporate law environment amid growing criticism from executives who view the state as increasingly unfriendly to entrepreneurs.

The current appeal will not only decide Musk’s fate but also test Delaware’s standing as America’s premier corporate law venue.

Tesla’s Argument

Tesla’s lawyers argue that the Chancery Court’s decision misinterpreted both the facts and the law. They maintain that shareholders had full access to the economic details of the 2018 plan before approving it.

The board insists that Musk’s leadership transformed Tesla from a risky EV startup into a trillion-dollar giant, and that his compensation reflected performance, not privilege.

If the Supreme Court upholds the lower ruling, Tesla already has a backup plan. In August 2025, the company’s directors agreed to a new pay structure to retain Musk as he steers Tesla into robotics and autonomous driving. Despite slowing EV demand and mounting competition from Chinese automakers, Tesla’s board recently floated a potential $1 trillion compensation framework, signaling unwavering faith in Musk’s long-term vision.

Billions and Influence on the Line

At stake is more than Musk’s personal payday. The Delaware Supreme Court’s ruling could reshape how executive pay and board independence are handled across corporate America. The case also involves a separate $345 million legal fee awarded to the shareholder’s attorneys, which Tesla is appealing alongside the pay package decision.

Back in 2018, Tesla estimated Musk’s stock options could be worth $56 billion if performance milestones were met, milestones the company says were achieved. With Tesla’s stock appreciating since, the package’s value now exceeds $120 billion, making it the largest executive payout in history.

While Musk himself was absent from court this week, his influence loomed large. As the world’s richest individual with an estimated $480 billion fortune, Musk’s compensation case has evolved into a broader symbol of corporate power, legal jurisdiction, and the balance between entrepreneurial vision and shareholder fairness.

The post Tesla ($TSLA) Stock: Musk’s $56B Pay Battle Enters Final Round Before Delaware Supreme Court appeared first on CoinCentral.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

While Bitcoin Stagnates, Gold Breaks Record After Record! Is the Situation Too Bad for BTC? Bloomberg Analyst Explains!