Bitcoin Hyper the Next Crypto to Explode in 2026 as Presale Reaches $23.9M

Takeaways:

- Bitcoin Hyper’s presale reaches $23.9M after sustained investor participation since day one.

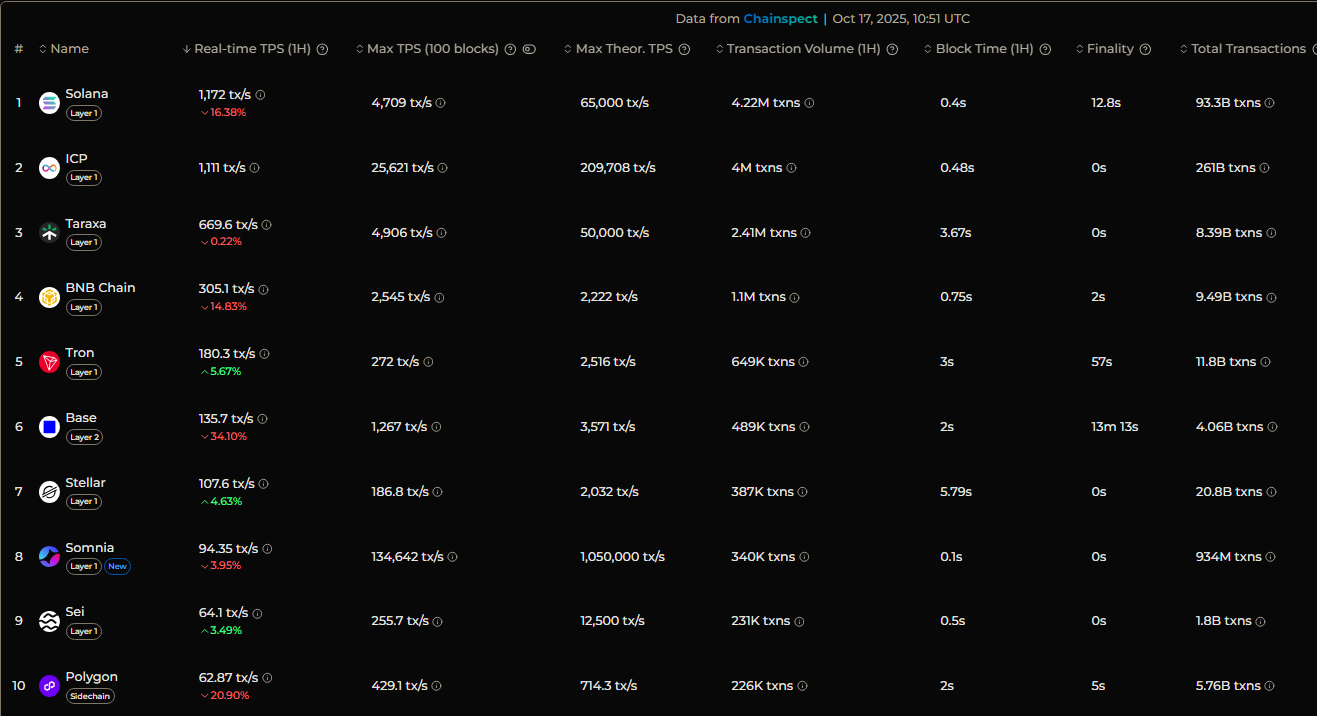

- Bitcoin ranks 27th on the list of the fastest blockchains by TPS, far below expected industry standards.

- Hyper aims to remove Bitcoin’s performance cap, currently at seven TPS, for higher scalability and lower finality times.

- The $HYPER presale aims for a Q1 2026 release, but could happen sooner in case of favorable ‘market conditions and demand.’

Bitcoin Hyper’s presale has just reached $23.9M after an impressive run, making it one of the most successful presales of 2025.

With $HYPER sitting at $0.013125 and the promise to change the Bitcoin ecosystem forever, Bitcoin Hyper ($HYPER) shows outstanding growth potential and it’s now in its most critical stage, given the projected release date in Q1 of 2026.

Hyper is the Layer 2 that aims to tackle Bitcoin’s most impactful problem: its performance limitation.

If successful, we could see the Bitcoin network become a staple in the crypto world, attracting more institutional investors thanks to its scalability and performance.

But, before that happens, we have the problem.

What Is the Bitcoin Problem?

Bitcoin is now capped at seven transactions per second (TPS), which is the maximum that the network can process at any given time.

This is the root of all evil.

The limited performance is responsible for the emergence of the fee-based priority system, which prioritizes larger transactions to the detriment of the smaller ones.

This translates to higher fees, obscene confirmation times, and the inability to accommodate large institutional investors like Paypal or Visa, which pack a TPS of 193 and 1,700 respectively. Visa can go as high as 24,000 practical TPS, with a theoretical one of 65,000.

Few blockchains are capable of accommodating those numbers, Solana being the most obvious example, as it ranks first on the list of the fastest blockchains.

The reason why you can’t see Bitcoin in the top 10 is because it’s on the 27th spot.

Even Ethereum, despite being at no. 18, still outranks Bitcoin in terms of ecosystem usage. We’re talking about a 65.3% higher number in terms of active developers.

A change is needed and the Lightning Network was one of the first to have a go at it.

Unfortunately, it fell short due to issues like excessively high fees, security problems, and overall missing the mark on its promises.

So, what does Hyper promise to do differently?

The Hyper Solution

Hyper addresses Bitcoin’s scalability problem directly with tools like the Solana Virtual Machine (SVM) and the Canonical Bridge.

SVM is directly responsible for enabling the low-latency, ultra-fast execution of smart contracts and DeFi apps for a drastic on-chain performance boost.

The Canonical Bridge, on the other hand, eliminates Bitcoin’s TPS cap by bridging Bitcoin’s native Layer 1 to Hyper’s Layer 2 ecosystem. The Bridge then mints the users’ tokens into the Hyper layer, relying on the Bitcoin Relay Program for near-instant finality.

The wrapped Bitcoins are available for use on Layer 2 or until you decide to withdraw them to Bitcoin’s native layer with confirmation times of seconds.

Together with SVM, the Canonical Bridge turns the Hyper ecosystem into an ultra-fast and scalable layer that transforms the Bitcoin network into a true threat for Solana.

With the finality times now measured in seconds instead of minutes and hours, Hyper will also eliminate the fee-based priority system which has been plaguing Bitcoin since inception.

All without jeopardizing Bitcoin’s brand reputation and security.

Hyper’s Presale Numbers and Roadmap

$HYPER’s presale is now at $23,974,630.68, which makes it one of the best presales of 2025 in terms of growth rate and long-term potential.

With $HYPER now selling at $0.013125, this one is a great investment opportunity, especially given the project’s long-term potential.

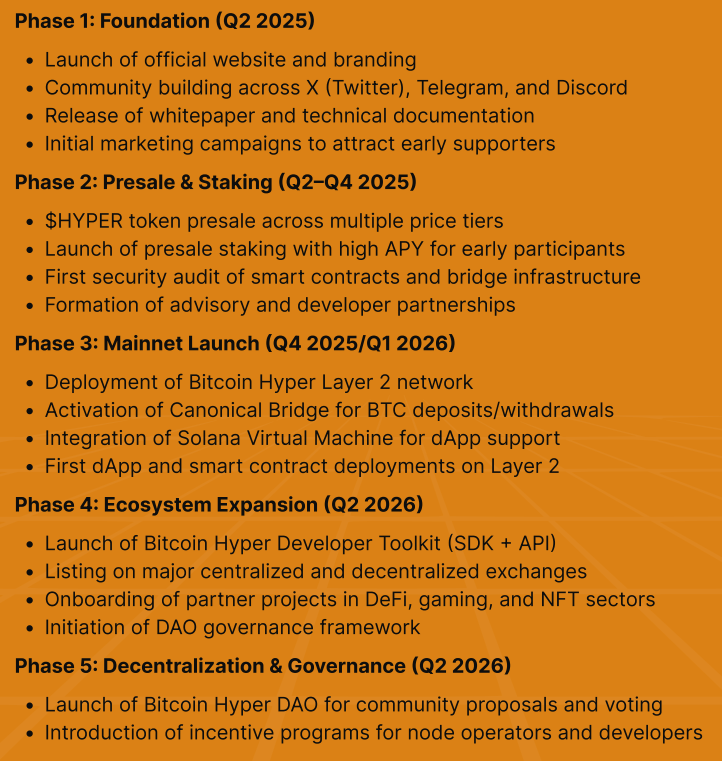

The roadmap speaks volumes in this sense. With five phases in play, the roadmap goes from the launch of the official website, whitepaper and presale, to the Bitcoin Hyper Developer Toolkit and the Bitcoin Hyper DAO in phases four and five.

According to the whitepaper, Hyper targets a Q1 2026 release depending on ‘prevailing market conditions and demand’. Seeing how the presale has been going since its release, the project could reach these ideal ‘conditions and demand’ sooner than expected.

So, a Q4 2025 release is not out the door yet.

This is a great incentive for anyone looking to catch the FOMO train early on. The staking rewards, currently at 49%, add another layer to that.

If you want to buy your $HYPER today, you have four payment options at your disposal: $ETH, USDT, $BNB, and credit card.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Bitcoin Hyper the Next Crypto to Explode in 2026 as Presale Reaches $23.9M appeared first on Coindoo.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

While Bitcoin Stagnates, Gold Breaks Record After Record! Is the Situation Too Bad for BTC? Bloomberg Analyst Explains!