G20 Watchdog Sounds Alarm: Privacy Rules Are Handcuffing Global Crypto Oversight

The G20’s top financial watchdog has warned that strict privacy and data protection laws are hindering global regulators from effectively overseeing the fast-growing cryptocurrency sector.

In a detailed peer review report released on Thursday, the Financial Stability Board (FSB), a global authority funded by the Bank for International Settlements (BIS), said inconsistencies in national crypto frameworks are creating major barriers to cross-border supervision and systemic risk monitoring.

The FSB’s 107-page review outlined persistent gaps in how countries regulate digital assets such as Bitcoin and stablecoins.

It noted that divided supervisory responsibilities, fragmented approaches, and especially data privacy laws are complicating information-sharing among regulators worldwide.

“Secrecy or data privacy laws may pose significant barriers to cooperation,” the FSB wrote, adding that in many jurisdictions, confidentiality rules prevent companies from sharing transaction or risk-related data with foreign regulators.

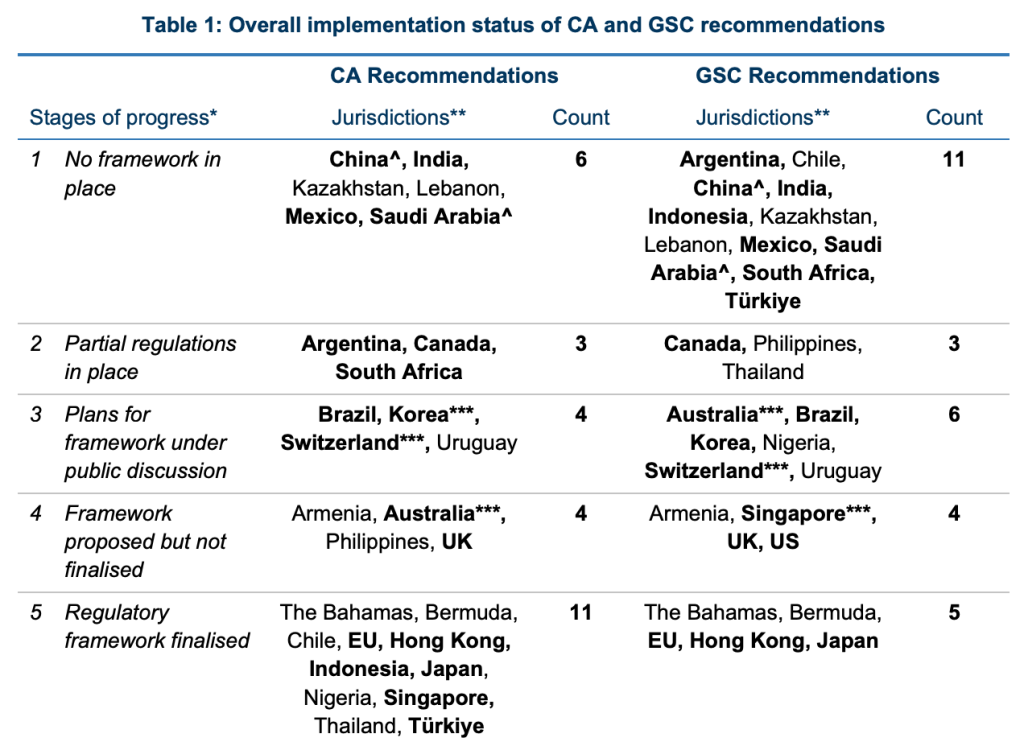

Source: FSB

Source: FSB

Lack of Data Access Leaves Regulators “Blind” to Crypto Risks, FSB Finds

This, the report said, “leads to delays in addressing cooperation requests” and in some cases “discourages participation in cooperation arrangements altogether.”

The board said privacy protections, while essential for personal and corporate rights, have become a double-edged sword for global oversight. Without consistent and reliable data access, regulators are unable to identify potential systemic risks in the crypto sector.

The report also said that “regulatory data sources remain limited,” forcing authorities to rely on incomplete information from commercial providers and surveys that often lack accuracy and consistency.

According to the FSB, the uneven regulatory environment across major economies has led to regulatory arbitrage, allowing crypto companies to shift operations across borders to exploit weaker oversight regimes.

The board urged governments to close data gaps and strengthen cooperation mechanisms to avoid further fragmentation of the global crypto market.

The FSB’s warning comes as privacy debates intensify within the crypto industry.

Advocates argue that privacy is essential for protecting users from surveillance and financial exploitation, while regulators view the lack of transparency as a major obstacle to combating money laundering and illicit finance.

The tension reflects a deeper divide between two financial philosophies. For governments, data access is a cornerstone of financial stability and compliance enforcement.

For the crypto community, privacy represents a fundamental right and a necessary layer of security in digital finance.

Privacy advocates note that transparency on public blockchains can expose people and businesses to competitive and security risks.

Public wallet data can reveal salaries, trade volumes, and strategic holdings, information that, in traditional finance, remains strictly confidential.

Experts say that without privacy, enterprises and institutions remain hesitant to adopt blockchain for mainstream financial operations.

Experts, Especially Ethereum, Say Lack of Privacy is Crypto’s Biggest Weakness

Recent initiatives within the Ethereum ecosystem show the industry’s efforts to address these privacy concerns.

The Ethereum Foundation recently launched a 47-member Privacy Cluster coordinated by Blockscout founder Igor Barinov. The group seeks to develop privacy-preserving technologies such as private reads and writes, selective disclosure for digital identities, and a new privacy-focused wallet called Kohaku.

The foundation warned earlier this year that without robust privacy safeguards, Ethereum could risk becoming “the backbone of global surveillance rather than global freedom.”

Ethereum co-founder Vitalik Buterin has also been vocal on the issue, describing privacy as “essential to decentralization.”

In his essay “Why I Support Privacy,” Buterin argued that information asymmetry, when power is concentrated among those who control data, undermines democratic and financial balance.

The debate over crypto privacy has also drawn attention from regulators in the EU, U.S., and U.K., where laws governing Know Your Customer (KYC) procedures and the Financial Action Task Force’s (FATF) Travel Rule are tightening.

Developers of privacy tools such as mixers and zero-knowledge proof systems have faced increasing scrutiny, with some jurisdictions treating privacy technologies as potential tools for criminal activity.

Despite regulatory pressure, many within the crypto industry maintain that privacy and compliance are not mutually exclusive.

Emerging models such as smart contract privacy allow transactions to remain verifiable without exposing sensitive data, a balance that could satisfy both regulators and institutions.

Finance veteran Petro Golovko, trust protector at British Gold Trust, told Cryptonews that the lack of privacy is “crypto’s biggest undoing.”

He argued that no monetary system can function if “every transaction is permanently public,” saying that without privacy, crypto “will never scale beyond a niche.”

The FSB’s report concludes that addressing privacy barriers will be key to supporting effective cross-border cooperation.

You May Also Like

Wealthfront Corporation (WLTH) Shareholders Who Lost Money – Contact Law Offices of Howard G. Smith About Securities Fraud Investigation

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets