Bitcoin Treasury Bubble About To Burst, Say 10x Research

The post Bitcoin Treasury Bubble About To Burst, Say 10x Research appeared first on Coinpedia Fintech News

For months, investors believed buying shares in Bitcoin treasury companies like MicroStrategy and Metaplanet was the smarter, safer way to gain exposure to the world’s largest cryptocurrency. It felt like a shortcut to Bitcoin profits until the Bitcoin treasury bubble bursts.

According to a new report by 10x Research, retail investors have lost over $17 billion chasing these so-called “Bitcoin treasury” stocks. And the crash didn’t come from a fall in Bitcoin’s price, but from something far more painful.

Sky-High Premiums Come Crashing Down

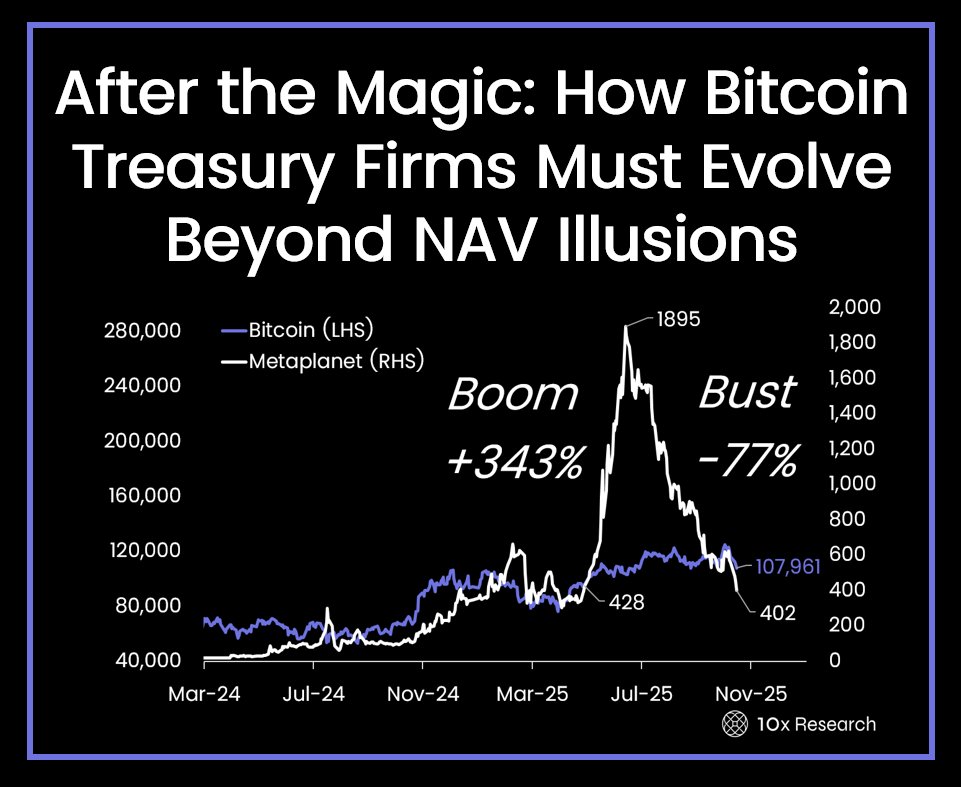

During 2024 and early 2025, excitement around Bitcoin’s institutional adoption reached its peak. Investors began paying 3 to 4x their net asset value (NAV) just to own shares in Bitcoin-holding companies, treating them like leveraged bets on crypto’s future.

But as global markets cooled and Trump’s trade tensions with China added uncertainty, these inflated valuations couldn’t hold.

Multiples collapsed to around 1.0–1.4× NAV, erasing billions in shareholder value, even while Bitcoin’s price stayed near record highs. Overall, 10x Research estimates that around $20 billion was overpaid, showing the cost of chasing hype over real assets.

Metaplanet & MicroStrategy Struggle Too

Metaplanet, once called “Asia’s MicroStrategy,” stopped buying Bitcoin in early October after its share price fell nearly 47% in just three weeks, pushing its enterprise value below the worth of its BTC holdings. The company alone lost $4.9 billion from its peak.

MicroStrategy was not spared either; its premium fell sharply from 4× to 1.4× NAV, showing how even established players felt the squeeze.

How Investors Lost Big

10x Research calls this the end of the “financial magic.” These treasury firms, once celebrated for their bold Bitcoin strategies, now face pressure to prove real value through lending, custody, or arbitrage.

The crash was simple math: companies bought Bitcoin with stock or debt at inflated prices. When valuations cooled, investors who bought at the peak lost about 67% compared to holding Bitcoin directly.

As a result, many are shifting to spot Bitcoin ETFs or direct holdings, where transparency is better and premiums don’t erode returns.

10X Research further warns the premium collapse could erase $25–30 billion in value by year-end, hitting speculative Bitcoin capital further. To survive, firms must now earn 15–20% returns through real yield strategies—or risk collapse.

You May Also Like

Galderma Expands Restylane® Portfolio in Japan With Launch of OBT™ Hyaluronic Acid Injectables Restylane Defyne™ and Refyne™

Dubai airport expects 100m passengers this year