VC Explains: Stablecoins Are Just CBDCs in Private Wrapper

- Privately-issued stablecoins resemble central bank digital currencies (CBDCs) in terms of surveillance and control features, raising concerns about privacy and monetary sovereignty.

- Overcollateralized stablecoins, backed by cash and government securities, face risks like bank runs during mass redemptions.

- Algorithmic and synthetic stablecoins carry counterparty risks and vulnerabilities to de-pegging amid volatile crypto markets.

- The stablecoin market surpassed $300 billion in market capitalization, driven by innovation and regulatory developments.

- Legislative action, such as the U.S. GENIUS Act, sparks debate over potential implications for monetary policy and privacy in the crypto ecosystem.

Recent commentary from Jeremy Kranz, founder and managing partner of Sentinel Global, underscores the importance of investor discernment when dealing with privately-issued stablecoins. Kranz warns that these tokens, often branded as digital dollar equivalents, embed many of the same surveillance and control mechanisms as central bank digital currencies (CBDCs). “Central business digital currency is really not necessarily that different. So, if JP Morgan issued a dollar stablecoin and controlled it through the Patriot Act, they could freeze your funds and unbank you,” he explained.

He further pointed out that overcollateralized stablecoins, which are backed by cash and short-term government securities, are vulnerable to “bank runs” if multiple holders attempt to redeem their assets simultaneously. Meanwhile, algorithmic and synthetic stablecoins, which rely on complex software and trading algorithms to maintain their dollar peg, come with their own risks—particularly counterparty failures, volatility, and flash crashes that can cause de-pegging from the dollar.

Kranz emphasizes that technology itself is neutral; it can build a more inclusive and efficient financial future or be exploited for control and surveillance. For investors, the key lies in understanding the fine print, risks, and making informed choices about holding digital assets and derivatives in the fast-evolving crypto landscape.

A rapidly advancing landscape with myriad opportunities and risks

The pace of innovation in stablecoins, DeFi platforms, and tokenization technology resembles “multiple black swan events,” according to Kranz. He highlights that both opportunities and risks are mounting as the crypto industry navigates this disruptive wave of technological progress.

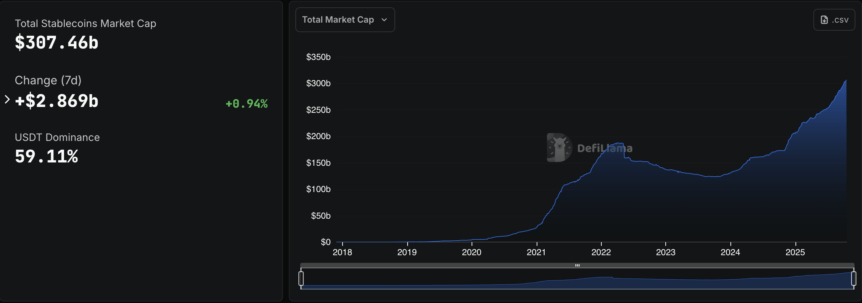

The stablecoin market has surged past a $300 billion valuation, according to data from DeFiLlama. This growth followed increased interest after the passage of the U.S. GENIUS Act, a bill that aims to regulate stablecoins but has sparked controversy.

Current stablecoin market cap exceeds $307 billion. Source: DeFiLlama

Current stablecoin market cap exceeds $307 billion. Source: DeFiLlama

Critics, including U.S. lawmakers such as Representative Marjorie Taylor Greene, have raised alarms about the potential for stablecoin regulation to serve as a backdoor for a CBDC. Greene described the bill as a “CBDC Trojan horse,” warning that it could lead to a cashless society where digital currency use is controlled by government authorities.

As the debate continues, the future of stablecoins and their role in the wider financial system hinges on the delicate balance between innovation, regulation, and privacy concerns—making this one of the most watched areas in the ongoing evolution of cryptocurrency and blockchain technology.

This article was originally published as VC Explains: Stablecoins Are Just CBDCs in Private Wrapper on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Buterin pushes Layer 2 interoperability as cornerstone of Ethereum’s future

US Prosecutors Seek $327K Crypto Forfeiture Over Romance Scam