Ethereum Enters Supply Squeeze Phase, Hinting at a New Bull Cycle

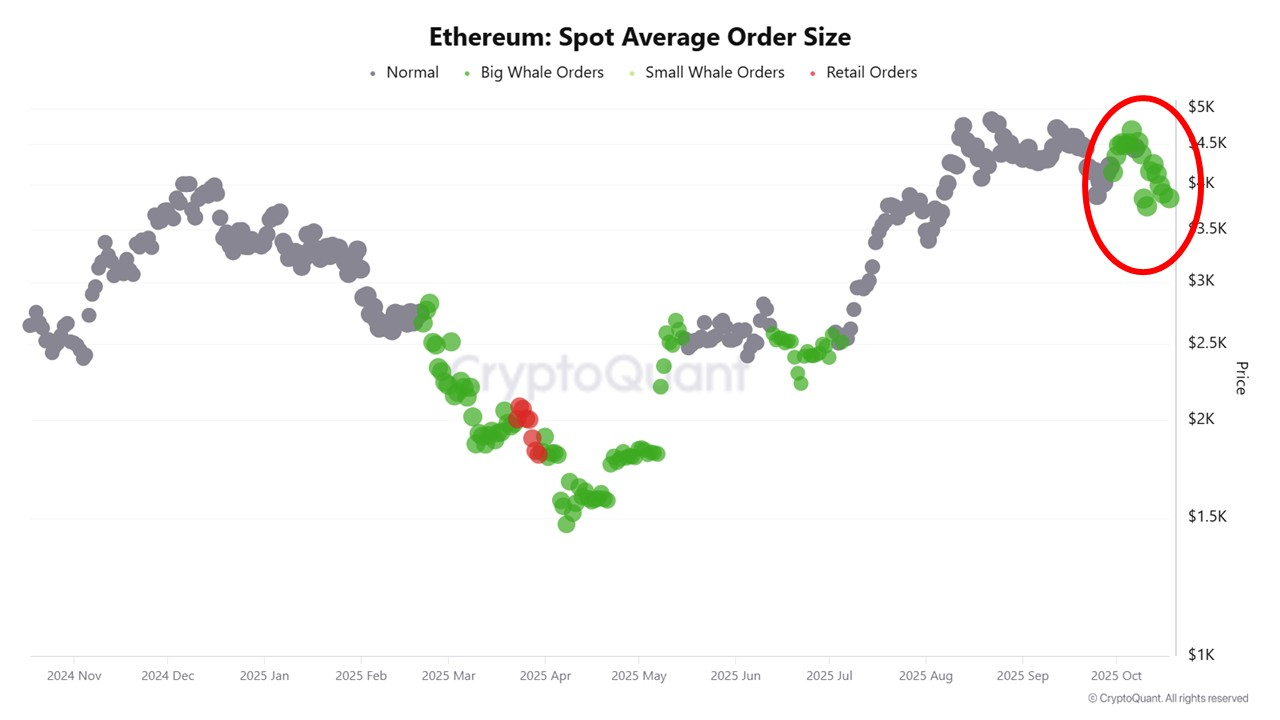

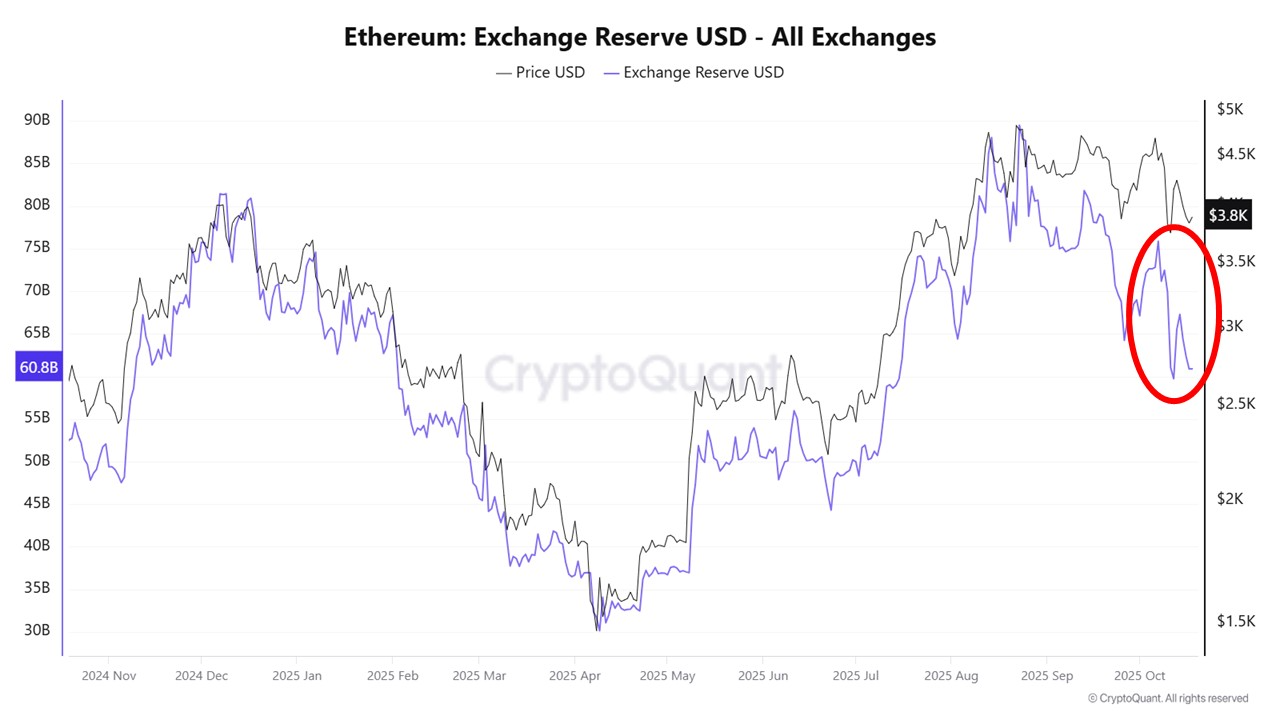

- Ethereum’s exchange reserves keep shrinking as whale-sized spot orders dominate on-chain activity.

- Institutional accumulation hints that Ethereum may be entering another supply squeeze phase.

The latest on-chain data from analysts at XWIN Research Japan shows a pattern in Ethereum reminiscent of late 2020, when silent accumulation by large players laid the foundation for the subsequent rally.

This time, the same signals are emerging: Ethereum reserves on exchanges have plummeted sharply, while the average spot order size is now dominated by large whale orders.

Source: CryptoQuant

Source: CryptoQuant

Meanwhile, as of press time, ETH is trading at about $3,890, up 0.56% in the last 4 hours and 0.46% in 24 hours. Over the week, its gain has reached 3.74%, boosting investor enthusiasm, as investors begin to see signs of a major move ahead.

Daily spot volume is recorded at $2.33 billion, with a market cap of $470.40 billion and open interest of around $42.78 billion. While the movement appears stable on the surface, Ethereum’s underlying market structure is actually tightening.

Whales Quietly Reload as Ethereum Liquidity Dries Up

According to XWIN Research Japan, a sharp decline in ETH reserves on exchanges, coupled with an increase in large orders from whales, typically signals an accumulation phase by institutional investors and individuals with significant capital.

Source: CryptoQuant

Source: CryptoQuant

Interestingly, the volume of dollar-denominated ETH held on exchanges is now at one of its lowest levels throughout 2025. With increasingly thin liquidity, even modest new demand could trigger a much faster price surge.

On the other hand, popular analyst Mike Investing warned bears that the market may be preparing for a surprise.

“Just a message to all ETH bears that $7,000 is incoming within the early months of 2026,” he wrote.

Mike added that Ethereum’s low of around $3,800 is likely the final pullback before a major rally begins. He stated, “This run will create generational wealth for many.”

This statement may sound optimistic, but history shows that supply squeezes like the current one often fuel the beginning of the next bull cycle.

Source: Mike Investing on X

Source: Mike Investing on X

New Push from Asia and Global Adoption

Furthermore, capital flows from Asia are also beginning to show a clear direction. Recently, the CNF reported that a group of Asian investors committed $1 billion to establish a new Ethereum Treasury.

This move is seen as a sign of long-term confidence in Ethereum’s potential, especially as various countries in the region begin to strengthen blockchain-based digital infrastructure.

Furthermore, just a few days ago, Bhutan became the first country in the world to run its national Digital ID system on the Ethereum network, replacing the previous system on Polygon. Around 800,000 Bhutanese citizens can now securely access public services through this network.

The government aims for the full migration to be completed by early 2026—a move that strengthens Ethereum’s position as the backbone of the developing world’s digital transformation.

]]>You May Also Like

Octav Integrates Chainlink to Deliver Independent Onchain NAV for DeFi

SEC Final Judgments on FTX Executives Filed