Blockchain News: Corpo Chains’ Doom Looms Without Crypto Ethos Shift

The CEO of StarkWare sounds an alarm that corporate blockchains will not succeed without adopting the concept of decentralization and self-custody, which is the main idea of crypto.

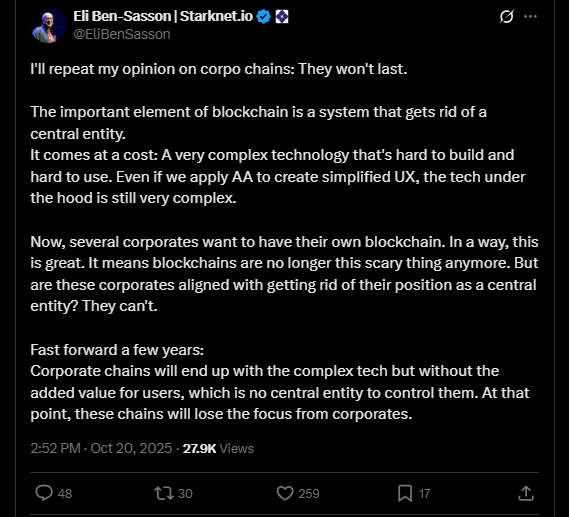

Co-founder and CEO of StarkWare, Eli Ben-Sasson, tightened his grip on the future of blockchains in companies.

Ben-Sasson reiterated in recent remarks on X that corporately-created and operated blockchains are unlikely to survive.

Source- X

He stressed that the most important aspect of blockchain is the elimination of central actors to empower the users.

Otherwise, it can be concluded that corpo chains will become obsolete as users will move to networks where they can enjoy the benefits of self-custody and control of their assets.

Even with complicated technology, such as account abstraction to make the user experience simpler, the main principle of decentralization of blockchain cannot be compromised.

Ben-Sasson noted that while corporate chains may ease blockchain’s intimidation and encourage short-term adoption, they offer a grim long-term future.

The failure of these chains to provide the actual user value of decentralized finance (DeFi) and self-custody advantages will turn into technical headaches and corporate disinterest.

The more users insist on the ability to control their assets, the less corporations implement chains that keep them centrally controlled, leaving behind costly yet unappealing infrastructure.

Decentralization or Death: The Blockchain Imperative

By introducing the ethos of blockchain, Bitcoin aims to reform centralized finance and give power back to the people.

Corporate-controlled blockchains do not align with this core idea as they put the control in the hands of the corporation.

Ben-Sasson described non-decentralized blockchains as inferior technologies with no future or practical use.

The emergence and subsequent decline of corporate blockchain initiatives in trade and finance are a good illustration of this quandary, with numerous platforms having returned to conventional central databases due to reasons of efficiency, which reflects how challenging it is to ensure corporate power on-chain.

This black and white contrast raises controversy in the crypto community. Some say that corporate chains would perform well by catering to its own owning companies, but this would not provide a participation incentive to users.

This opinion of Ben-Sasson shows a certain kind of growing distrust of corporate chains as the crypto community places more emphasis on DeFi, self-custody, and permissionless innovation.

The corporate blockchain model should transform to adopt these principles or become obsolete.

The post Blockchain News: Corpo Chains’ Doom Looms Without Crypto Ethos Shift appeared first on Live Bitcoin News.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

South Korea Orders Crypto Custody Overhaul After Police Lose Seized BTC