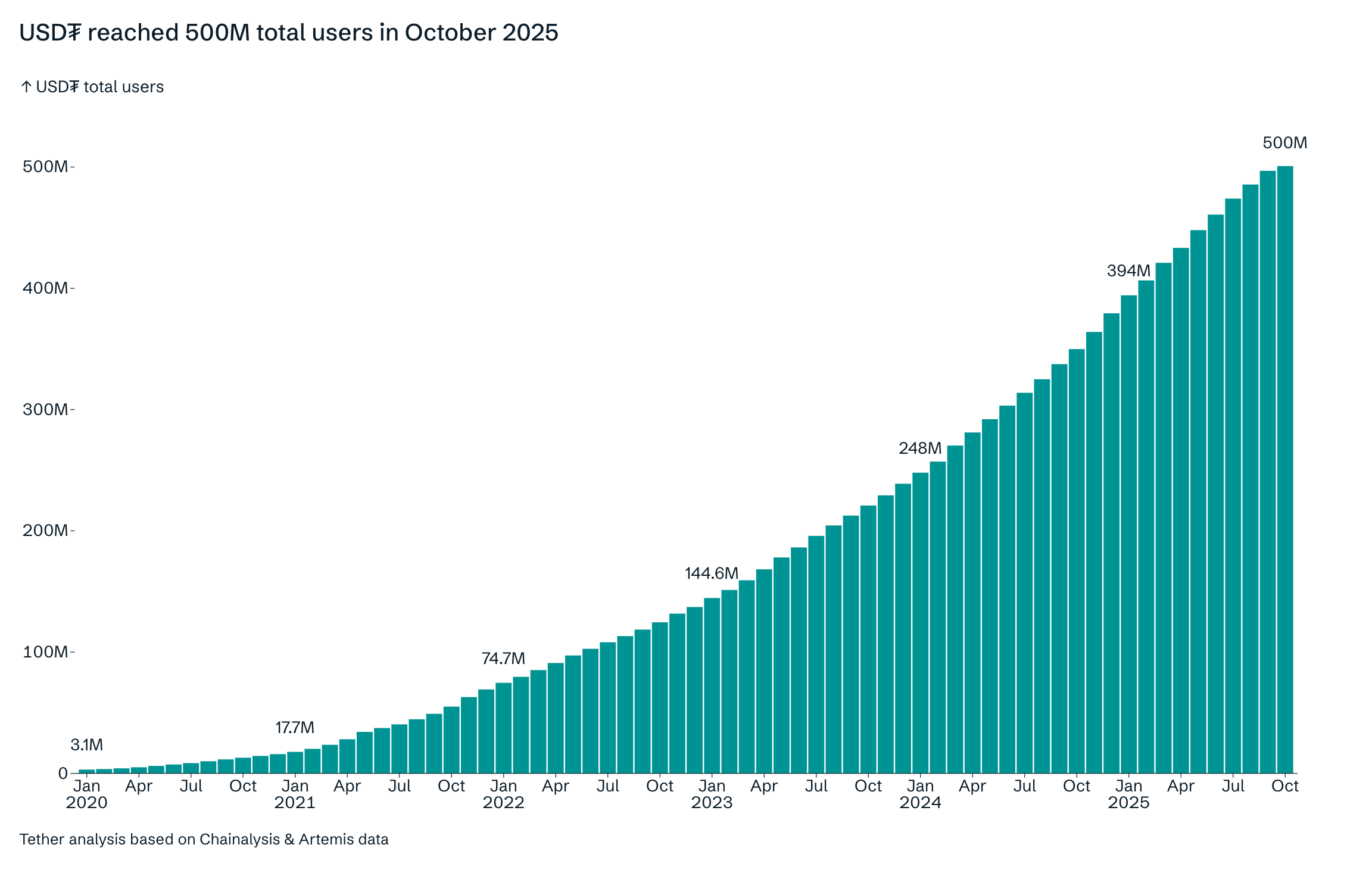

Tether Reaches 500 Million Users as Stablecoin Adoption Accelerates Worldwide

CEO Paolo Ardoino called it “the biggest financial inclusion achievement in history,” emphasizing that stablecoins are no longer a niche tool for crypto traders but a financial lifeline for millions of unbanked and underbanked individuals worldwide.

Expanding Financial Access for the Unbanked

Tether’s growth comes as the World Bank estimates roughly 1.4 billion adults still lack access to a bank account. For many of them, stablecoins like USDT offer a fast, low-cost, and censorship-resistant way to save and transfer money across borders. Anyone with a smartphone can download a crypto wallet and gain instant access to digital dollars, bypassing local banking restrictions and high remittance fees.

Source: Paolo Ardoino’s X Profile

Source: Paolo Ardoino’s X Profile

In developing economies, where inflation and currency devaluation have eroded trust in traditional finance, USDT is becoming a key alternative. Its dollar peg allows users to hold value in a more stable form, reducing exposure to volatile national currencies.

To celebrate the milestone, Tether released a 10-minute documentary filmed in Kenya, showcasing how stablecoins are transforming local economies. The film highlights how both individuals and small businesses rely on USDT “not for speculation, but for survival.” With the Kenyan shilling losing value, local merchants have turned to stablecoins to pay for imports, preserve savings, and transact globally.

Paolo Ardoino revealed that about 37% of USDT holders now treat the token as a long-term store of value rather than a transactional instrument. This statistic illustrates how deeply embedded stablecoins have become in everyday life, particularly in regions facing inflationary pressures.

Tether’s Growing Market Power

According to CoinGecko data, Tether’s market capitalization stands at approximately $182.5 billion, representing a dominant 58.4% share of the entire stablecoin market. Its closest rival, Circle’s USDC, maintains a $76.8 billion valuation.

READ MORE:

Altcoin Season 3.0: Analysts Predict the Biggest Rotation Since 2021

This lead has solidified Tether’s position as the central source of on-chain liquidity for both exchanges and decentralized finance platforms. The stablecoin is now used across virtually every blockchain ecosystem, including Ethereum, Tron, Solana, and Avalanche.

Recent reports also suggest that Tether may be preparing for one of the largest private company valuations in history. Sources indicate that the firm is exploring a potential capital raise of up to $20 billion, with an estimated valuation of around $500 billion. If successful, this would make Tether one of the most valuable privately held financial entities in the world. Cantor Fitzgerald is reportedly acting as the lead financial adviser for the discussions.

Fresh Mint Confirms Strong Liquidity Demand

Blockchain data shows that Tether has minted another $1 billion in new USDT tokens this week alone. Over the past month, on-chain records reveal that more than $7 billion in USDT has been newly issued, signaling sustained demand for dollar liquidity following recent market volatility.

This continuous issuance demonstrates that institutions, traders, and retail users alike are turning to Tether for stability and liquidity as markets recover from recent turbulence. Historically, USDT minting has often coincided with renewed inflows into the crypto ecosystem – a pattern analysts are closely monitoring as digital asset prices rebound.

A Cornerstone of Global Crypto Liquidity

Tether’s influence now extends far beyond the crypto market. Its growing user base, expanding liquidity operations, and dominance across multiple blockchains highlight how stablecoins have evolved from speculative tools into vital infrastructure for the digital economy.

As traditional finance struggles to meet the needs of billions without access to stable currencies, Tether’s model continues to prove that global financial inclusion can come not from banks, but from borderless digital assets.

With a half-billion users and counting, Tether’s trajectory shows no signs of slowing – and its expanding market cap may soon redefine what it means to be a “global reserve” in the digital age.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Tether Reaches 500 Million Users as Stablecoin Adoption Accelerates Worldwide appeared first on Coindoo.

You May Also Like

Pump.fun-linked address deposits $148M in USDC and USDT to Kraken

Top Solana Treasury Firm Forward Industries Unveils $4 Billion Capital Raise To Buy More SOL ⋆ ZyCrypto