Polymarket Valuation Could Hit $15B Amid New Funding Talks

Prediction markets are rapidly gaining momentum, attracting significant investor interest amid soaring valuations and record-breaking trading volumes. With major players like Polymarket and Kalshi eyeing multi-billion-dollar funding rounds, the sector is quickly transforming into a pivotal component of the evolving cryptocurrency and blockchain landscape.

- Polymarket is in early negotiations for funding at a valuation ranging from $12 billion to $15 billion, a potential tenfold increase from recent months.

- The company’s recent funding efforts follow a $200 million round in June and an imminent investment from ICE valued at $8 billion.

- Kalshi also emerges as a major competitor, with investor offers valuing it at over $10 billion amid plans for further funding.

- Partnerships with DraftKings and the NHL highlight Polymarket’s expanding presence in mainstream sports and entertainment sectors.

- Global prediction markets are experiencing unprecedented activity, with weekly trading volumes surpassing $2 billion, driven mainly by Polymarket and Kalshi.

Polymarket raises eyebrows with valuation targets

Prediction platform Polymarket is engaging in early-stage discussions with investors for a new funding round, aiming for a valuation between $12 billion and $15 billion. This marks a dramatic increase from its last valuation of $1 billion following a $200 million investment in June, led by Peter Thiel’s Founders Fund. Just earlier this month, the parent company of the New York Stock Exchange, Intercontinental Exchange (ICE), revealed plans to invest up to $2 billion in Polymarket at an $8 billion valuation.

Meanwhile, its main competitor, Kalshi, is also attracting investor interest, with offers to value the company at over $10 billion—a significant increase from its recent $5 billion valuation after a $300 million funding round. These developments signal a surge in confidence and interest in prediction markets as vital tools within the broader cryptocurrency ecosystem, especially amid rising demands for DeFi and blockchain-based financial products.

Cointelegraph reached out for comment; however, no response was received at press time.

Strategic partnerships drive mainstream adoption

Polymarket continues to strengthen its ties across the sports and entertainment industries. CEO Shayne Coplan announced that DraftKings will utilize the platform as a clearinghouse for its prediction markets, positioning the platform within the mainstream sports betting and fantasy sports community. Additionally, the National Hockey League (NHL) has signed multiyear agreements with Polymarket and Kalshi, designating both as official prediction market partners.

Further signals of growth include the integration of Polymarket into OpenAI CEO Sam Altman’s World App, an innovative digital identity platform. The app now incorporates Polymarket’s prediction market functionalities, blending decentralized identity tools like World ID with blockchain-based financial services.

Record-breaking trading volumes highlight sector momentum

Interest in prediction markets has hit new heights globally. According to data from Dunedata via Dune Analytics, weekly trading volumes exceeded $2 billion in mid-October for the first time. Polymarket facilitated over $1 billion of this activity, representing more than half of the total market share, with Kalshi close behind at approximately $950 million.

This surge underscores the increasing mainstream acceptance and participation in crypto-driven prediction markets, aligning with broader trends in cryptocurrency adoption, NFTs, and blockchain-based finance. As the sector matures, it is poised to become a crucial element of the digital economy, offering new opportunities for investors and users alike.

This article was originally published as Polymarket Valuation Could Hit $15B Amid New Funding Talks on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

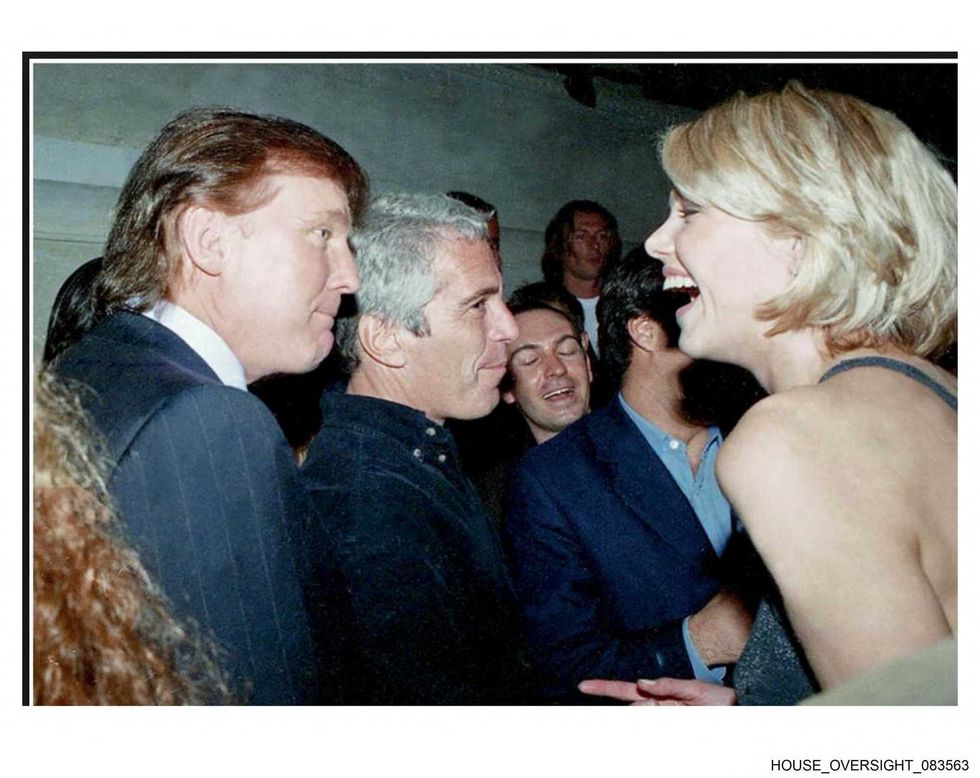

Trump's Kryptonite just got even more dangerous to handle

Shopify Stock Price Hits $141 Premarket After Q4 Revenue Beat