Cardano Price Prediction: ADA Poised To Retest 2021 Highs, Could 2025 Mark Its Biggest Rally Yet?

Cardano is back on center stage after a choppy week for large caps. ADA trades around $0.64 today, still up sharply year on year, and traders are drawing fresh lines toward the 2021 peak near $3.10 if liquidity improves and flows stabilize. Developer reports this week pointed to consistent network work, which keeps the narrative alive for a disciplined push higher into 2025.

There is also a quiet buzz around a payments upstart with an active wallet beta and a security pedigree that has analysts’ attention, a potential complement for readers who track the best crypto to buy now alongside Cardano.

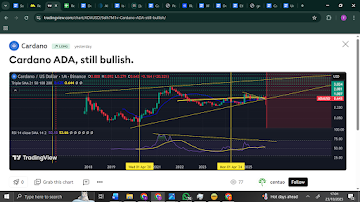

Cardano: “Stair-Steps” Back Toward the Peak

Spot Cardano sits near $0.62 after recent pullbacks, roughly 70% above its level a year ago. The historical line to beat remains the September 2021 all-time high around $3.10. Bulls argue that steady throughput progress and clean macro conditions could reopen that path if demand holds.

Cardano watchers highlight the $0.95 to $1.05 band as a key inflection. Clear acceptance above that zone would invite momentum desks and trend followers, especially if exchange inflows skew positive.

Market Context: Why 2025 Matters for Cardano

Leadership rotated across this cycle, yet Cardano kept showing sticky developer activity, active governance, and expanding wallets. If risk appetite broadens and policy headlines ease, quality L1s like Cardano can benefit.

The caveat is volatility. If Bitcoin swings widen or liquidity tightens, Cardano likely climbs in steps rather than in one straight line. That is why many investors pair technical levels with on-chain health when mapping a 2025 rally case.

Near term, Cardano needs to reclaim prior range highs before a credible march toward $1.40 and higher. A weekly close above $1.05 would be a strong signal for trend traders. Below, bulls want to defend the mid $0.50s. Losing that shelf would delay the retest narrative. For DeFi project allocators screening early-stage crypto investment ideas, Cardano remains a core L1 to track while rotating into selective catalysts.

Spotlight on a Rising Opportunity

Remittix (RTX) is turning heads because it solves a simple problem that many users face every day. It moves value from crypto to bank accounts with real-time FX rails and a mobile wallet built for daily spend. Currently, RTX is priced at $0.1166, but that price will soon increase, as over 40,000 investors have already acquired tokens in recent months.

Security signaling is strong. The team is fully verified by a top auditor that is widely regarded as the most trusted name in blockchain security, and it currently holds the number one slot in that auditor’s pre-launch rankings. Community beta testing for the wallet is live, which is exactly the kind of proof investors want before they commit more capital to the next big altcoin in 2025.

The Window That Closes Fast

Cardano has the structure to grind higher if $1.05 flips into support and macro conditions stay friendly. That keeps a retest of the 2021 zone on the table for 2025. At the same time, selective rotations into working utility plays can improve portfolio balance.

If you believe 2025 favors delivered products over promises, keep Cardano on the primary watchlist and keep RTX on the radar. Momentum does not wait, and the most rewarding entries often arrive when the crowd is still undecided.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post Cardano Price Prediction: ADA Poised To Retest 2021 Highs, Could 2025 Mark Its Biggest Rally Yet? appeared first on Live Bitcoin News.

You May Also Like

CME Group to launch options on XRP and SOL futures

XRP Volumes Crash 52%, Is This Concerning?