Bitcoin Miners Enter Fierce Hash Wars Following 2024 Halving

- Mid-tier Bitcoin miners like Cipher Mining, Bitdeer, and HIVE Digital are rapidly increasing their realized hashrate, narrowing the gap with industry leaders such as MARA and CleanSpark.

- The top public miners collectively achieved 326 exahashes per second (EH/s) of realized hashrate in September, more than doubling last year’s levels, now representing nearly one-third of Bitcoin’s total network hashrate.

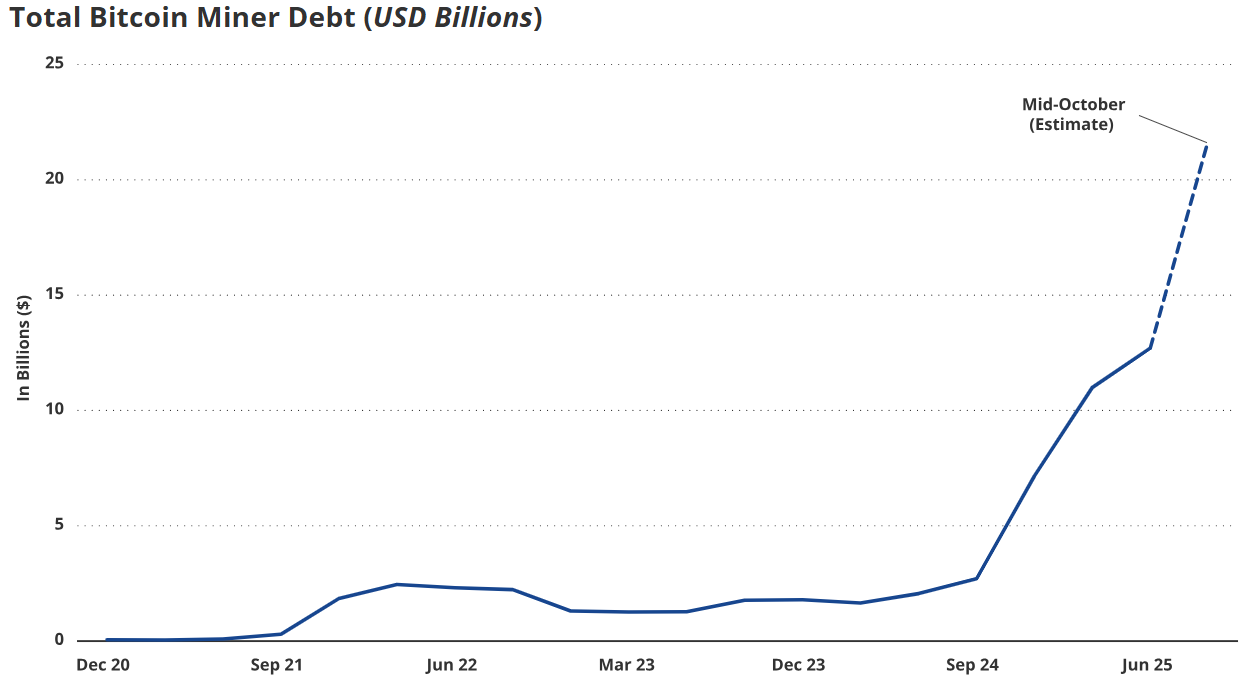

- Bitcoin mining firms are taking on unprecedented levels of debt—total sector debt has surged to $12.7 billion—to fund expansion into new hardware and AI-driven infrastructure.

- Mining companies are diversifying revenues by investing in artificial intelligence and high-performance computing, aiming to offset reduced earnings post-2024 halving.

The Bitcoin mining sector is undergoing a significant transformation as industry players race to expand their operational capacity ahead of the 2024 halving. Companies such as Cipher Mining, Bitdeer, and HIVE Digital have accelerated their infrastructure development, significantly boosting their realized hashrate. Their growth is narrowing the gap with established industry leaders like MARA Holdings, CleanSpark, and Cango, signaling a more competitive landscape.

According to The Miner Mag’s latest Miner Weekly newsletter, the middle-tier miners are now rapidly scaling production, once trailing behind their larger counterparts. While giants MARA, CleanSpark, and Cango maintain their dominant positions, rivals including IREN, Cipher Mining, Bitdeer, and HIVE Digital posted substantial year-over-year increases in their realized hashrate, highlighting a sector-wide shift towards increased capacity and efficiency.

In total, the leading public miners achieved 326 EH/s of realized hashrate in September—more than twice the amount from the previous year. Collectively, these firms now account for nearly one-third of Bitcoin’s total network hashrate, emphasizing their growing influence in the ever-evolving blockchain ecosystem.

Year-over-year growth in realized hashrate. Source: The Miner MagHashrate measures the total computational power securing the Bitcoin blockchain. Realized hashrate offers a more accurate reflection of on-chain performance, representing the rate of successfully mined valid blocks. For publicly traded miners, this metric serves as an essential indicator of operational efficiency and revenue potential, crucial ahead of third-quarter earnings reports.

As the competition heats up, Bitcoin miners are taking on record levels of debt—sector-wide debt has climbed to $12.7 billion from just $2.1 billion twelve months ago, according to research by VanEck. Miners are compelled to continually invest in advanced hardware to maintain their market share and prevent falling behind amid rising mining difficulty.

The growing debt of Bitcoin miners. Source: VanEck

The growing debt of Bitcoin miners. Source: VanEck

Some mining companies are also diversifying their revenue streams by investing in artificial intelligence and high-performance computing workloads, aiming to offset shrinking margins following the halving. As the block reward drops to 3.125 BTC, these firms are exploring new markets in AI hardware and services to compensate for declining traditional income.

Overall, the sector’s aggressive expansion and technological innovation are set to play pivotal roles in shaping the future of cryptocurrency markets, blockchain security, and the broader adoption of decentralized finance (DeFi) and NFTs.

This article was originally published as Bitcoin Miners Enter Fierce Hash Wars Following 2024 Halving on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

How Wheelchair Transportation Transforms Daily Life by Enhancing Mobility, Safety, Independence, and Social Inclusion for Individuals with Limited Mobility

CME Group to launch options on XRP and SOL futures